As the FTX avalanche rolls down the hill, fintechs worldwide hope to stay out of its destructive path.

Mike Cagney has built a reputation as one of the smartest people in all of fintech. His capacity to raise...

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

The $150 million securitization of HELOCs is being billed as the first transaction where all aspects were managed on the...

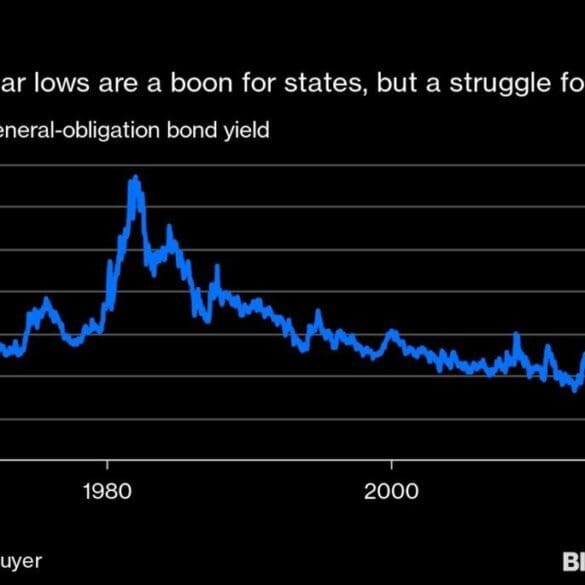

I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

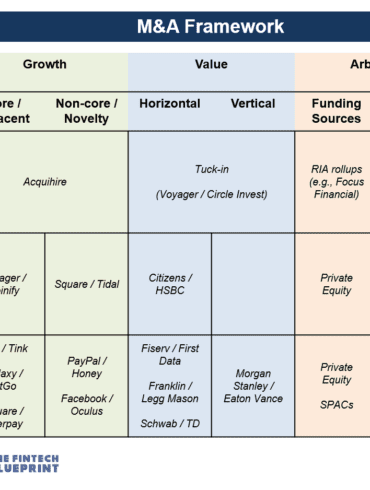

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

Mike Cagney is one of the most successful fintech entrepreneurs with his founding of SoFi and now Figure; Cagney sat...

With Figure in the news this week completing their first securitization using blockchain we thought it would be interesting to...

Blockchain based lending fintech Figure has seen a 300 percent surge in loan applications due to the recent rate cut...

Figure, the blockchain-based fintech lending startup founded by Mike Cagney, has a new president; Asiff Hirji was the former president...