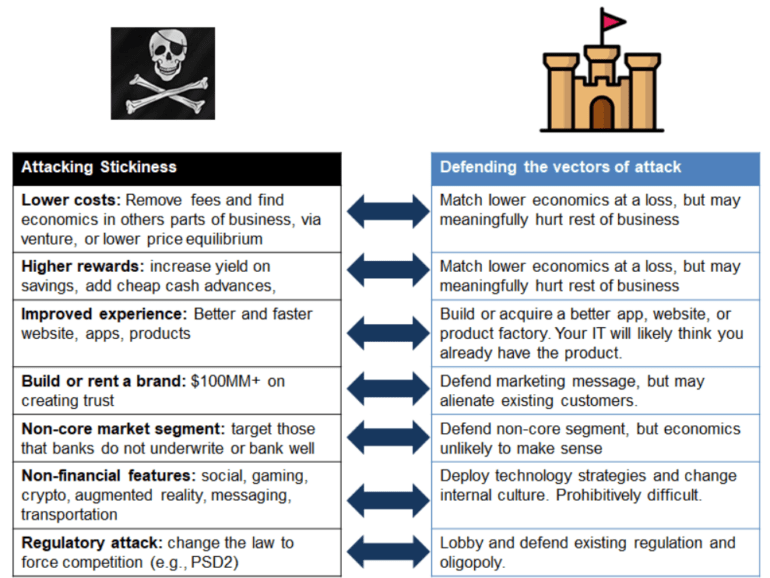

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?

Luxury and fashion markets are structurally different from finance or commodity markets in that they seek to limit supply in order to generate value. This increases price and social status. We can analogize these brand dynamics to what is happening in NFT digital object markets and better understand their function as a result.

We’re not cool. That’s why we’re in finance.

But people want to be cool. As highly social and intelligent animals, we want and need to belong, differentiate against each other, and negotiate for status. We create signals and hierarchies to create pockets of relational capital, which we then cash in for real world benefits.

Such mammalian realities are contrary to the economic rendering of the homo economicus, the abstracted rational agent making choices in financial models. In 2021, our financial models are waking up and instantiating themselves, becoming Decentralized Autonomous Organizations (DAOs), spun up by DeFi and NFT industry insiders, and implemented into commercial actions onchain.

The cost of living crisis has been tough for merchants, but other factors are affecting their ability to future-proof.

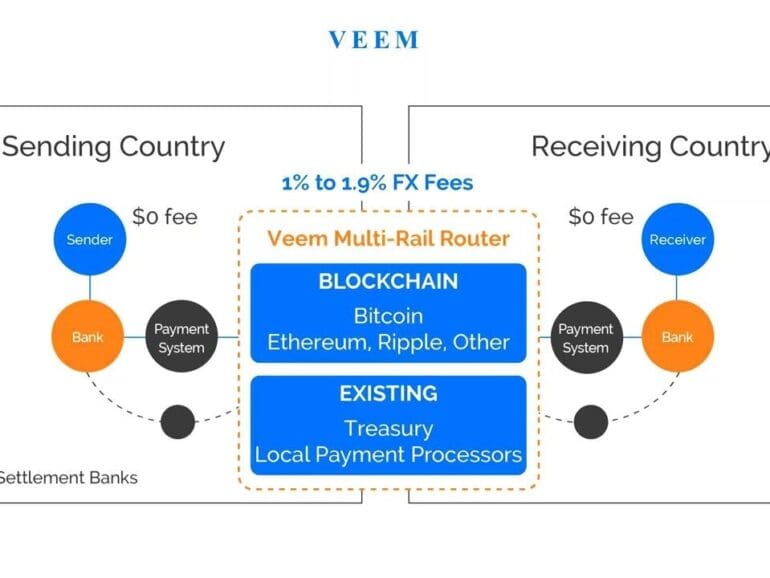

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

Let’s do some math homework. It’s good for you:

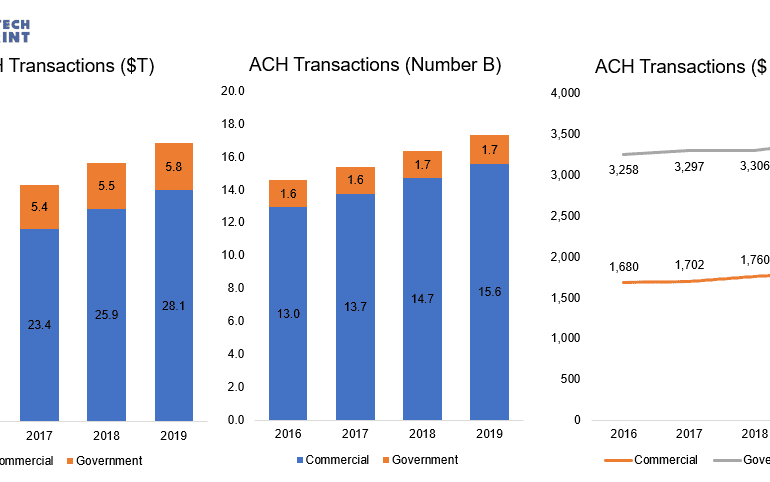

The Federal Reserve money movement system broke for several hours. We look deeply into its volumes and transactions, and value it like a Fintech unicorn.

The Ethereum ecosystem is throwing around as much volume in settlement as the Fed check processing system. We explore scalability barriers and solutions.

Can eCommerce fit into our emerging infrastructure? We anchor to the market numbers in China and the United States.

Things break.

Sometimes the things that break are the US Federal Reserve ACH service, Check 21, FedCash, Fedwire, and the national settlement service. They were down for a few hours — discovered at 11AM on Feb 24th and still in trouble at 3PM that day. Everything is now up and running again.

Chinadigital lendingeCommerceMetaverse / xRneobanksmall businessSocial / Communitysuper appsupply chain / trade

·This week, we cover these ideas:

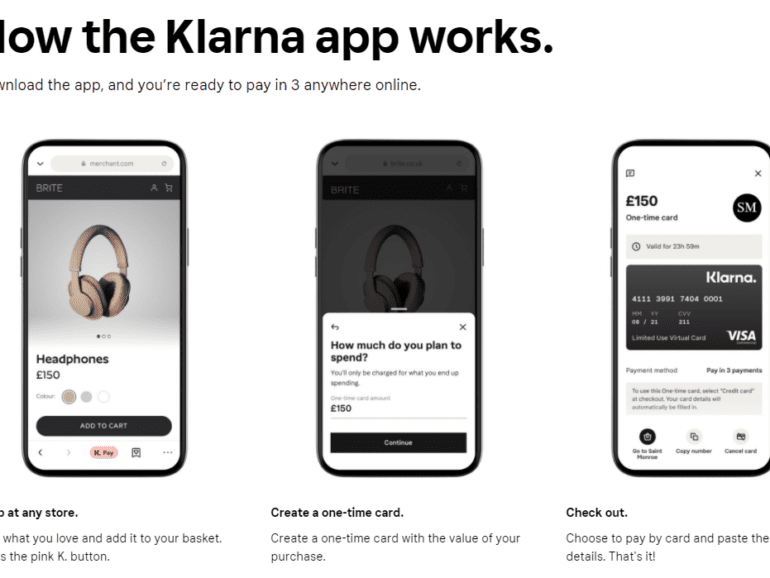

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

No More Content