In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status of the account on a quarterly basis. Below are links to the full series of blog posts in chronological order:

- How to Open Up a New LendingClub Account in 2018

- Setting Up LendingClub’s Automated Investing Tool

- New LendingClub Account Performance – Q2 2018

- New LendingClub Account Performance – Q3 2018

- New LendingClub Account Performance – Q4 2018

- New LendingClub Account Performance – Q1 2019

Every quarter I first like to take a look at any recent news from LendingClub. Last quarter we reported a pretty significant change as LendingClub ceased offering of E Grade loans.

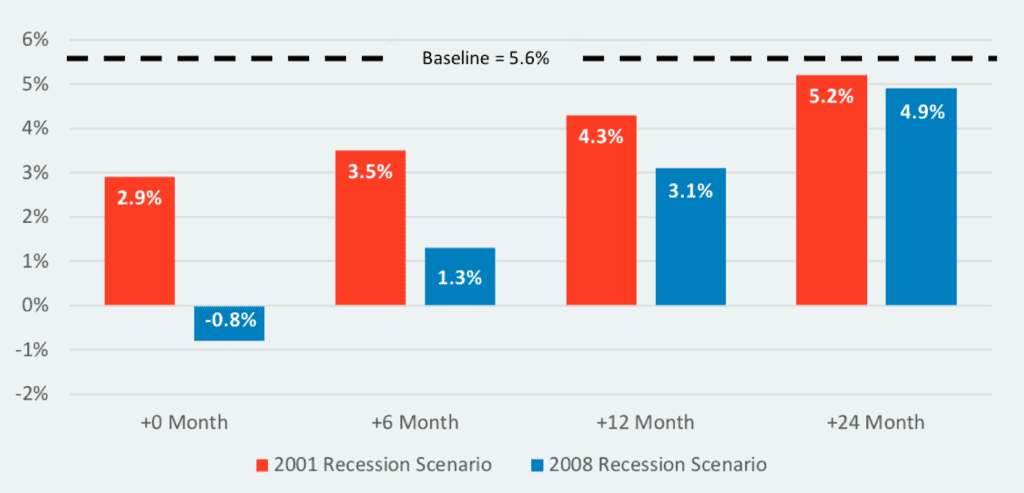

In June, LendingClub shared a blog post titled, “Marketplace Loans in a Downturn: 5 Questions and Answers“. In it they shared that they are leaning a bit bearish citing a variety of factors. Despite this LendingClub believes that the coast is clear for the rest of 2019 with consumers being in a good position. They also discuss the advantages of investing in loans in a recession, how LendingClub loans may perform in a recession, what LendingClub will do from a servicing standpoint and how LendingClub’s approach will change in a downturn. From LendingClub’s blog post:

We found the biggest impact would occur if a recession started within two quarters of a loan’s origination date. Next, we looked at returns. There, our data suggest that loan performance would still compare favorably to what happened in equity markets during the last recession. In a severe recession we believe we could expect vintage level returns to fall into negative single digits.

LendingClub also shared updates regarding their credit policies. In it they discuss their early delinquency tool which uses customer risk signals and credit bureau data to flag higher risk borrowers. Nixing the riskier loan grades is one way that they have worked towards making returns more stable and focusing more on loan grades with higher demand. Grades A and B now make up 50% of LendingClub’s offering. Interest rates were also adjusted upwards in C grade loans in June 2019. You can view the full update on LendingClub’s blog.

LendingClub Account Performance

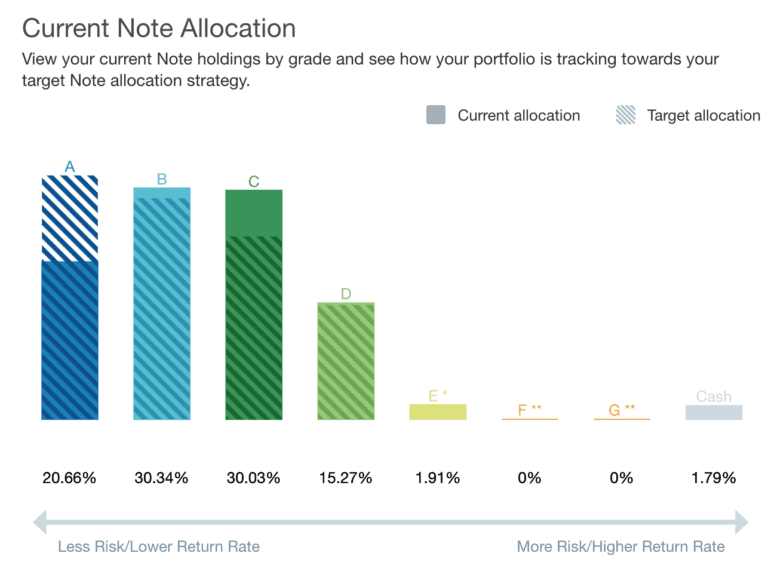

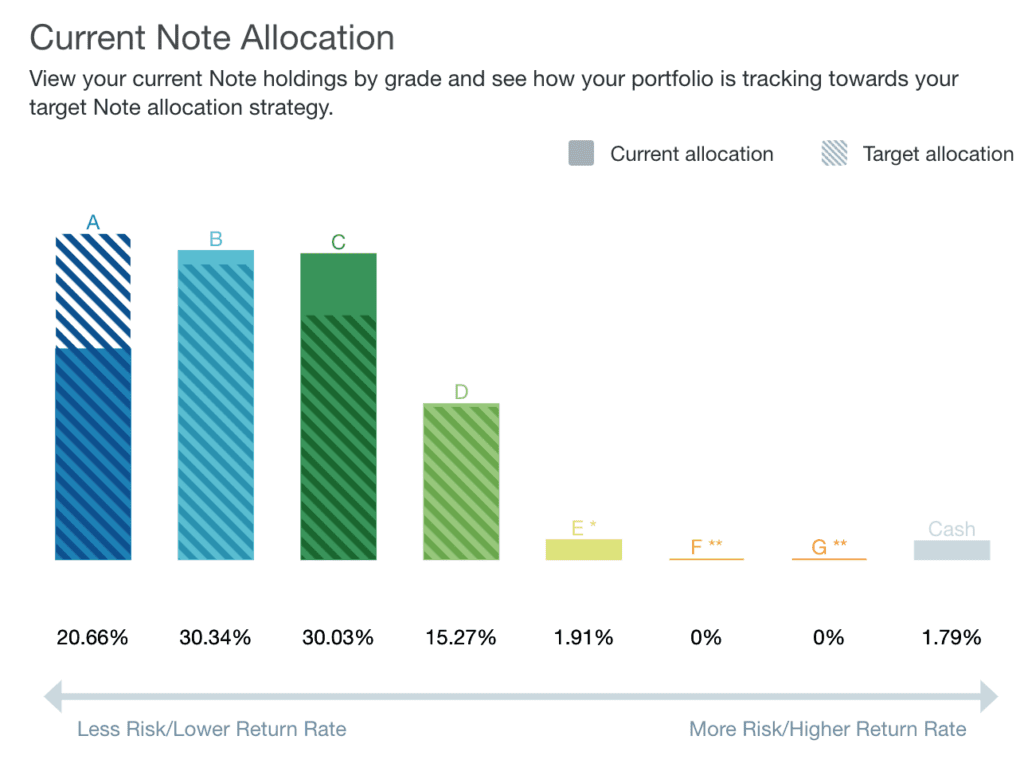

This LendingClub account was set to invest in all grades, which now includes loan grades A through D. Given the recent removal of E grade loans this has somewhat adjusted the current allocation versus target allocation chart as shown below. This is LendingClub’s suggested mix using their Automated Investing service. As of July 10, 2019 the stated average historical return is 5.70%. Over the next several months we will see more funds allocated to A grade loans as payments come into the account.

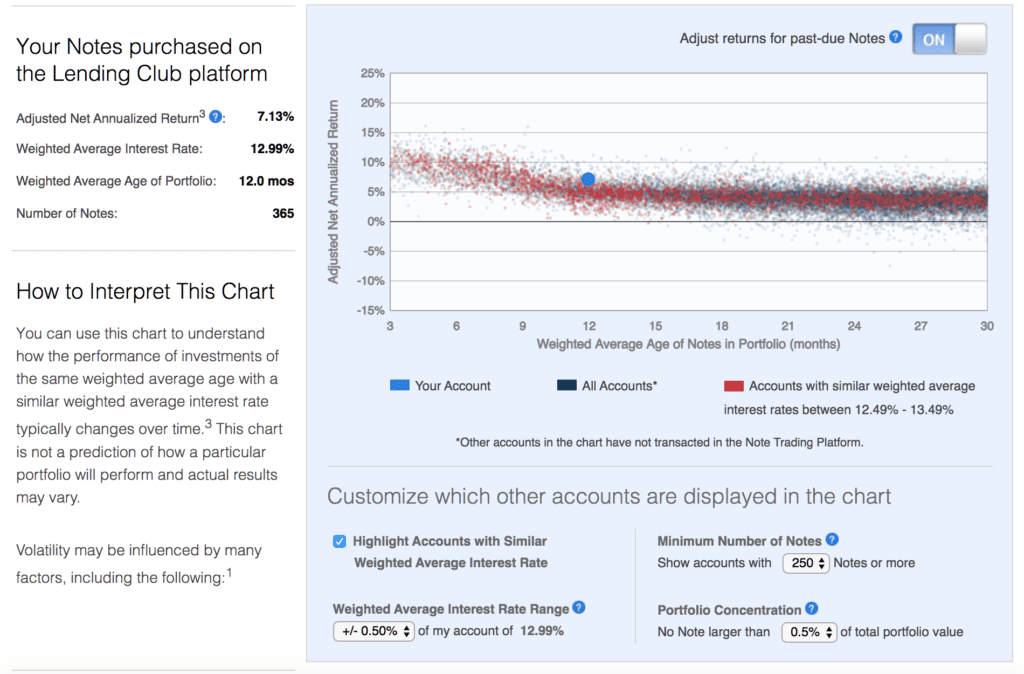

As we explain every quarter it’s important to understand the average age of the portfolio which now stands at 12 months. Accounts are considered seasoned around the 18 month mark. It is interesting to note that despite this account being on autopilot I am trending to the top end of returns for similar accounts.

Since we’re approaching the point at which an account is considered seasoned we can start to get an idea of the returns using the formula XIRR. Below is a snippet from a simple Google sheet I created. I am using June 30, 2018 as a starting point as all funds were allocated at that point. It is also beneficial to look at a rolling 12 month period. The account balances below were pulled from their respective statements. It is currently reporting a return of 8.45% which I expect will decrease over the next six months and eventually stabilize.

| LendingClub New | |

| 6/30/2018 | $5,145.62 |

| 6/30/2019 | -$5,580.30 |

| Formula: “=XIRR(E24:E25,D24:D25)” | 8.45% |

It has been quite the journey since I first began investing in Lending Club loans over 5 years ago. With this account it’s interesting to see what returns are possible today given that they have fallen significantly since I first invested. LendingClub has settled on the borrower segment they want to serve by removing E, F and G loans. While we no longer enjoy the double digit returns that were previously possible, investors are going to be better off if we were to enter a recession. As we continue to be in a low interest rate environment these returns could also be attractive for investors seeking income. For further reading Peter Renton, founder of Lend Academy and co-founder of LendIt, first got involved investing in 2009 and recently wrote a piece reflecting on his experience.