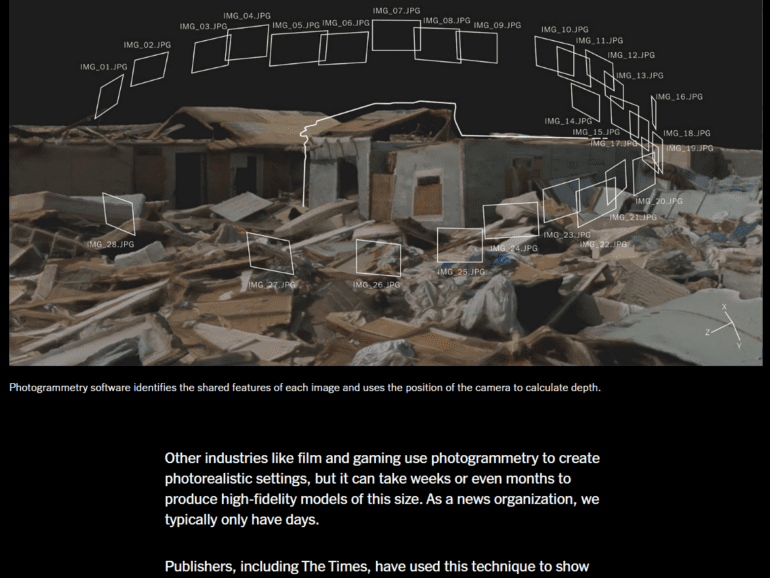

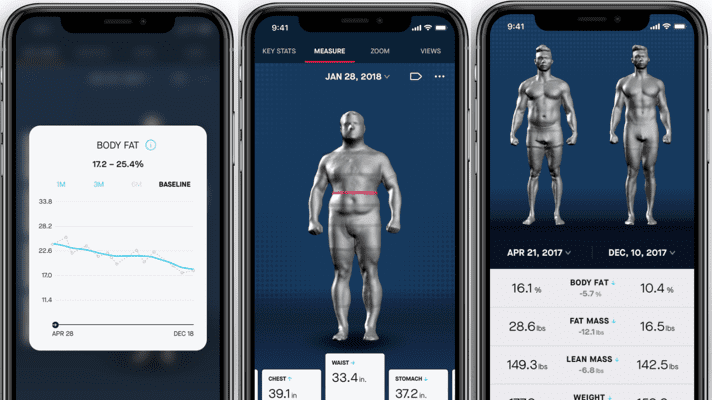

This week, let's dive into the Apple augmented reality glasses leak, the Magic Leap $350 million financing, and the uncanny imagery created by Epic Games' Unreal Engine. We summarize and pull apart the thesis of the Metaverse -- a virtual world as realistic and economically important as our own -- and how media and financial companies should think about the opportunity.

Within a decade, the form factor for computing will radically change from staring at screens with flat imagery, to participating in embedded virtual worlds with fully navigable, hyper-realistic environments. Those environments will be filled with software agents, some hybrid human and others entirely AI, that are entirely unrecognizable as anything but real to 90% of the population.

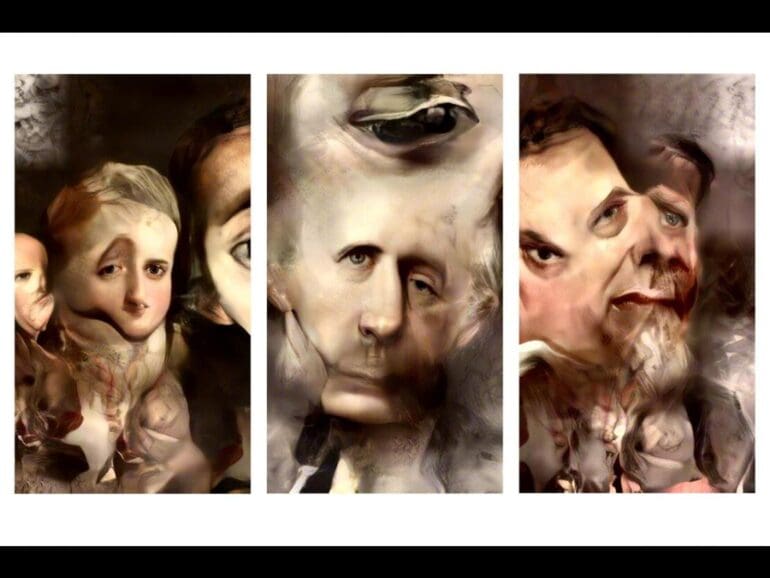

The image is taken from an AI paper which explains how to use generative adversarial networks (i.e., GANs) to hallucinate hyper realistic-imagery. By training on hundreds of thousands of samples, the model is able to create candidates representing things like “just a normal dude holding a normal fish nothing to see here”, and then edit out the ones that are too egregious.

The reason the stuff above is so scary is actually that you can mathematically transition in the space between images. So for example, you could move between “a normal dude” and “just a normal fish” and have nightmare fish people. Or you could create a DNA root for an image which is part dog, part car, and part jellyfish. Check out the video below and the very accessible https://www.artbreeder.com/ website to see what I mean.

Let’s look at the recent Fortnite blackout and compare it to neobank Chime's embarassing down time, as well as explore the business model implication of what it means to be the social square where people hang out. Does Finance have such an equivalent? Maybe it is Venmo, crypto Twitter, or the credit unions. We also look at statistics behind influencer marketing, and how influencers have usurped the position of music labels. Perhaps banks should get ahead of this game too.

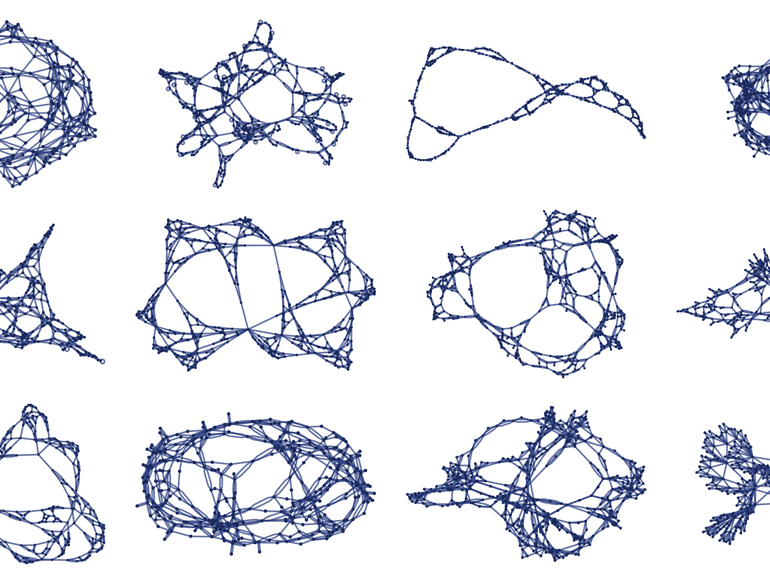

I came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

We look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

Today, we’re joined by Angela Dalton to explore the fun and fantastical world that sits at the intersection of gaming, immersive technology, crypto and economics, namely, the Metaverse.

Angela is the Founder and CEO of Signum Growth Capital, an M&A advisory firm focused on emerging opportunities in fintech, especially blockchain, and digital media.

In this conversation, we discuss expectations for both recreation and work in a digital future, technological advances in recent years that underpin coming changes to immersive virtual experiences, the economics of virtual worlds and more.

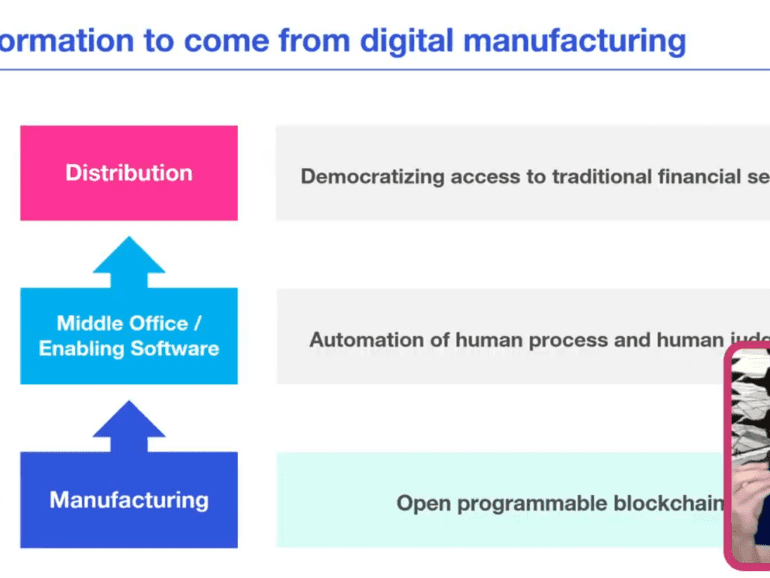

I presented earlier this week at the Ally Invest virtual conference, and the prompt asked for a description of what happens to finance from Fintech to Crypto / Blockchain to Augmented Reality / Virtual Worlds and finally to Artificial Intelligence.

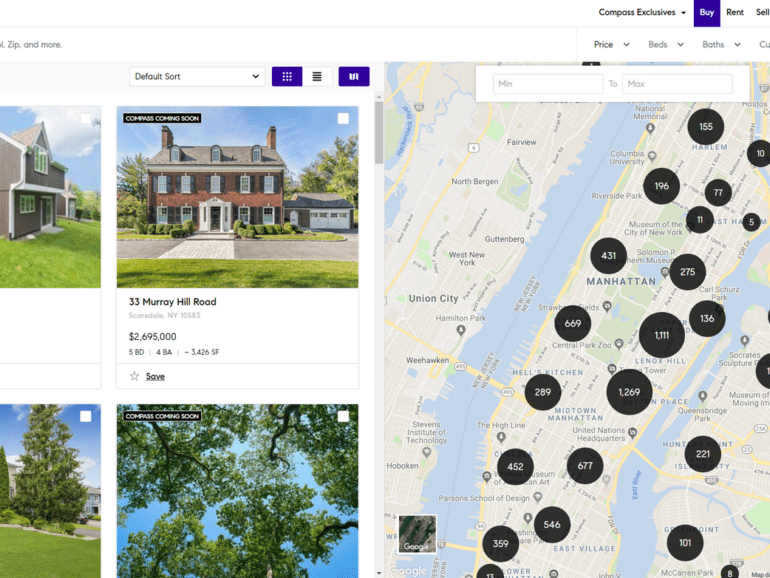

I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience. Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.