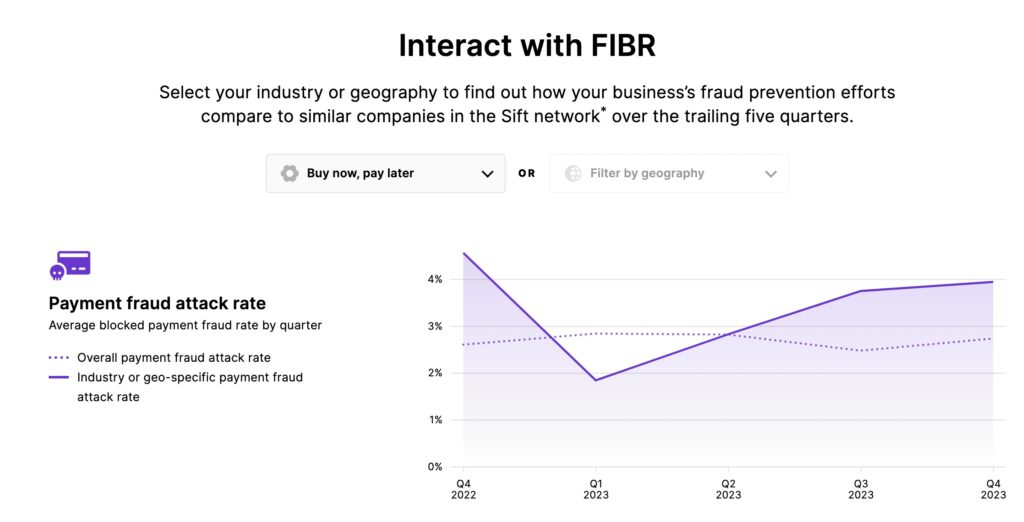

Sift’s new Fraud Industry Benchmarking Resource (FIBR) lets fraud and risk professionals see how their business’ security tools stack up against the competition. FIBR posts payment fraud attack rates, fraudulent chargeback rates, and manual review rates against aggregated industry averages over time, using Sift’s one trillion-plus processed transactions. Rates are broken down by industry and geography.

CMO Armen Najarian said he often hears from executives wondering how their fraud rates compare to their competitors. Across industries and geographies, Sift customers see an average payment fraud attack (block) rate of 2.5%. That is attempted payment fraud rates that Sift detects and prevents in real-time. The Merchant Risk Council (MRC) reports an average 4% order rejection rate globally.

Sift customers average a 0.08% fraudulent chargeback rate, 97% lower than the 2.6% rate reported by the MRC. The MRC found global merchants manually screen an average of 19% of all e-commerce orders. Sift slices that down to 2.1%.

Najarian said Sift began using the data a year ago during different reviews they held with clients. Then in early summer, they decided to make the data available to anyone interested via FIBR. With so many people looking to compare themselves to the Joneses, why not let everyone do it?

Currently, data seekers can check either by industry or geography. Soon, they can do both and get insights on account creation, log-ins and other KPIs. With more than one year of data, FIBR allows annual comparisons, too.

What FIBR shows in the Americas

A quick look at Central and South America fraud attack rates shows they are consistently higher each quarter. Najarian suggests that this is because top fraud control use is inconsistent across the region. With lower levels of control, Latin America may invite more fraud attempts.

“This region is starting to invest not just in the tools but the people,” Najarian said. “We’re seeing, especially in the last several quarters, more talent being hired, put into place and promoted. That might explain why we’re seeing that region overachieve in the manual versus the rest of the population.”

In North America, FIBR shows rates generally track to global averages. There is room for first-party (aka friendly) fraud to work as science struggles to identify aberrant behavior from otherwise normal customers.

Crypto volumes returning

FIBR tracks many key fintech sub-sectors and also cryptocurrency. Najarian sees crypto transaction volumes returning. Payment fraud attack rates are higher in crypto.

“That’s just consistent with not seeing full regulation in all markets with all crypto transactions,” Najarian said. “And there’s a nuance here where using crypto as a payment vehicle is one thing we’re looking at. We’re also looking at moving crypto through open banking. Between those two, I think that supports the reality that with lighter regulation, especially in some markets, with this being a newer space still, there’s absolutely some room for exploitation, and we’re seeing the attack volume this year was higher.”

But post-chargeback fraud rates in crypto are lower. Najarian credits people.

“The amount of talent flowing into the space is pretty strong. We’re also seeing, perhaps, some effect on manual reviews. It’s more effective manual reviews. So even though the manual review rate is lower, in general, versus the general population, we’re seeing some really good talents and good leadership and fraud management that are maybe helping to drive better decisioning faster.”

Also read: