The cost of living crisis has been tough for merchants, but other factors are affecting their ability to future-proof.

Rising interest rates drive retailers to seek new options that will encourage safe consumer spending. That is good news for companies like Accrue Savings, which offers an FDIC-insured wallet that helps customers build a balance with their favorite retailers.

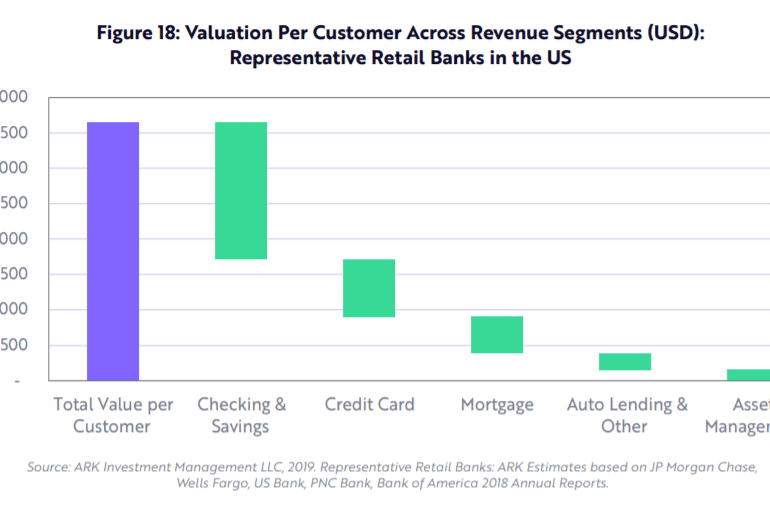

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

Addressing an issue of trust in cross-border purchases, pay after delivery removes the financial concern of long delivery times.

No More Content