Funding Circle was approved for a 7(a) license by the SBA but now there are some in Congress that want to take that away from them.

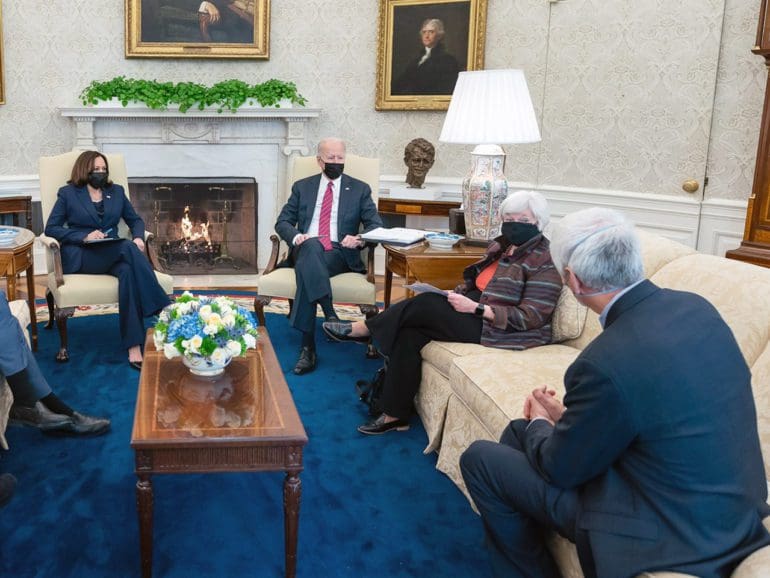

Secretary of Treasury Janet Yellen spoke at American University about the government's role in creating cryptocurrencies or CBDCs.

Their website mentions names such as 'digital sterling' or 'Britcoin' and emphasizes the difference between CBCDs and cryptocurrencies.

Representative Patrick McHenry says Dodd-Frank reform is not likely to make it to the House of Representatives until June or July; he is confident in major changes for the regulation from the House of Representatives however he foresees opposition from Senate democrats; in an interview with WSJ Pro Financial Regulation he also provided his insight on a range of regulatory aspects which could be integrated into legislation in various ways. Source

CFPB Director Rohit Chopra has made it clear that he embraces an expansive view of the Bureau's authority to remedy inequities.

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

The UK government has told P2P lenders that wholesale lending does not count under the current regulations and the practice is too risky for retail investors; wholesale lending is when you lend money to a business who then lends that money out; the FCA said, "this would mimic banking – but without the same protection for individuals or regulations for the firms involved"; P2P lender RateSetter started to wind down their wholesale loan book after getting more clarity from the FCA in December; the FCA still hasn't provided full clarity on the subject, but they are at least beginning to give more insight so lenders know where the boundaries are. Source

The report found that more than half of banks reported challenges reducing cyberattacks, and nearly half of firms are concerned with safeguarding sensitive data and adapting to consumer privacy laws.

Chinese regulators have issued new guidance for P2P lenders in further efforts to regulate China's fintech industry; the new guidance requires P2P lenders to register with the government which will also help regulators to build an industry database for development of future regulation; regulators involved with the new guidance include the China Banking Regulatory Commission, the Ministry of Industry and Information Technology and the State Administration for Industry and Commerce. Source

Earlier this month a task force of Joe Biden and Bernie Sanders supporters released a document with policy ideas including...