Let’s look at the recent Fortnite blackout and compare it to neobank Chime's embarassing down time, as well as explore the business model implication of what it means to be the social square where people hang out. Does Finance have such an equivalent? Maybe it is Venmo, crypto Twitter, or the credit unions. We also look at statistics behind influencer marketing, and how influencers have usurped the position of music labels. Perhaps banks should get ahead of this game too.

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

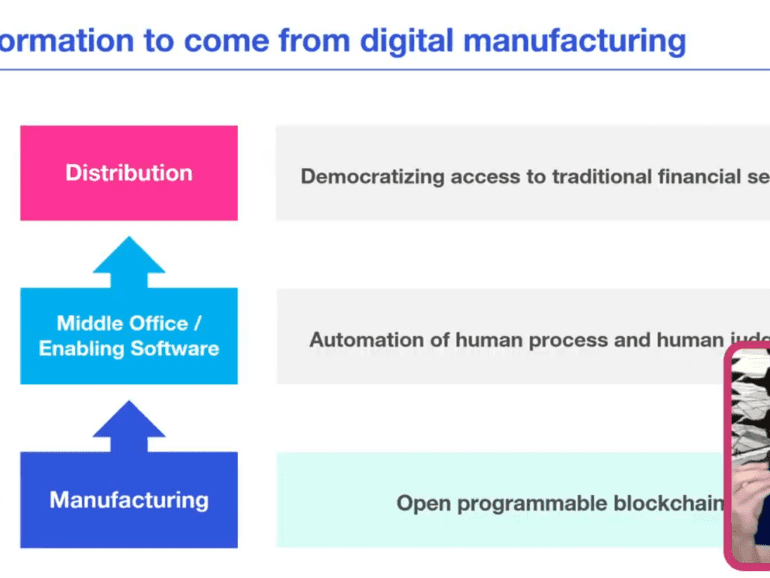

I presented earlier this week at the Ally Invest virtual conference, and the prompt asked for a description of what happens to finance from Fintech to Crypto / Blockchain to Augmented Reality / Virtual Worlds and finally to Artificial Intelligence.

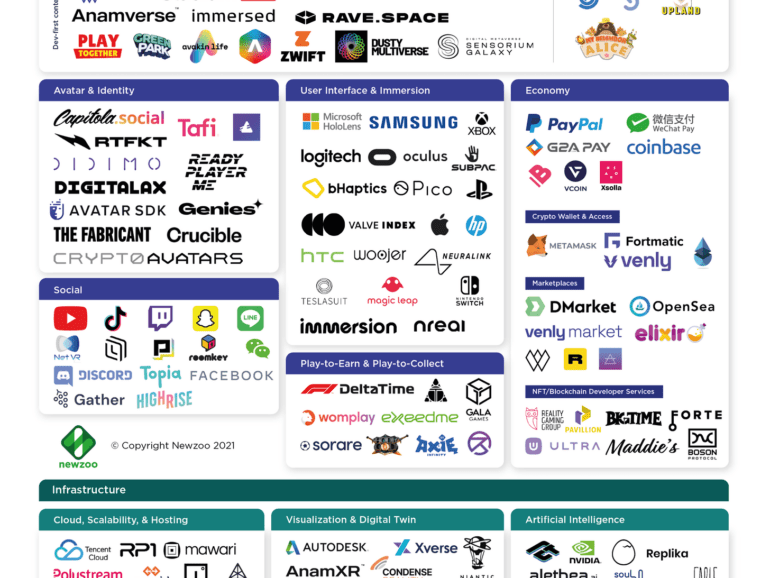

In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

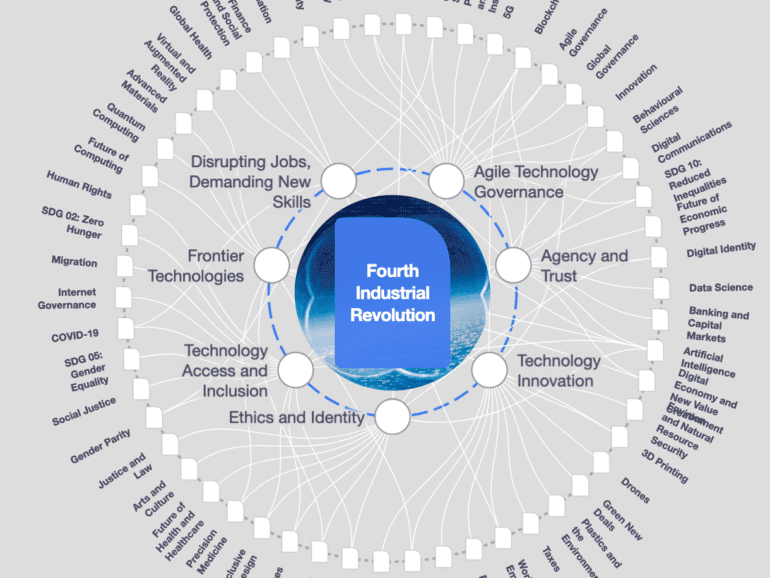

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

We’ve had this write-up in some various mental states floating around for a while, and better done than perfect. So treat this as a core idea to be fleshed out later.

Payments and banking companies should be looking at how people purchase and store digital goods and digital currency in video games. That experience has been polished over 40 years, and is what will be the default expectation for future generations.

For those interested, here is a website that collects user experiences of shopping across hundreds of designs.

exchanges / cap mktsidentity and privacymarketingMetaverse / xRNFTs and digital objectsSocial / Communityvisual art

·The structure of capital markets precedes the innovations that come from it. High frequency trading, passive ETF investing, SPACs, and crypto assets all telegraphed their value proposition before becoming large and meaningful in scale. We are now seeing a new market shape emerge, one that starts with community and builds up into financial instruments that are cultural and social. This analysis looks at the most recent developments in the overlap between decentralized social and cultural work and related financial features.

This week, let's dive into the Apple augmented reality glasses leak, the Magic Leap $350 million financing, and the uncanny imagery created by Epic Games' Unreal Engine. We summarize and pull apart the thesis of the Metaverse -- a virtual world as realistic and economically important as our own -- and how media and financial companies should think about the opportunity.

No More Content