Amazon's palm reader is having an impact on the fortune teller industry

Amazon launched a credit card product in Brazil in an effort to compete with Mercado Libre and ramp up its fintech strategy in South America.

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

Jeff Bezos does not care about competitors, only customers How can financial institutions provide more Amazon-like services?

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

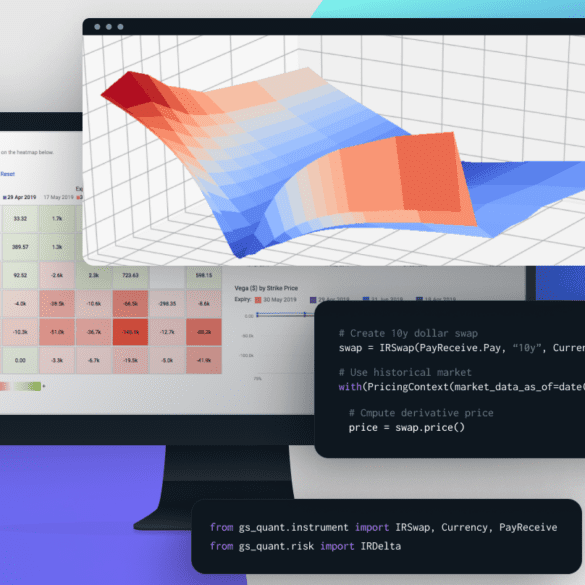

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Mexican fintech Kueski announced a partnership with Amazon to offer BNPL on its marketplace, a first for the retail giant in Mexico.

Amazon partnered with Affirm to offer BNPL to their North American customers.

At the end of September, Lendistry reached the one-year mark running the Amazon Community Lending program.

In 2021, firms who had stayed alive through the initial pandemic became giants: fintechs became banks, banks became super apps, and super apps became some of the most successful public companies in the world.

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.