While Synapse collapse is in the news a lot right now, this is a reminder that not all fintech is created equal. Let's not forget that there are many fantastic innovations that have come out of the rise of fintech.

According to Business Insider, fintech startup Synapse is laying off as many as 63 people or more than half of...

Back office banking infrastructure needs updating; fintech companies and banks want to work with companies that can provide a customizable,...

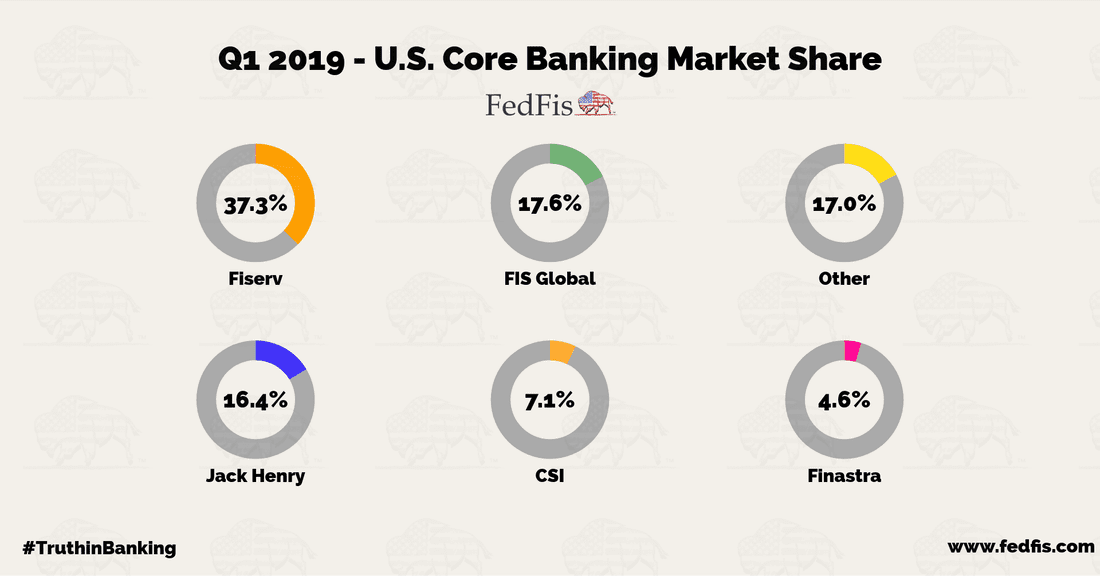

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

Global BaaS platform Synapse this week announced the launch of Global Cash, a secure cash management account product that enables residents in more than 35 countries to invest and hold U.S. dollars.

Digital banking fintech Synapse burst onto the scene in the last few years and is reportedly suffering from some serious...

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is...

Fresh off a new round of funding led by Andreessen Horowitz Synapse CEO sat down with American Banker to discuss...