The crypto world was buzzing with the news of ethereum's successful shift to PoS. But what actually is staking? And why is it significant?

In the aftermath of 2022, Cogni launches non-custodial wallet. Founder calls for a shift in mentality in creating Web3 products.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

Entry into the real estate market is challenging for younger generations. For those who are "crypto native" perhaps there are options.

In the SEC's suit against Binance, the regulator goes far beyond the "unregistered securities" take - but still lack the community's trust.

Tribal Credit's Chief Product officer Arvind Nimbalker said the firm is enjoying a lot of demand for b2b crypto, and they aim to add Defi.

To meet the need for crypto education, Fintech Nexus has announced the launch of Crypto Nexus Workshop, season one.

Despite the crypto-winter, Mexican cryptocurrency unicorn Bitso is expanding its reach in Latin America, and they added a QR code feature.

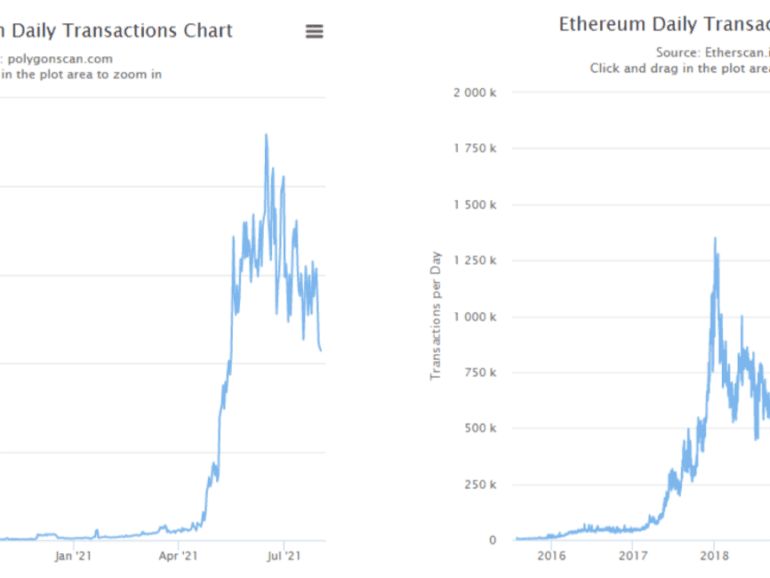

The macro and crypto economic thesis for 2021, building out the linkages between “Risk-On” assets, flows into and valuation of Bitcoin and Ethereum, and the interplay between value locked, the growth of decentralized application revenue, and the volumes around digital objects. We bring it all together.

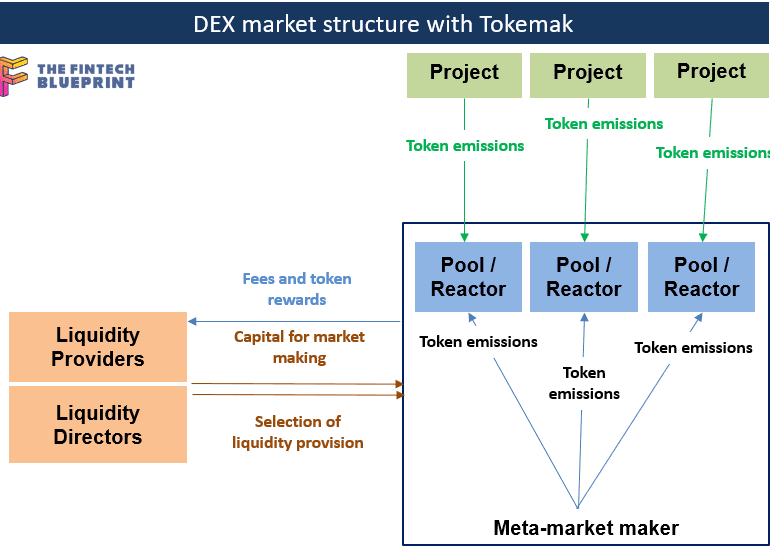

This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.