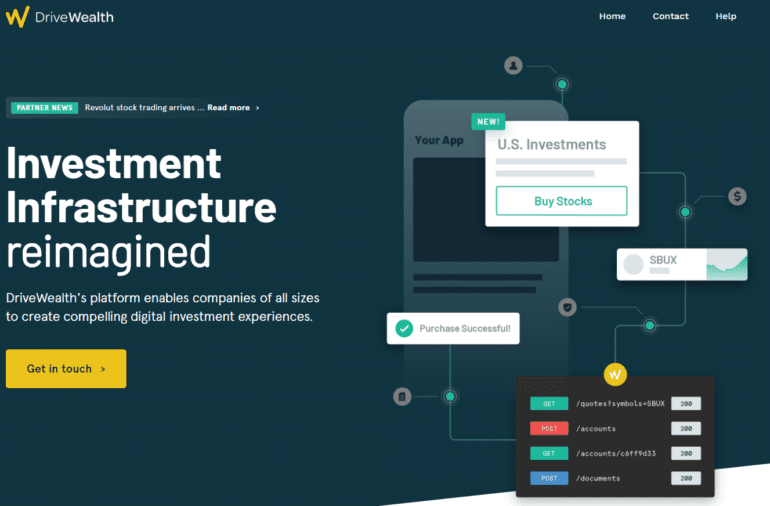

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

Surely, it’s not just random capitalist chaos in the hurricane of absurd flailing experiments running out of other people’s money! Or the forces of creative destruction and ego-centric insanity battling against rigid regulatory structure and hopeless conservatism.