Chinese credit card management firm, 51 Credit, has raised $84 million in Series C+ funding from Harvest Capital and Yintai Group, this is soon after they secured $310 million from Series C funding; the fundraising will help the company establish its own investment fund targeting fintech companies; in total the firm has raised $444 million in equity capital; according to Sun Haitao, 51 Credit CEO, the fund will be launched within a year, and will focus on asset management, data and credit services. Source

5G technology is beginning to be rolled out by telecom companies as the technology has a lot of potential to...

More than 6 million Bank of America customers are now using the Erica virtual assistant and it has processed more...

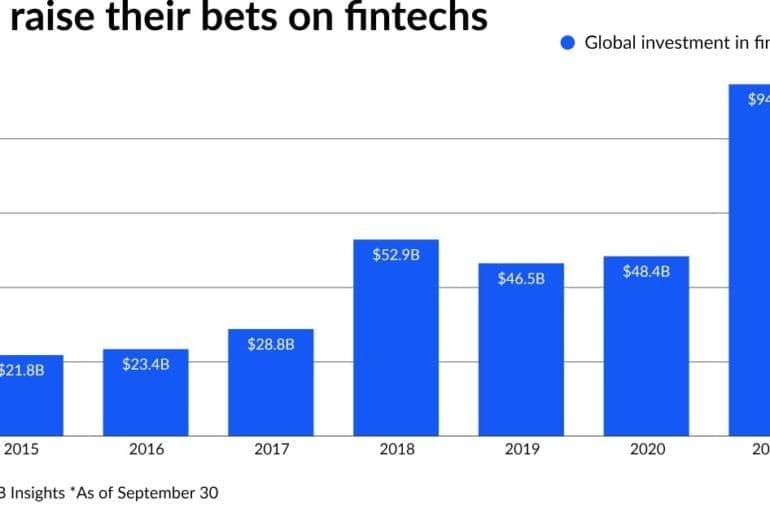

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

Neobanks and traditional institutions face a period of intense change, driven by technology, but framed within new political realities.

In our latest guest post, direct response marketing veteran Mike Gunderson discusses the seven ways voice marketing enhances digital banking;...

A report by Credit Kudos shines a light on the adoption of open banking as well as the profound impact that Covid has had on decisions taken by lenders.

A new report by Accenture shows that seven out of 10 consumers would welcome exclusive robo-generated advice for investing and insurance needs; not all is lost for the human experience; 68% of consumers would still want to interact with a human for complex financial needs like a mortgage or to help solve a problem; the main reasons given for this shift are computers are seen to be less biased, they make services cheaper and the tasks are done faster; additionally, the report showed that consumers were willing to share their data if they thought a non traditional provider could be faster and cheaper. Source

The Head of Amex’s mobile app, Stewart Kendall, sat down with the Tearsheet Podcast to discuss the shift in customer...

European venture capital firm 83North has announced the closing of a $250 million investment in its fourth fintech fund; the firm focuses on startup investments in Europe and Israel and says that its fourth fund will continue to invest in those regions; the firm's latest investment brings its total capital under management to $800 million; the firm says it sees a greater opportunity for startup investment throughout Europe following Brexit. Source