Sam Bankman-Fried became the regulators' "face of crypto" supposedly bringing clarity to the space - despite this, confusion is rife.

Sometimes more is more, and sometimes less is more.

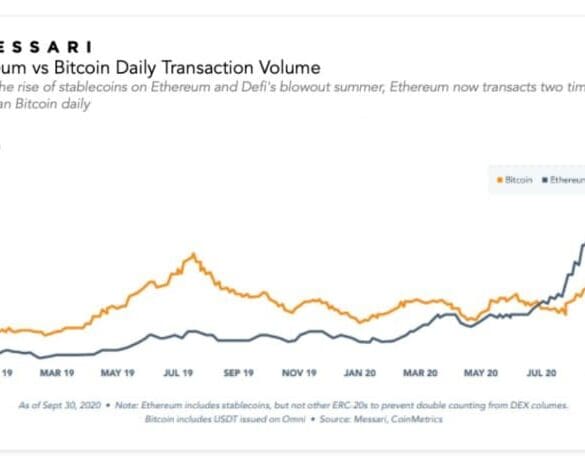

In that spirit, we strongly urge you to check out Messari’s Crypto Theses for 2021. It is a mammoth work of 134 pages, covering each and every development in the ecosystem.

If you don’t want to fuss around with the email gate, the direct link is here.

We are going to pick out five things that are interesting to us substantively and provide a view below. By pick out, we mean screenshot and respond.

Since the FTX meltdown, centralized exchanges in the DeFi space are rushing to publish PoRs, but without liability data, are they relevant?

Leading the news this week was the incredible demise of Fast that imploded this past week. Also making news was a big M&A deal from Fast archrival Bolt, Jamie Dimon's shareholder letter discusses tech, the UK go all-in on crypto, the SEC wants to regulate crypto exchanges and more.

·

The FTX debacle continues- when you thought it was all over, things just get weirder.

·

Talking Web3 investing went from a niche topic to a crazy idea very quickly this fall. But Fin Capital is still excited about blockchain tech.

Along the companies trying to soften the crisis impact on their business was Mexico's Bitso, one of the largest crypto exchanges in LatAm.

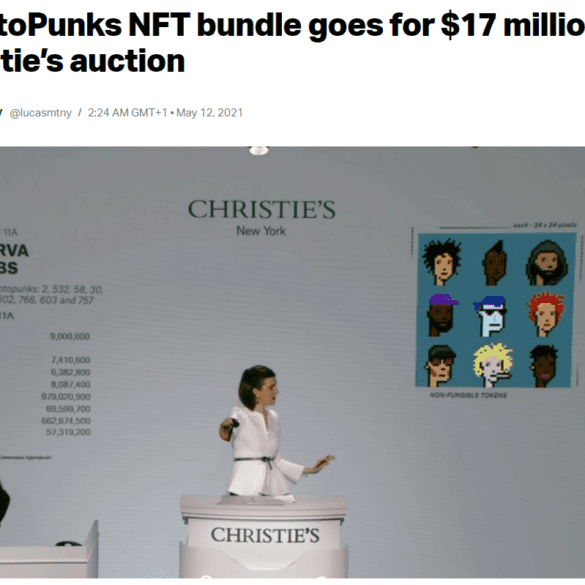

Luxury and fashion markets are structurally different from finance or commodity markets in that they seek to limit supply in order to generate value. This increases price and social status. We can analogize these brand dynamics to what is happening in NFT digital object markets and better understand their function as a result.

We’re not cool. That’s why we’re in finance.

But people want to be cool. As highly social and intelligent animals, we want and need to belong, differentiate against each other, and negotiate for status. We create signals and hierarchies to create pockets of relational capital, which we then cash in for real world benefits.

Such mammalian realities are contrary to the economic rendering of the homo economicus, the abstracted rational agent making choices in financial models. In 2021, our financial models are waking up and instantiating themselves, becoming Decentralized Autonomous Organizations (DAOs), spun up by DeFi and NFT industry insiders, and implemented into commercial actions onchain.

FTX led the news all week with the fastest fall in crypto history. This story crowded out any other major news story.

The crypto contagion continued this week with BlockFi being the center of attention. There was also news from FTX on Robinhood, Celsius continued to flounder, Three Arrows Capital is toast, and amid all this turmoil the EU agreed to a crypto regulatory framework.