Venmo continues to pay dividends for PayPal with the p2p payments app growing payments volume by 56 percent in the...

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

Venmo users have started to use the payments app to show their appreciation to sports stars or celebrities; in most...

Venmo currently accounts for about 39 percent of PayPal’s digital p2p payments business; PayPal and Venmo only charge users a fee when they use their credit cards, though Venmo has started to diversify their offerings to help PayPal’s bottom line; Venmo has expanded Pay with Venmo and started a instant cashout service which both have fees associated with them; they have seen fast adoption with both and the hopes are that a breakthrough year is coming soon. Source.

Venmo is getting ready to seal a deal with Synchrony Financial to offer a credit card in a bid to...

Shareholders of PayPal have sued firm directors implying that management falsified statements in quarterly reporting related to Venmo; as a subsidiary of PayPal, Venmo's business activities influence the overall results of the firm; in 2016 Venmo was investigated for unfair and deceptive practices resulting in a fine and ongoing investigations with the FTC; shareholders are arguing that PayPal did not properly disclose and inform shareholders of the implications of the investigations which led to shareholder losses of approximately 15%. Source

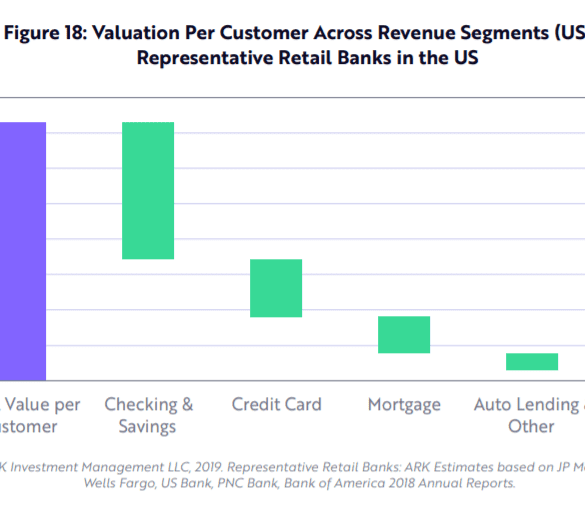

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.

PayPal has helped to secure the ability for Venmo payments to be accepted at over 2 million retailers; users will be able to make purchases in store and online using the Venmo app; the move will help PayPal to get merchants interested in other products and allows them to begin monetizing Venmo; the strategy is another piece of good news for PayPal as just this week they surpasses Amex in market cap. Source.

A new survey by Promotory Interfinancial Network of 543 senior bank executives showed that their number one fear is the...

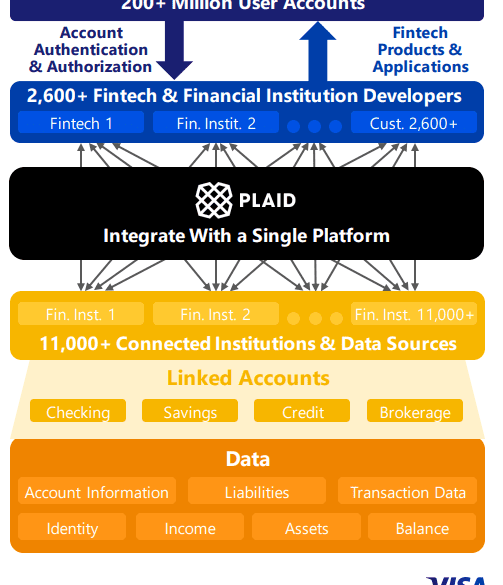

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.