The SEC makes the decision to approve a spot Bitcoin ETF

Editorial cartoon featuring commentary on the recent SEC "guidance" on bitcoin ETFs

This week Isabelle sat down with Alex de Vries, founder of Digiconomist to talk about the environmental impact of crypto currencies.

Binance has announced a new $500 million lending facility to support struggling public and private bitcoin miners.

Celsius, one of the largest crypto lenders, shut its doors to the public over the weekend, citing the dangers of market volatility and defi scams.

Offering a segregated bitcoin custody model, the bank provides institutional customers with SPDI-driven protections.

Following a solid start to 2023, investors are beginning to grow in confidence that a prosperous period for bitcoin is on the horizon.

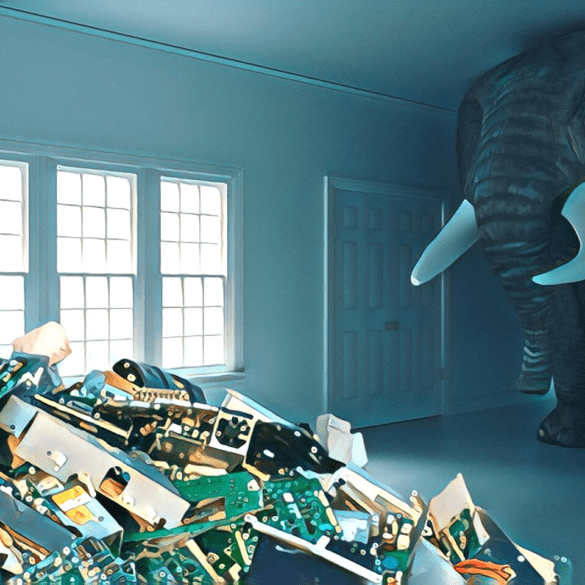

The sustainability of bitcoin is still an issue. Industry experts say a collaboration of all stakeholders is needed to make an impact.

Bitcoin's growing e-waste issue is even more concerning that its bloated energy consumption. Unlike the energy, it's not yet being addressed.

Making news this week was the CFPB director testifying before both the Senate and House, Fidelity will allow bitcoin in 401(k) plans, Robinhood had a bad week, the OCC is talking stablecoins, Goldman created a lending facility backed by bitcoin and more.