Plaid has announced a new cash flow underwriting tool call Consumer Report that is the most comprehensive offering for lenders yet.

The number of fintechs operating in Mexico has grown consistently. Progress in financial inclusion, however, has been far less explosive.

The number of fintechs in Mexico has grown to nearly 1,000 as of 2023, with U.S. startups commanding a lead among foreign fintechs.

The US is ranked highly for financial inclusion, but it faces dropping further amidst waning Government and Employer support.

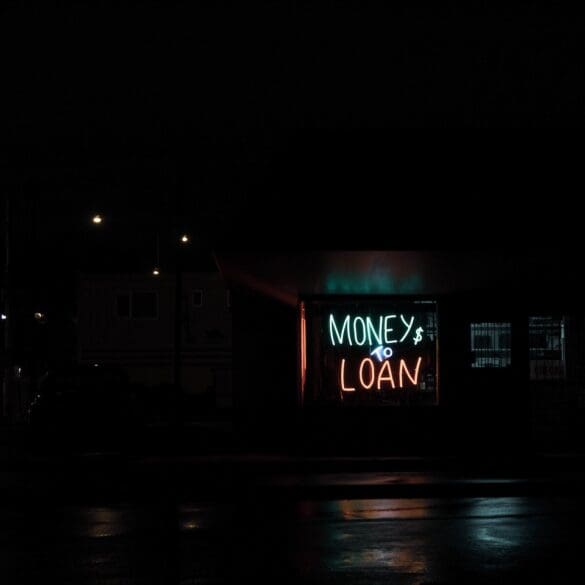

Earned wage access can provide a solution to an underserved population in need of cash, but fee structures may need clarification.

In the west we take it for granted that the vast majority of people have internet access. But that is not true in the developing world. For digital payments to take off there we need to develop robust offline payments infrastructure.

For the unbanked and underbanked, BaaS means easy access to financial services that meet their specific needs. By combining fintech's approach with the capabilities of traditional banks, BaaS fosters financial inclusion.

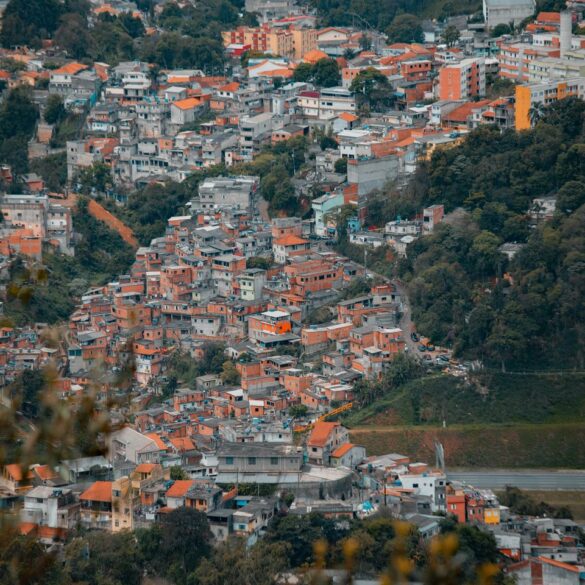

Digital bank G10 is the first of its kind in a Brazilian favela, low-income areas which together account for roughly 17 million citizens.

Fintechs have touted the importance of cashflow data in underwriting. This week, the CFPB published their evidence to support the approach.

While DeFi, could be powerful in improving lending, it has collateral limitations that on-chain reputation could solve.