Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. In this episode, we talk through a few recent events that are indicative of the Fintech world right now. Brex raised an additional $150 million at a slightly improved valuation vs. its last round just as Monzo is reportedly looking at a 40% down round. Why? Shopify launched bank accounts for its merchants and announced the Shop app, basically an Amazon competitor plus Klarna, just as it worked with Facebook to support the launch of Facebook Shops and joined the Libra Association. Lots going on. Lastly, we discuss why Goldman’s M&A activity over the past couple years leads to the natural conclusion that they should buy Schwab.

Rising interest rates drive retailers to seek new options that will encourage safe consumer spending. That is good news for companies like Accrue Savings, which offers an FDIC-insured wallet that helps customers build a balance with their favorite retailers.

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

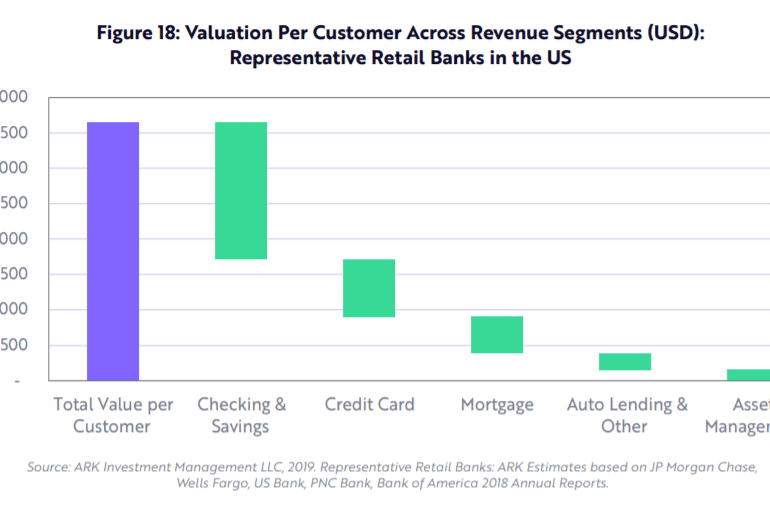

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.

Addressing an issue of trust in cross-border purchases, pay after delivery removes the financial concern of long delivery times.

E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

In this conversation, we talk with Maximilian Rofagha, who serves as the CEO and Founder of Finimize, about how to do personal finance right and how to do it bottoms up for the world.

Additionally, we explore Max’s journey to becoming an entrepreneur, the nuances of the e-commerce business, the building of and drivers behind community and creating business activities around it, the influences of FinTok and crypto assets on financial community, and the drivers of value back into said communities fulfilling the feedback loop.

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

·

Galileo’s CPO, David Feuer, said AI and improving infrastructure allow financial services innovators to create more responsive products, including in BNPL.