On episode 50 I talk with Chris Peacock of Aquaoso, a climate fintech providing data, analytics, and risk reports to financial institutions.

This week we sat down with OakNorth's Matt Bullivant, to talk about ESGs and fintech's advantage in data which could impact carbon emissions.

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

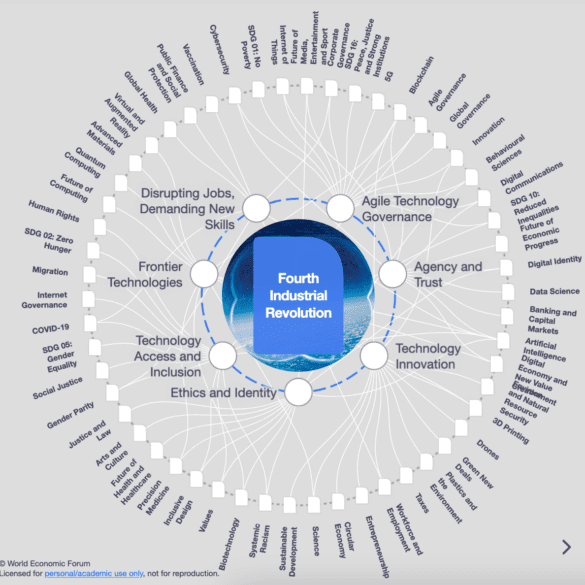

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

Helios, raised $9.4 million in a recent seed round, news that has encouraged the industry to think about broader ESG issues.

Banks use relationship-based services to attract and retain customers in these times of higher interest rates. SunTec Business Solutions President Amit Dua said if these services are correctly deployed, they benefit both the bank and the customer.

[Editor’s note: This is part of a series of articles we are publishing from Wharton Fintech ahead of LendIt Fintech...

While many "green" fintech startups like Aspiration or Sugi appear on the market, their infrastructure can stay environmentally harmful.

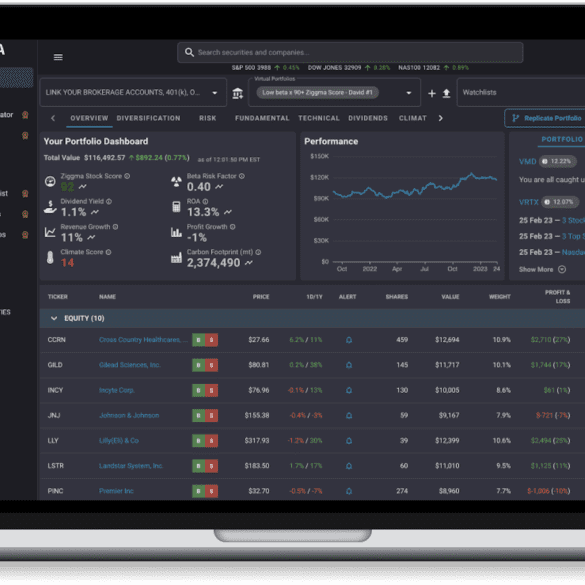

For investors who want to make an impact on the climate crisis, Ziggma provides data on companies' financial performance and their footprint.

Despite coverage highlighting the environmental issues of certain cryptocurrencies, the crypto sector may be unexpectedly ESG aligned.

In the face of global warming projections, investment becomes critical. ICE have released bond indices to support net-zero objectives.