Mike Cagney is one of the most successful fintech entrepreneurs with his founding of SoFi and now Figure; Cagney sat...

With Figure in the news this week completing their first securitization using blockchain we thought it would be interesting to...

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

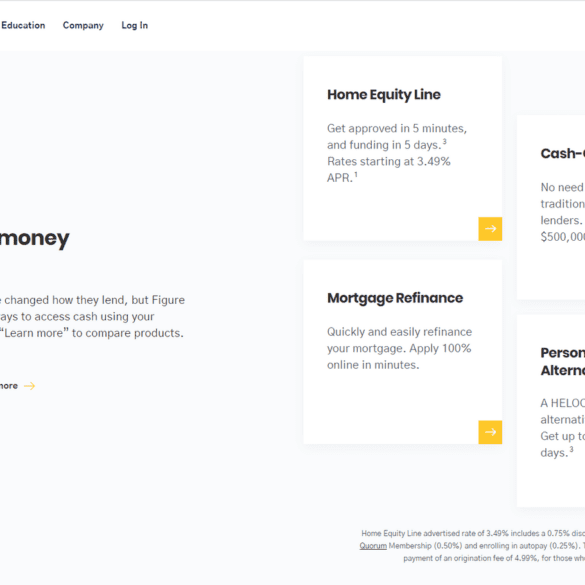

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

The $150 million securitization of HELOCs is being billed as the first transaction where all aspects were managed on the...