This week, we look at:

TikTok has become a platform with billions of views for investing and stock recommendations to teens. This emotional and persuasive labor can be traced from Jim Cramer to Roaring Kitty.

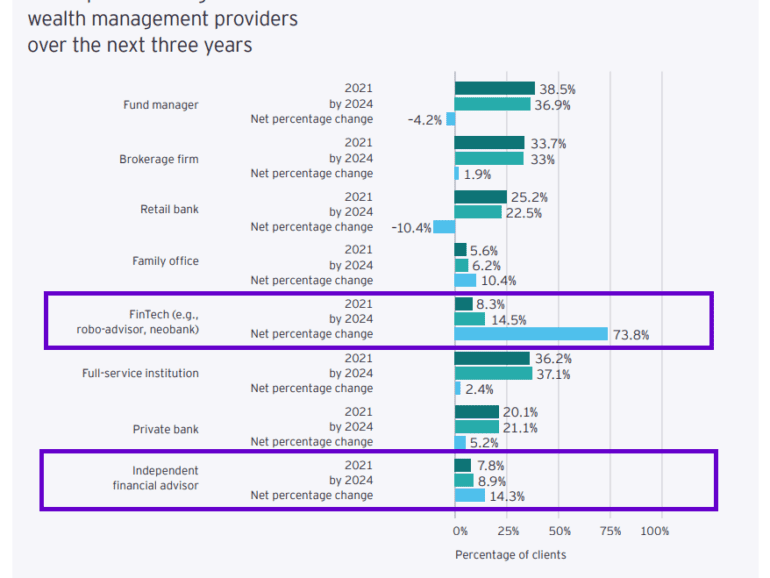

78% of Millennials (vs. 31% of Boomers) plan to use more digital tools in wealth management and 81% of them think that technology has made investing more efficient (vs. 61% Boomers)

This generational change has implications for investing technology, digital wallets, and the role of people in the financial advice process