TruVision Consumer Property Insights for Portfolio Management protects borrowers and lenders through a holistic view of property value fluctuation risks.

Financial institutions struggle to meet consumer demand for more payment types, mainly because they lack the proper data science capabilities. This drives suboptimal strategies like layering multiple payment types.

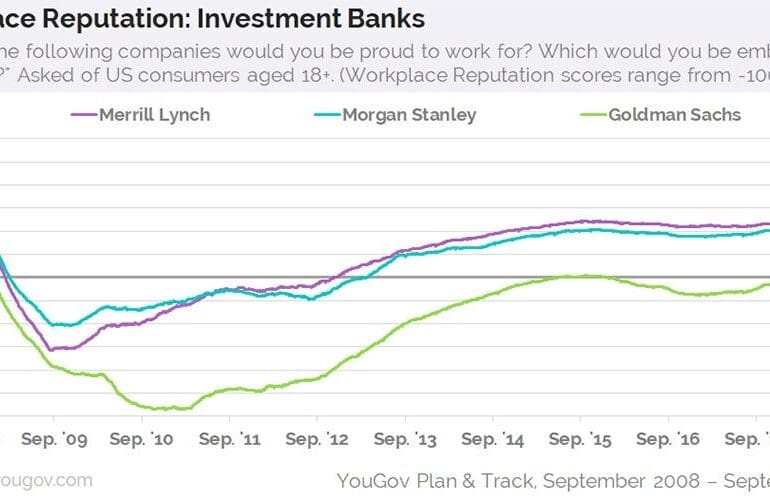

This week, we put on the Goldman hat and go shopping for companies. We buy a little bit of Folio and sell some Motif. We look at Personal Capital and the $1 billion it wants for its $12 billion of assets. We examine the private markets with Addepar / iCapital and SharesPost / Forge, and then move over to the banking sector. Should we buy Wells Fargo, as rumored, or some digital wallet apps? Read on for how to acquire a best-in-class Fintech.

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

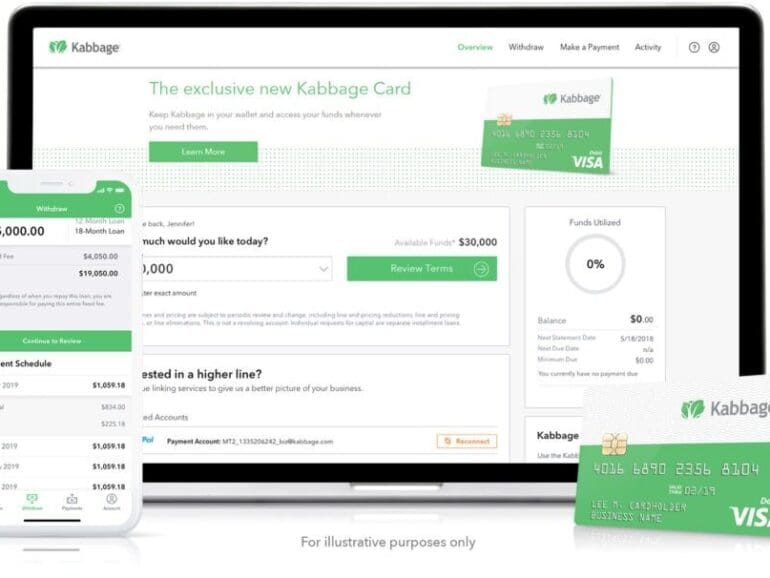

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

Two things are on my mind: (1) the acquisition of United Capital by Goldman Sachs, and (2) Mike Cagney's Figure securing a $1 billion funding line from Jefferies and WSFS for blockchain-tracked home equity loans. Both are outcomes of complex, interesting, somewhat unexpected processes -- and both are examples of demand-driven market expansion. Let me highlight that again. Both of these are consumer-centric developments, and not product-driven developments, which goes to the core of the problem in the financial services industry.

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

In a webinar sponsored by Provenir, experts discussed the promise and challenges of AI in lending, and where the sector was headed next.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

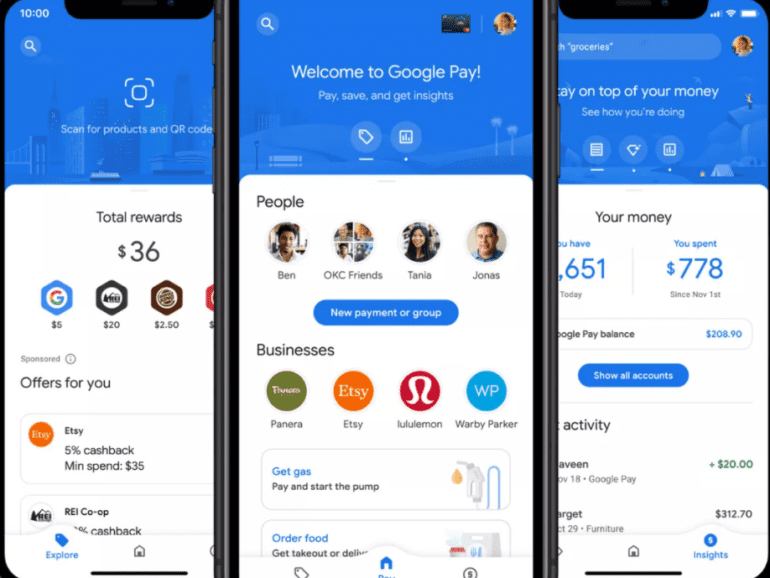

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

Pinwheel’s new partnership with Jack Henry will help banks and credit unions win primacy with more clients.

This week, we look at:

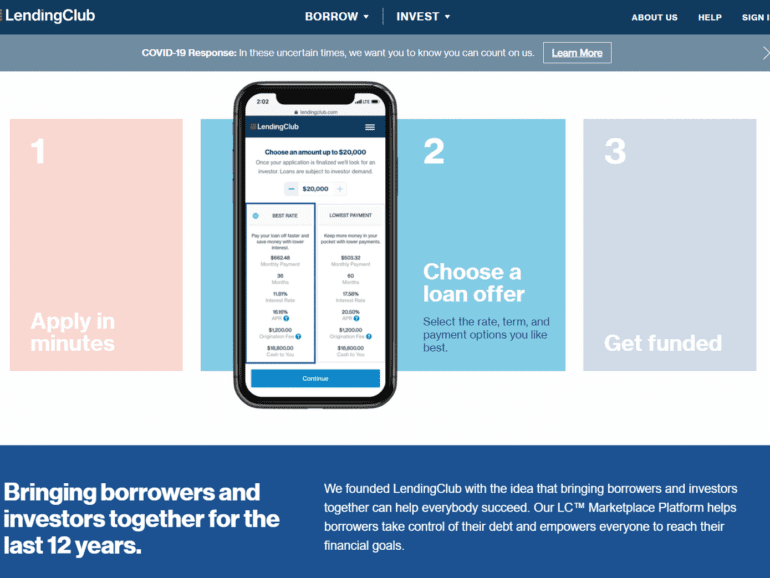

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma