MoneyLion reported earnings for Q1 2024 and the company showed record numbers across revenue, EBITDA and net income.

EY Nexus for Banking Powered by MoneyLion unites two category leaders to help banks scale with integrated digital financial solutions.

A record-setting fourth quarter and full year have MoneyLion cofounder and CEO Dee Choubey excited about what comes next.

In this episode we talk with Dee Choubey, the CEO and co-founder of MoneyLion. He shares how they are rethinking customer engagement, changing the form factor of finance, navigating the bear market in fintech valuations, going all-in on NASCAR and much more.

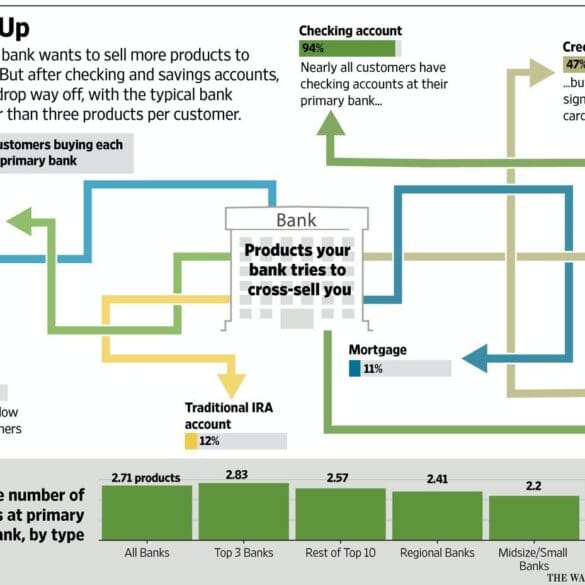

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

MoneyLion reported Q4 2023 earnings that exceeded expectations and showed significant improvement across the business.

The love-child of Moneylion's Even aquisition, Engine, looks to create tools for even non-financial companies to embed personalized products.

Results from MoneyLion's first Personal Financial Wellness Study confirm the growing influence of digital sources in our financial lives, but the steep drop-off of knowledge among millennials and Gen Z consumers.

This earnings season started strong but turned uneven this week. Even firms that showed outsized growth saw their stock prices...

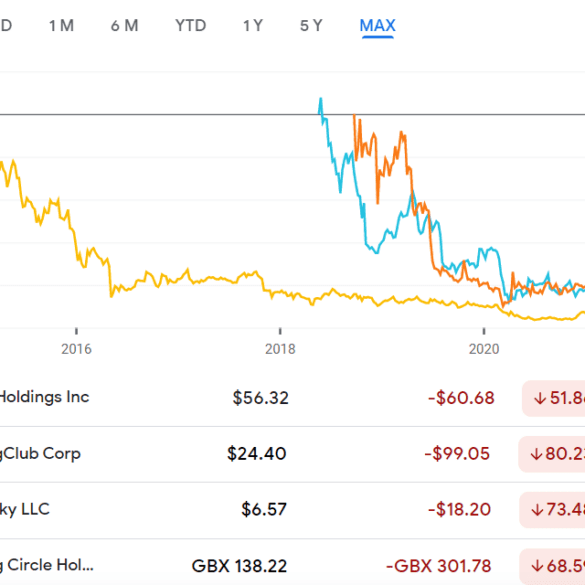

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.