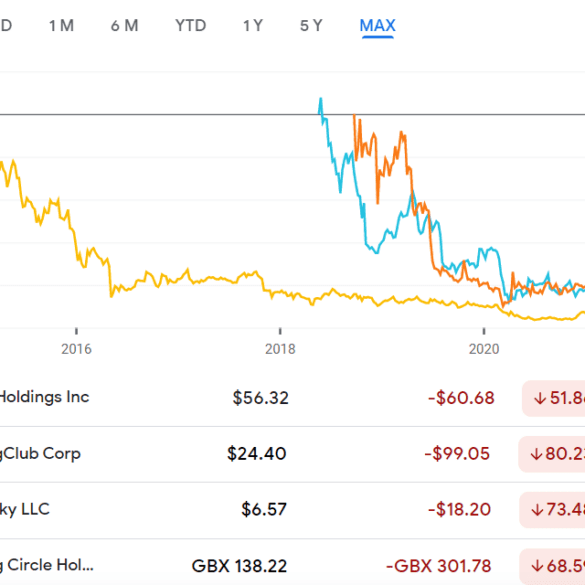

GreenSky made headlines as the largest fintech IPO of the year in 2018. It was all downhill from there...

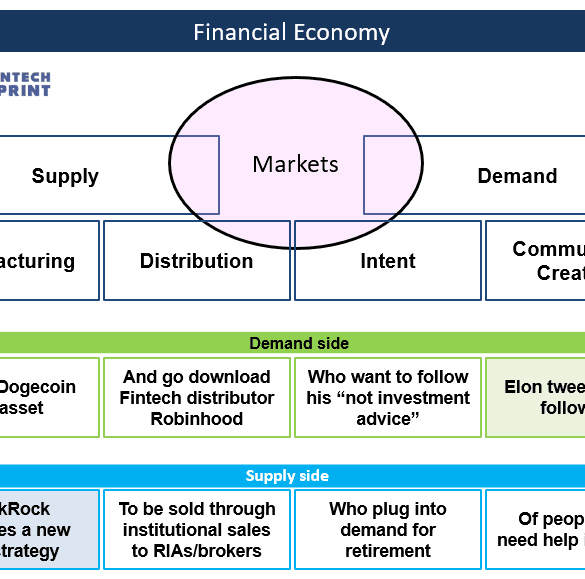

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

Kaspersky Lab Sees Spike In Mobile Banking Cyberattacks Zero raises $20 million from NEA and others for a credit card...

In this week’s PeerIQ Industry Update they cover the troubling data of millennial delinquency rising significantly higher than older borrowers;...

CNBC reported today that Goldman Sachs is likely to take a "large writedown" as they seek to offload their ill-fated acquisition.

Wednesday morning Goldman Sachs, not looking to be left behind, announced it would be acquiring GreenSky for $2.24 billion.

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

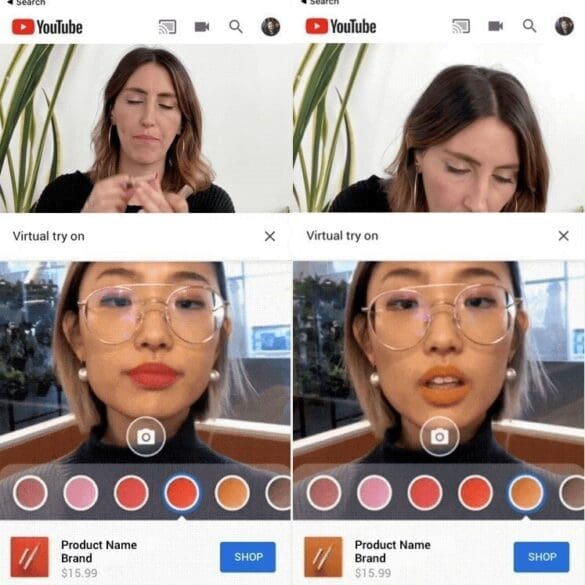

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

GreenSky is a point of sale lender which partners with merchants in a variety of verticals; they also work with...

We recap the earnings results from LendingClub, OnDeck and GreenSky; LendingClub is off to a good start in 2019 and...