The Consumer Financial Protection Bureau (CFPB) was established as part of Dodd-Frank reform following the 2008 financial crisis to focus on financial law pertaining to the protection of consumers in the financial marketplace; in 2016 a three-judge D.C. circuit panel declared the CFPB unconstitutional in the PHH vs. CFPB case and gave full director accountability power to the president; an appeal by the CFPB overturned that ruling and called for a rehearing of the case before a broader panel of judges which is set for May 24, 2017; on Friday, March 17 the US Justice Department filed a brief requesting that the federal appeals court restructure the CFPB; the brief appears to be focused on the fact that the CFPB director was setup to have no accountability to the president; in the case of PHH vs. CFPB, lawyers from PHH reported that the CFPB should be dissolved; the Justice Department's brief appears to focus just on the CFPB director's accountability. Source

Over my decade-plus covering fintech, I see parallels between earned wage access (EWA) and equity crowdfunding, P2P lending and BNPL.

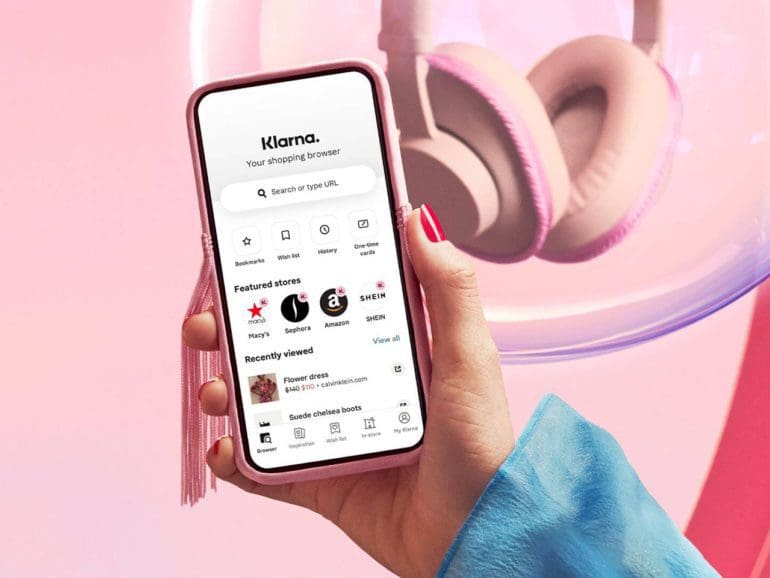

Buy now, pay later (BNPL) giant Klarna will start reporting data on customers' usage of its products to credit bureaus in the UK.

Earlier this month a task force of Joe Biden and Bernie Sanders supporters released a document with policy ideas including...

Anew approach to the FCA and how they interact with fintech, focusing on fostering innovation, being intelligence-led, and preparing for the future.

Last year the U.S. House passed a crowdfunding bill (H.R. 2930 – Entrepreneur Access to Capital Act) but it has...

It seems that regulators in Pennsylvania have had some misgivings about p2p lending. So, the PA Securities Commission issued this...

Banks have been given a deadline of early 2018 to comply with new regulations that will allow for open banking; many industry experts believe this deadline is too tight; to comply, banks would need to completely overhaul their current security infrastructure and banks are not known to rapidly change anything; the UK's big four - Lloyds Banking Group, HSBC, Barclays and Royal Bank of Scotland - control 77% of personal current accounts and 85% of business accounts; these new regulations will allow consumers to control access to their data and give them comparison tools to shop for the best mortgage, credit card or loan. Source

Collectibles — call centers—rumored legislation... There have been many developments in Reg A and Reg crowdfunding, yet the same old challenges persist.