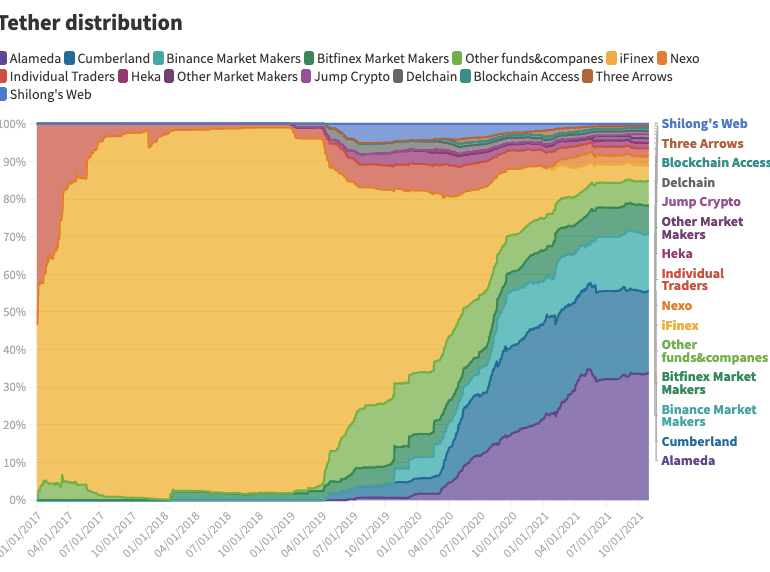

We look at a recent report from Protos that traces the issuance of USDT to the institutional players in the centralized crypto capital markets. The data reveals the market share of players like Alameda, Cumberland, Jump, and others in powering trading in exchanges. We try to contextualize this market structure with what exists both in (1) investment banking and (2) decentralized finance. The analogies are helpful to de-sensationalize the information and calculate some rough economics.

A digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

central bank / CBDCdigital transformationgenerational changemega banksnarrative zeitgeistphilosophyvisual art

·This week, we look at:

The nature of innovation hubs, and how close groups of actors within a particular environment can be massively, fundamentally productive. Take for example the 30 million years of the Cambrian explosion.

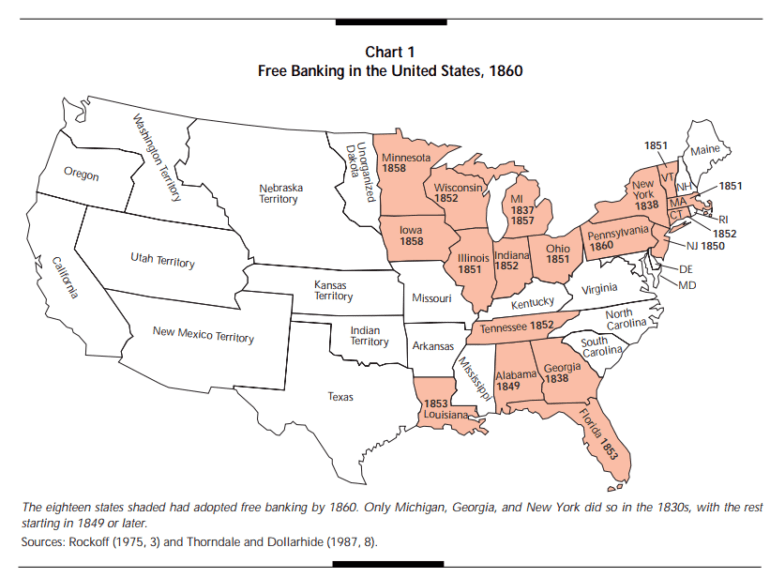

The difficulty of experimenting with banking and money frameworks, the limits of traditional econometrics, and an overview of “free banking” in the 1840s.

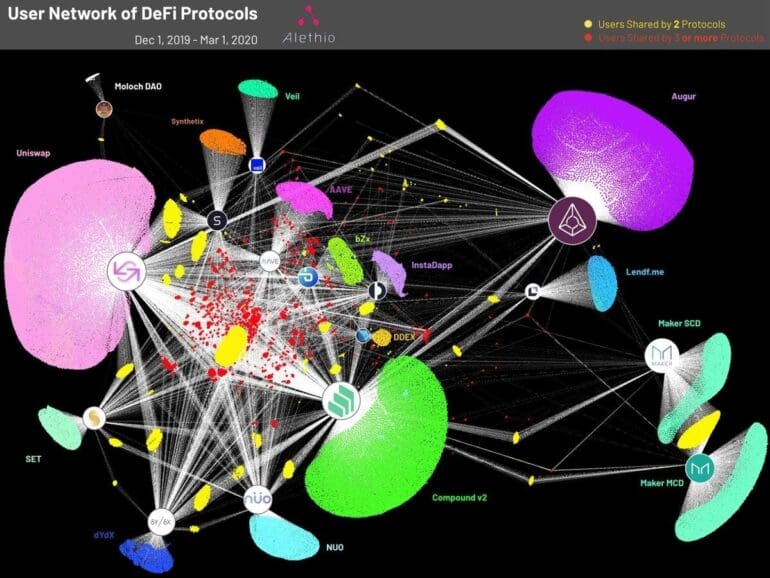

How evolutionary theory can help us think about selection of economic models, and the hyper-competition and hyper-mutation that we see in crypto. DeFi protocols, like BadgerDAO and ArcX among hundreds of others, are experiments in designing different monetary policies and banking regime experiments in real time.

We have never before had such acceleration in the design space of the economic machine, subject to evolutionary pressures, built by a closely-wound nexus of developers. It is a fortune for the curious.

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

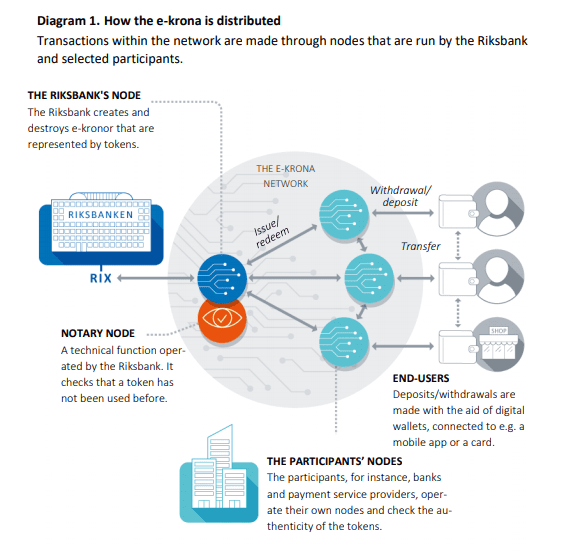

This week Isabelle sat down with Jonas Gross from the Digital Euro Association to talk about Europe's development of a CBDC.

In this conversation, we talk with Jon Helgi Egilsson about his incredible journey to becoming Chairman and a co-founder of Monerium.

Jon is a former chairman and vice-chairman of the supervisory board of the Icelandic Central Bank, a former adjunct professor in financial engineering and MBA lecturer at Reykjavik University, a visiting scholar at Columbia University, and co-founder of four software companies. Additionally, we explore the various concepts of digital money in the framework creating a competitive yet unified environment between fiat money, banking based on fractional-reserve, and the token economy.

This week, we cover these ideas:

The nature of digital identity, and the difference between a representation at some moment of time vs. a record of your being

The launch of the DeFi Passport by Arcx and how it can be useful for underwriting

The European Digital Wallet, and the implication of such a development for CBDCs and government services

China’s CBDC, Sweden’s BankID, and other existential crises

If you want to go deeper on this topic, we strongly recommend our conversation with Michael Cena of the Ceramic Network here. Whereas Michael started working on the identity problem by trying to add labels to people, where he ended up is creating a protocol that tracks historic software activity and interactions between actors. In thinking about the Ship of Theseus, this is the solution that says — your identity is your journey through the river of time itself, and not any particular stop you make along the way.

In this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.