In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

Salt Labs, which helps lower-income workers but does not subtract from their earnings, has recruited Ted Benna, the father of the 401(k), as an advisor.

I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

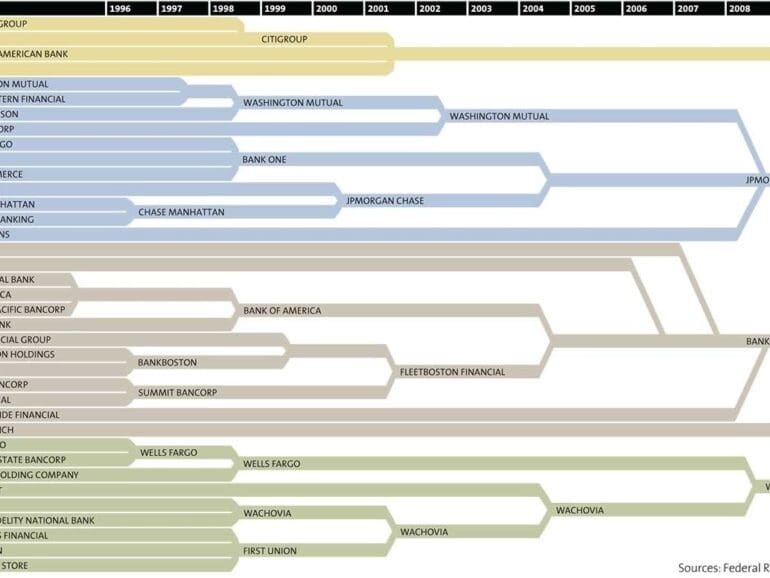

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

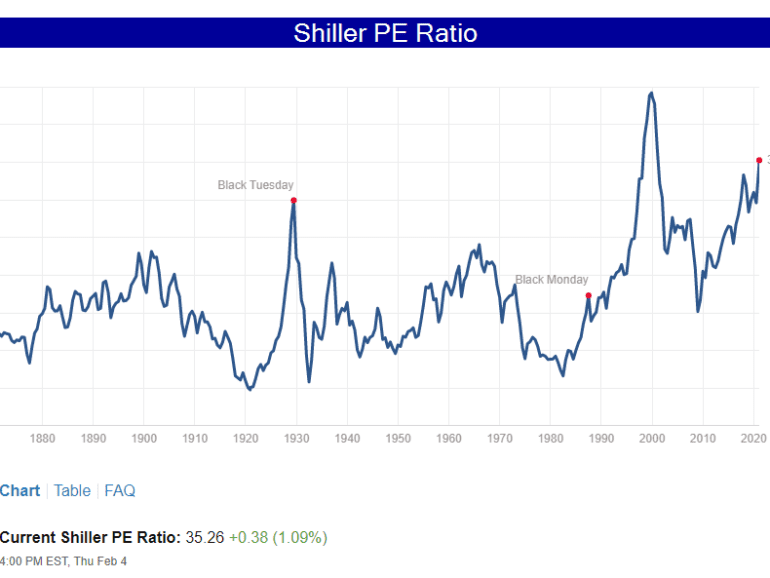

Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

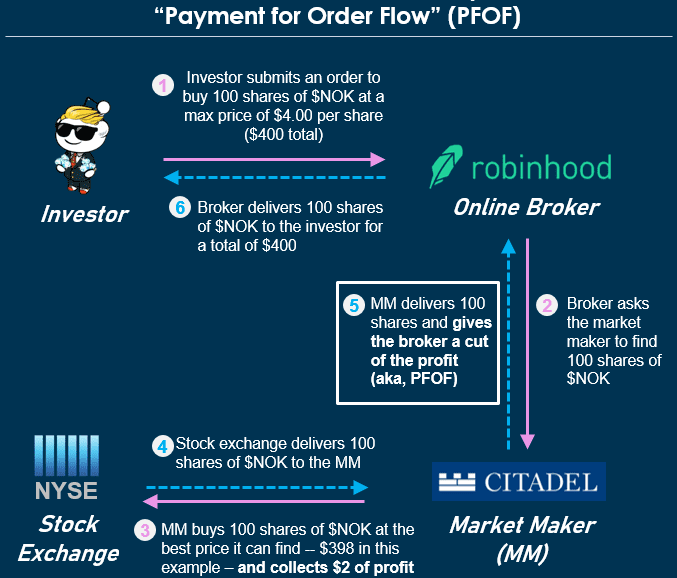

In this conversation, we talk with Will Beeson of Bella and Rebank, about how the Internet/Reddit/Gamestop broke out financial market structure, the social contract, and what the new American finance structure will look like.

More specifically, we give some thought to which FinTech and Crypto companies win or lose from the GameStop adventure, the actual market structure issues that led to the suspension of Robinhood’s trading, and what’s next for the mobile broker, and finally, the social meaning of the war against hedge funds by Reddit’s r/wallstreetbets. Check out our conversation on these exciting new developments.

With the explosion of Generative AI Sam Altman has become one of the most famous entrepreneurs on the planet. But not much has been written about his fintech investments.

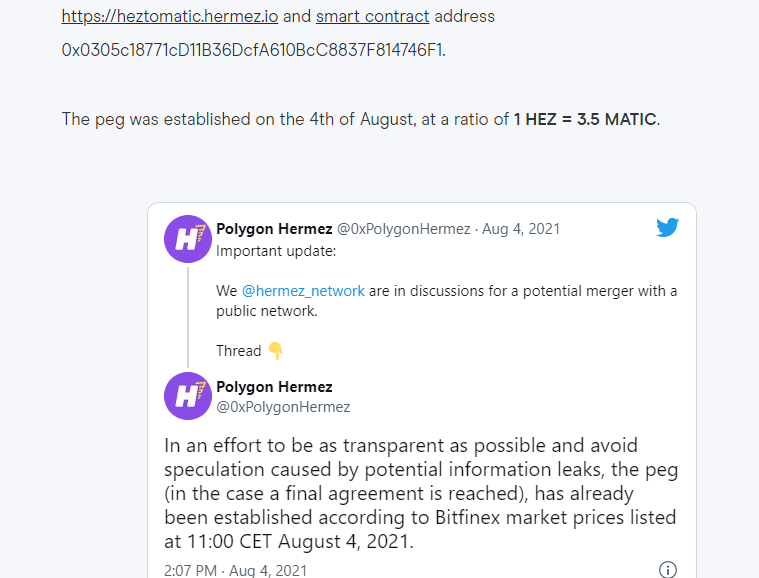

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

Research from TransUnion suggests that the Federal Housing Finance Agency’s (FHFA) move to a bi-merge system could significantly impact both consumers and lenders while providing little benefit.

In this conversation, we talk with Paul Rowady, who is the Director of Research for Alphacution Research Conservatory. Paul has a deep background in capital markets, derivatives, and the macro structure of the industry. He has been uncovering the transformation of that structure with data driven analyses, making visible the economics of market makers like Citadel and retail order flow aggregators like Robinhood. This is a rich discussion of what trading stocks is really like. And make sure to check out Alphacution.