At 23 years old, Paul Gu has attended Yale, been awarded a $100,000 grant as a Thiel fellow, co-founded Upstart,...

There is a demographic trend happening today that no one is really talking about. It is a trend that will...

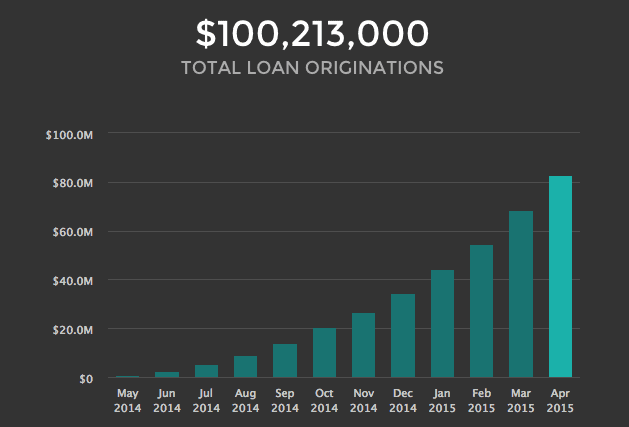

Upstart is a relatively new player in the marketplace lending industry and was founded in 2012. Since they began originating...

Upstart Co-Founder Dave Girouard talks with Forbes about alternative credit data modeling and his firm Upstart; Girouard's inspiration for Upstart came from his experience at Google where he was involved in developing algorithmic models for evaluating candidates and their potential success as Google employees; a third of Upstart's management team comes from Google and the firm is now building advanced credit models that utilize machine learning and modern technology to make credit more accessible for borrowers; the firm is targeting loan originations of $1 billion in 2017; Upstart will be at LendIt USA 2017 and is announcing a new white label software as a service product called Powered by Upstart. Source

Upstart has been steadily growing its online lending business and has now announced a new fundraising as well as the launch of a white label software as a service (SaaS) product; the fundraising will add $32.5 million in new capital from investors including: Rakuten, a large US-based asset manager, Third Point Ventures, Khosla Ventures and First Round Capital; Upstart has emerged with many significant developments in the online loan business including next-day funding and a robust proprietary credit underwriting platform built on machine learning and modern technology; with the evolution of the business, the firm has developed a new white label SaaS product called by Powered by Upstart which it is launching at LendIt USA; the service is an extension of the firm's proprietary credit underwriting system driven by machine learning and modern data science. Source

Upstart, who just launched their p2p lending platform a couple of months ago, has made some very interesting changes today...

Upstart, the millennial focused p2p lender today announced a huge deal with Victory Park Capital. This commitment raises Victory Park’s...

Upstart is gearing up for growth. One of the newer marketplace lenders announced some big news today. They have closed...

Upstart's Dave Girourad talks with TechCrunch about the company's new fundraising round which is adding new capital of $32.5 million; the new capital brings total funding to $85 million and this round's investors included Rakuten, Third Point Ventures, Khosla Ventures and First Round Capital; the fundraising will help the firm launch a new software as a service product called Powered by Upstart, an extension of its proprietary credit underwriting platform which utilizes machine learning and modern data science; Upstart will be releasing the new product at LendIt USA 2017. Source

Dave Girouard is the founder and CEO of Upstart; Girouard spent almost his entire career working for tech firms including Apple and Google and a lot of Upstart's team actually comes from Google; given that they lean heavier towards the 'tech' side of fintech, Girouard has a unique perspective; shares the general trend of software disrupting every business and that every business will become a tech business; discusses the history of marketplace lending, attributes of a marketplace and the evolution of the marketplaces; reports on how artificial intelligence and machine learning can help in a number of ways including creation of real time analysis, development of customized credit scoring, expanded access to credit through broader underwriting variables and faster processing; also discusses some of the challenges that currently keep machine learning solutions from the mainstream including adverse selection, loan stacking, fraud and regulatory concerns; ends with the benefits of alternative machine learning technology including more inclusion, lower rates, lower costs and greater financial support for consumers. Source