In early 2021, then Chancellor of the Exchequer, Rishi Sunak, announced a plan to supercharge fintech within the UK.

“Our vision is for a more open, greener, and more technologically advanced financial services sector,” he said. “The UK is already known for being at the forefront of innovation, but we need to go further. The steps I’ve outlined today to boost growing fintechs, push the boundaries of digital finance, and make our financial markets more efficient will propel us forward. And if we can capture the extraordinary potential of technology, we’ll cement the UK’s position as the world’s pre-eminent financial center.”

He wasnt wrong. At the time, the industry was making strides toward financial innovation. The Kalifa review had been published earlier that year and more than a few of UK-founded fintechs had reached unicorn status.

The “ambitious program of initiatives” aimed at driving innovation further forward. The FCA was to launch a regulatory “scale box,” the visa system was going to be streamlined to attract the best talent, recommendations following the Kalifa Review were going to be taken forward, and the illustrious CFIT (Center of Financial Innovation and Technology) was to be formed.

Two years on, with an almost stagnant economy and a dwindling appetite for UK IPOs, the fruits of this plan are yet to be seen.

It’s not all Sunak’s fault; the aftermath of the pandemic brought a number of economic headwinds, and the political landscape had its bout of instability. The fintech industry globally has been hit with difficulties and low funding, and the UK, stumbling to find its post-Brexit footing, has felt the implications.

RELATED: UK fintech investment sees 65% decline

Deal count for H1’2023 in the UK was seen to have dropped by 53%, according to KPMG’s Pulse of Fintech Report, dragged along by several mega-raises and a multi-billion buyout of data insights firm Wood Mackenzie. While the UK still remains the strongest in the EMEA region, The US has seen growing fintech funding, and Europe has implemented strong regulatory policies to improve its future position.

In addition, home-grown challenger banks are turning their sights elsewhere. Revolut CEO Nikolay Storonsky famously said earlier this year, “In the UK, there are higher taxes to pay and an extremely bureaucratic regulator.” The comment was made soon after the company withdrew its banking license application, amongst indications it would be rejected.

While this may be the comment of a disgruntled leader smarting from a banking license rejection, criticism of the UK’s approach in other areas of financial innovation has also seen print.

The government-commissioned Kalifa Review even noted a need for ongoing development, “The trajectory of UK fintech is at an inflection point of opportunity – and risk. While the UK’s position is well established, its future is not assured.”

Has the former pioneer in financial innovation lost its touch?

Losing the UK Lead in Open Banking

An area of particular concern for fintech leaders in the UK is the open banking sector. Britain, once a pioneer in open banking, was seen to be doing little to further innovation into open finance.

RELATED: UK reaches milestone of 5 million open banking users

“The UK was ahead of the world in open banking, there’s no doubt about it,” said James Lynn, Co- Founder of Currensea. “But there’s a real danger that the UK could be resting on his laurels when it comes to open finance and really getting behind.”

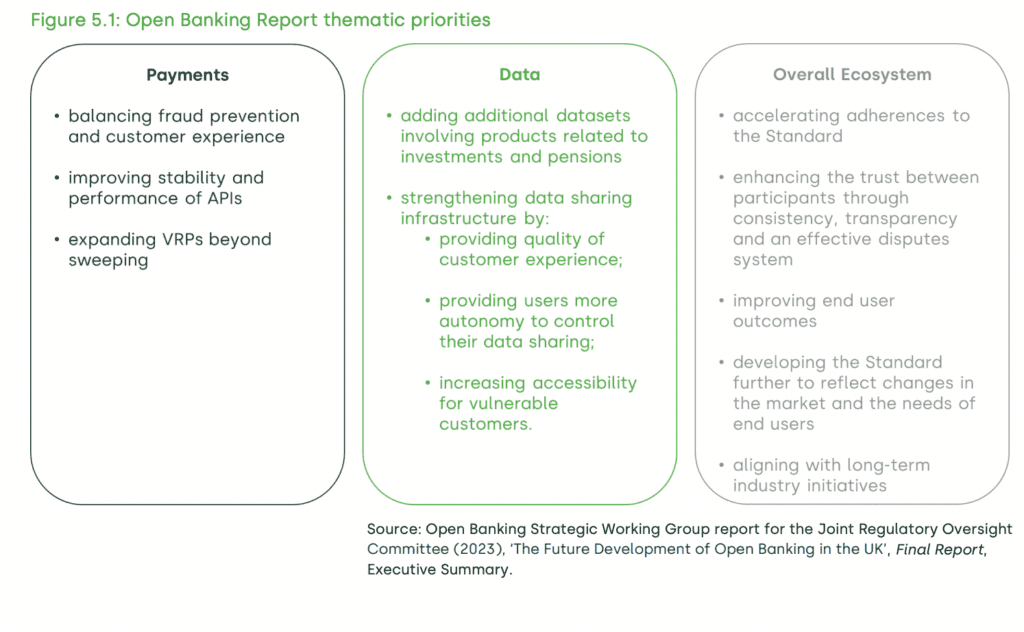

In early 2023, the Joint Regulatory Oversight Committee (JROC) published its recommendations to grow open banking in the UK. The goal of the recommendations was to increase innovation and competition while lowering costs. “While significant progress has been made, there is more to be done to deliver the full benefits of open banking within retail banking markets and beyond,” they stated. However, they also said its successful implementation would take years and rely heavily on the governments’ implementation of long-term open banking regulation.

The recommendations came at a critical time. In January of the same year, the Competition and Markets Authority (CMA) announced the completion of its open banking roadmap, which, for some, left much to be desired. In July 2023, Natwest, one of the largest banks in the UK, released a report identifying a need for development in the space. According to the report, while Open Banking in the UK has been a “qualified success”, it was still only utilized by 10% of adults.

“Unless the regulator says to do something, nothing happens,” said Stephen Wright, head of regulation and standards, bank of Application Programming Interfaces (APIs) at NatWest Group. “When you look at the adoption of internet and mobile banking, which is more than 60% adoption, and the adoption of contactless, that’s up at 85–90% – it’s got a way to go.”

Elsewhere, open banking standards have gained popularity, and while in many countries, regulators are yet to implement formalized rules, private companies have driven development.

In the US, fintechs such as Plaid have driven demand for more open access to financial data. According to a Plaid survey, the ability to switch accounts and connect fintech accounts easily to their bank has become a priority for US consumers. They also found demand had gotten even stronger as consumers faced more economic challenges. The efforts of private actors like Plaid have been bolstered by a movement from local regulators to implement rules supporting a move towards open banking.

Natwest identified a need for a coherent plan to reach UK open banking objectives set out in the JROC’s report. They stated there was a lack of incentives and coordination to meet these goals and called for a regulatory prioritization for removing roadblocks to encourage innovation.

Regulatory Sandboxes And The FSMB 2023

For many, the UK’s success in fintech innovation lies in the supportive regulatory structure.

The Financial Conduct Authority (FCA) has been at the forefront, sparking a significant shift in 2016 when the entity launched its regulatory sandbox for fintechs. Working with regulators, startups could work to find solutions that were innovative while remaining compliant.

Initially starting with accepted “cohorts,” the FCA opened out the sandbox in 2021 to any startup at any time, driving the pace of innovation.

For a lot of startups, this marked the beginning of their success story.

“When we initially set up, we went through the FCA sandbox,” said Lynn. “Staying really close to the regulator is important. For me, I think the most important approach there is being proactive and actually thinking through regulatory angles and working with the regulator, as opposed to just sort of coming up with ideas and waiting for someone to knock on the door.”

Currensea then grew to be valued at “just under £20million” last year before valuations across the industry plummeted. This was despite their launch “at the worst possible time in history” for a travel debit card – just before the COVID-19 pandemic grounded planes for months.

Despite the encouraging start and the subsequent regulatory “scale box” for growing startups promised by Sunak in 2021, momentum has dwindled. Leaders in the UK fintech sphere have voiced their concerns.

RELATED: Digital innovators ‘at war’: Wintermeyer

“Over the last decade, the UK has been the leading hub for fintech globally, supported by regulators who have embraced innovation,” said Janine Hirt, CEO of Innovate Finance. “However, as other countries are catching up, we risk falling behind unless our regulators continue to innovate.”

The Financial Services and Markets Act 2023 (FSMB 2023), given the Royal Accent in June, marked a pivotal step to improve the UK’s financial market competitiveness post-Brexit.

“The Act is central to the Government’s vision to grow the economy and create an open, sustainable, and technologically advanced financial services sector,” stated HM Treasury. The Treasury wrote in their statement that the FSMB2023 allowed for the UK to take advantage of post-Brexit freedoms and “rocket boost” the sector.

It allowed for a number of steps to be made towards regulatory innovation.

“This landmark piece of legislation gives us control of our financial services rulebook, so it supports UK businesses and consumers and drives growth,” said Economic Secretary to the Treasury, Andrew Griffith. “By repealing old EU laws set in Brussels, it will unlock billions in investment – cash that can unlock innovation and grow the economy.”

The rules are said to:

- “Enhance the scrutiny of financial services regulators”,

- “Remove unnecessary restrictions on wholesale markets,”

- “Protect free access to cash,”

- Enable regulation of digital assets

- Introduce fraud protections, particularly for APP scams

- Establish regulatory sandboxes that facilitate the use of new technologies such as blockchain.

In response to HM Treasury’s call for proposals regarding financial services regulation, running May to July 2023, Innovate Finance outlined its vision for regulation that would drive further innovation.

“As technology, and the fintechs who enable it, become central to financial services, we need to see new regulatory approaches that support innovation,” said Hirt. “We also welcome new policies that can create more agile regulators that can protect both consumers and market competitiveness and enable innovation in financial services”.

Central to their proposal was the move away from a “one size fits all” approach. “The application of the same rules for start-up and scale-up fintechs as traditional financial institutions has a disproportionate impact..when compared to incumbents,” they stated.

They explained that the current financial regulation framework can be difficult for startups with limited resources to navigate and understand. They also posed the idea for a “RegTech test” when new regulation is implemented to check the technology sector’s ability to remain compliant.

FSMB and Digital Assets

A particular area of the FSMB 2023 that was deemed progressive was its focus on enabling the “safe adoption” of digital assets and blockchain. Perhaps in direct response to the landmark MiCA bill introduced by the European Commission a month prior to the FSMB’s royal ascension, it provided guidelines for encouraging the establishment of regulated digital asset companies in the UK.

“The Act now gives regulators the powers to develop and apply rules for crypto assets, and we encourage the FCA and Bank of England to engage directly with industry on how existing rules can be tailored to crypto assets and stablecoin,” said Hirt.

“We would encourage rapid progress on (a sandbox for innovation in financial market infrastructure from the FCA), ensuring it is open to as wide a variety of technology and markets as possible – and with regulators tweaking their rules alongside firms testing the use of digital assets to improve efficiency and operational capability.”

The introduction of these allowances run in accordance with Sunak’s desire to “make Britain a global hub for crypto assets,” stated during his time as Chancellor of the Exchequer. This same desire led Sunak to announce plans for the creation of a government-backed NFT, which were subsequently dropped a year later.

RELATED: UK Economic Secretary announces innovative approach to crypto technologies

In addition to the FSMB, various regulators have put forth proposals that could nurture the digital asset space. The Law Commission proposed the creation of a new personal property category that would allow for the ownership of digital assets.

“The use and importance of digital assets has grown significantly in the last few years,” said Sarah Green, law commissioner for commercial and common law. “The flexibility of the common law means that the legal system in England and Wales is well placed to adapt to this rapid growth.”

Digital Pound Exploration Despite Public Distrust

Although Sunak’s NFT idea fell through, the government continues to make headway into exploring the creation of a CBDC, driven, like many governments, by a rise in digital payments and the development of stablecoins by the private sector.

In February 2023, The Bank of England announced its intention to investigate a digital pound, stating that it would be a “new type of money” to be used alongside cash.

“In an increasingly digital society, the U.K. needs to keep pace with the speed of innovation that’s happening in the payments sector,” Ian Taylor, head of crypto and digital assets at KPMG UK, told Cointelegraph. “The Bank of England’s consultation into a proposed CBDC is a sensible approach to keep the UK at the forefront of technological change without committing yet to the substantial investment needed to roll out a digital pound.”

However, the move was hit by public backlash, following concerns that it would work against economic freedom and increase public surveillance, driven by a global rhetoric surrounding CBDCs. While the exploration is ongoing, industry commentators have warned the distrust could stand in the way of adoption.

“If people don’t feel confident engaging with a CBDC or any other digital form of money, you won’t have consent,” said Lord Christopher Holmes to the Financial Times, “and without consent, you haven’t even got off the starting block.”

However, leaders within the fintech space have said that its development could be fundamental to ongoing payment innovation.

“The adoption of a retail digital pound, as proposed by the Bank of England, has tremendous potential to stimulate innovation across various domestic markets, including rental and e-commerce, foster financial inclusion solutions through integration with a renewable digital ID, and significantly reduce the cost of making and receiving payments for small and medium-sized enterprises across the country,” said Hirt.

R&D Tax Relief Cuts – Slowing Innovation?

In what could be considered a blow to the advancement of innovation, Research and Development tax credits were cut in November 2022.

As part of the Autumn Budget, Jeremy Hunt, Chancellor of the Exchequer, despite stating that he wanted to make the UK “the next Silicon Valley,” made significant cuts to R&D tax benefits for SMEs. The tax benefits, implemented in 2000, had been split into two sectors: those for SMEs and those for larger companies. Benefits for SMEs accounted for 64% of all benefits claimed, and larger companies claimed 36%.

RELATED: The Autumn Statement – A “Silicon Valley” vision for fintech

In Hunt’s proposed changes, SMEs engaging in R&D would receive a reduction in cashback on tax, shifting from 33% to 19% of all R&D investment. Sunak, although proclaiming a need to drive innovation, first proposed the idea of cutting the tax benefit during the 2022 Spring Budget while positioned as Chancellor. “In spite of spending huge and rapidly growing sums, clearly it is not working as well as it should,” he said at the time. Claims for tax benefits had increased significantly between 2015 and 2021, and the forecasted cuts were projected to save over £1 billion a year by 2027.

The cuts, working directly in opposition to Kalifa Review recommendations to expand tax relief for innovation, were met with outrage from the startup community. Many focused on research and development voiced concern over its effect on innovation.

“This plays a pivotal role in the long-term growth strategies of companies, and a reduction in the amount available will undoubtedly have a detrimental effect on these activities, stifling innovation,” said R&D tax specialist Steve Collins to Sifted.

Hunt scaled back on the cuts in his 2023 Spring Budget and announced that those SMEs that spent over 40% of their budget on R&D would be able to claim a 27% tax credit. However, many remained concerned.

Mark Smith, partner at Ayming, stated that the cut in tax relief could still significantly affect innovation and “undermines its ambition to make Britain the next Silicon Valley.”

“Forty percent of spend on R&D is very high, so only a very small portion of U.K. businesses will be eligible,” he said.

Others agreed, stating that the startup community was in need of a boost, particularly within the challenging economic climate. “Against a backdrop of stagnant productivity and absent growth, business investment is in the doldrums,” said Chirag Shah, CEO and Founder of Nucleus Commercial Finance, in the aftermath of the statement. “While those larger businesses working on innovative projects in science and technology will receive a boost to their growth ambitions, the reality is that SMEs up and down will likely see little benefit.”

Mind the Gap

Despite the cuts in R&D tax relief, the UK has acted elsewhere to fund innovation. One of the most recent developments was the announcement of a £1 billion Fintech Growth Fund in August 2023.

The action stemmed from the government-commissioned Kalifa Review, published in 2021, which identified a £2 billion funding gap in UK fintech and turned to institutional capital to fill the hole. The Fund is led by private market participants, including Mastercard, Barclays Bank, and London Stock Exchange Group.

It was found that few fintech funds in the UK could support the funding requirements needed for UK fintechs to IPO, leaving them to look elsewhere. Since 2021, financial advisors to the fund, Peel Hunt, noted that UK VC-funded fintech had remained concentrated in the early stages. Those that were most successful were “subject to exits before they met their full potential.”

“The UK has always been at the forefront of innovation in fintech, but there is a very clear and well-evidenced growth funding gap,” Fintech Growth Fund co-founder and managing partner Phil Vidler said.

“Our aim is to not only provide the capital needed for founders to scale their businesses but to also engage with stakeholders across the nation to support the wider ecosystem…In doing so, we believe we can ensure the UK remains a global leader in fintech.”

Those in the fintech industry have considered it a critical step towards fulfilling the governments’ Silicon Valley dreams.

Reaching for Silicon Valley status

While the fintech sector has seen a comparative drop in activity, it’s an affliction that has been seen globally. Sunak’s government, facing economic headwinds, has made some questionable decisions that many have considered to work against ongoing innovation. In the “global race” to be fintech’s leading hub, the UK’s initial head start has weakened, with global superpowers nipping at the nation’s heels

The US, despite some regulatory roadblocks, is now fintech’s Top Player and is one of the only areas that has seen fintech funding climb in H1 2023. While many consider the UK to be a strong environment for startups, the funding gap, exacerbated by economic headwinds, is starting to show. Deal volume in the UK during the same period dropped by 53%, yet the onus to fill the funding gap still lies in private initiatives.

Emerging technologies such as generative AI are set to drive the next wave of funding in the fintech sector, and the UK government’s apparent headway to encourage regulatory innovation could make a difference. The ascension of the FSMB 2023 in June could mark an advantage in nurturing future development with nascent technology in the financial services sector. However, the UK’s future success will be shaped by regulatory willingness to do so.

“Our (past) success must not breed complacency,” stated TechUK, a consortium of tech leaders in the UK. “There is now a fierce global race over the key technologies that will shape the future… If the next Government does not make the most of the UK’s strengths, there is a real risk of it falling behind.”