E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

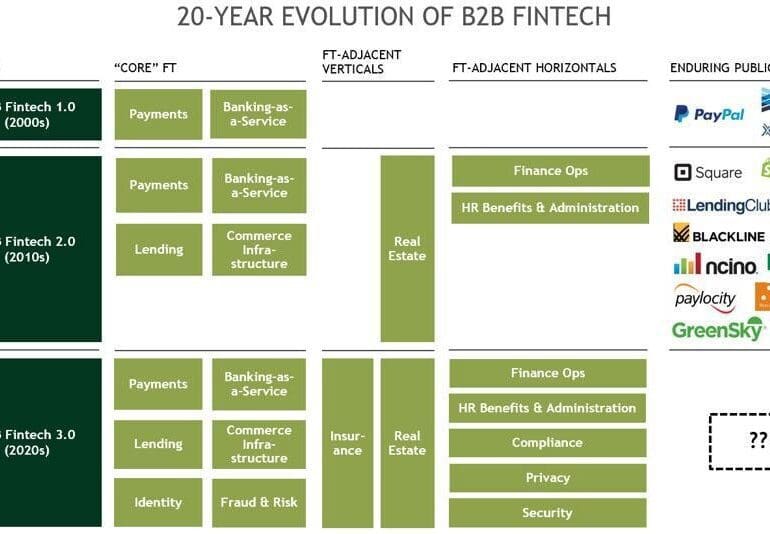

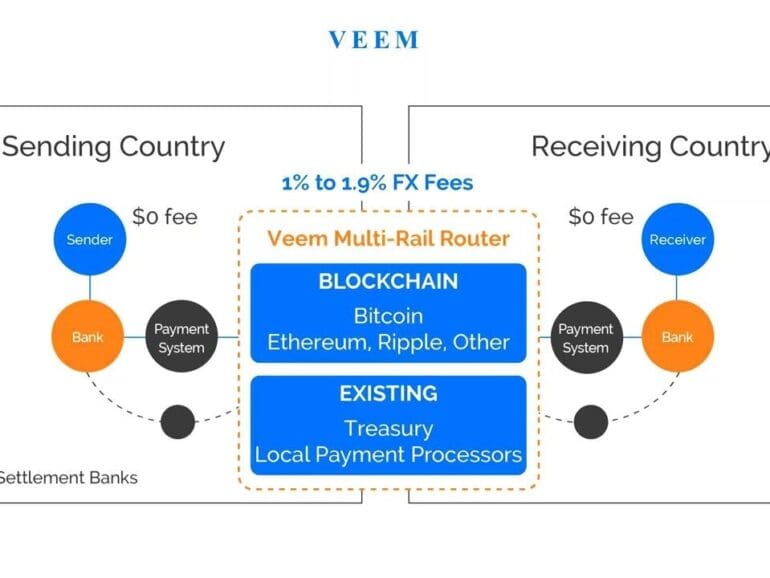

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

The cost of living crisis has been tough for merchants, but other factors are affecting their ability to future-proof.

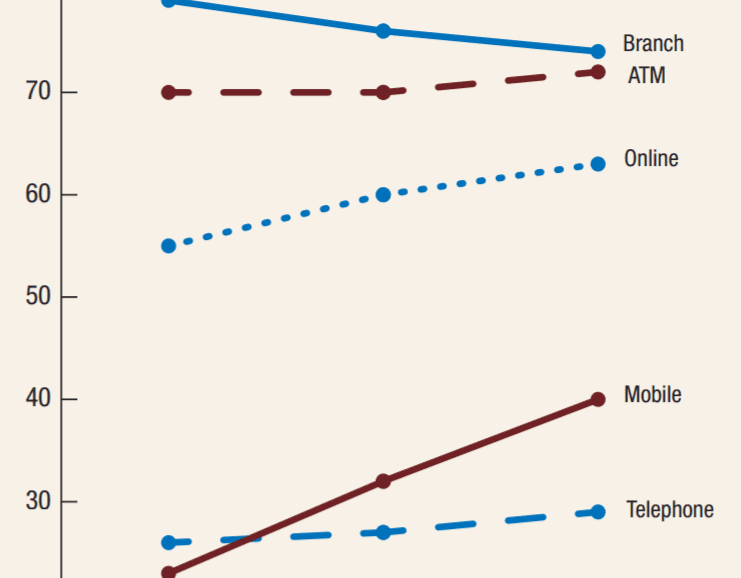

Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

Luxury and fashion markets are structurally different from finance or commodity markets in that they seek to limit supply in order to generate value. This increases price and social status. We can analogize these brand dynamics to what is happening in NFT digital object markets and better understand their function as a result.

We’re not cool. That’s why we’re in finance.

But people want to be cool. As highly social and intelligent animals, we want and need to belong, differentiate against each other, and negotiate for status. We create signals and hierarchies to create pockets of relational capital, which we then cash in for real world benefits.

Such mammalian realities are contrary to the economic rendering of the homo economicus, the abstracted rational agent making choices in financial models. In 2021, our financial models are waking up and instantiating themselves, becoming Decentralized Autonomous Organizations (DAOs), spun up by DeFi and NFT industry insiders, and implemented into commercial actions onchain.

In this conversation, we talk with Maximilian Rofagha, who serves as the CEO and Founder of Finimize, about how to do personal finance right and how to do it bottoms up for the world.

Additionally, we explore Max’s journey to becoming an entrepreneur, the nuances of the e-commerce business, the building of and drivers behind community and creating business activities around it, the influences of FinTok and crypto assets on financial community, and the drivers of value back into said communities fulfilling the feedback loop.

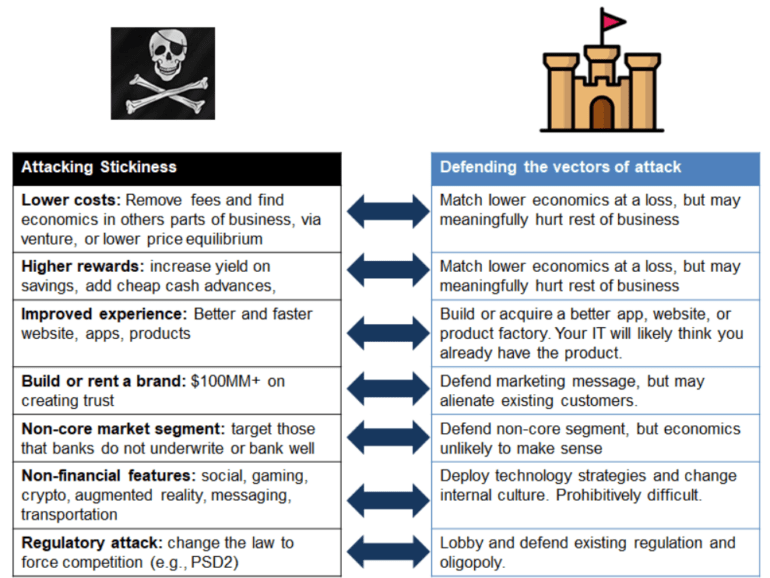

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?

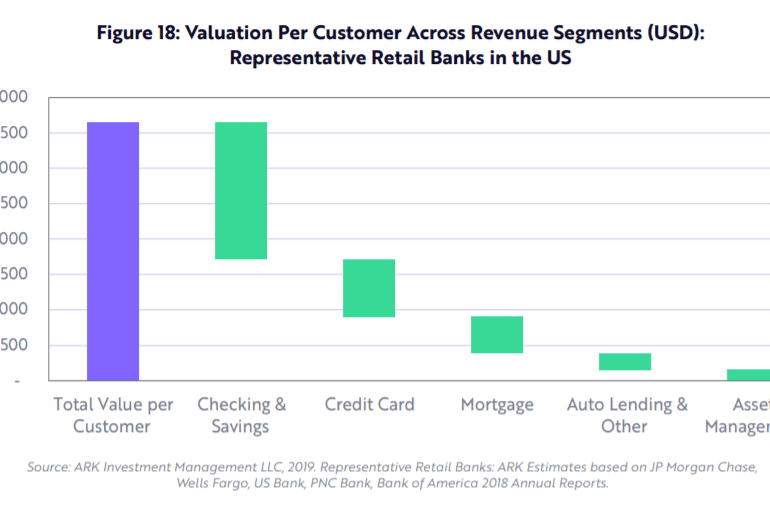

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.