The Fed looks to supervise banks' involvement in crypto and fintech. Innovation is the focus but their approach will determine if successful.

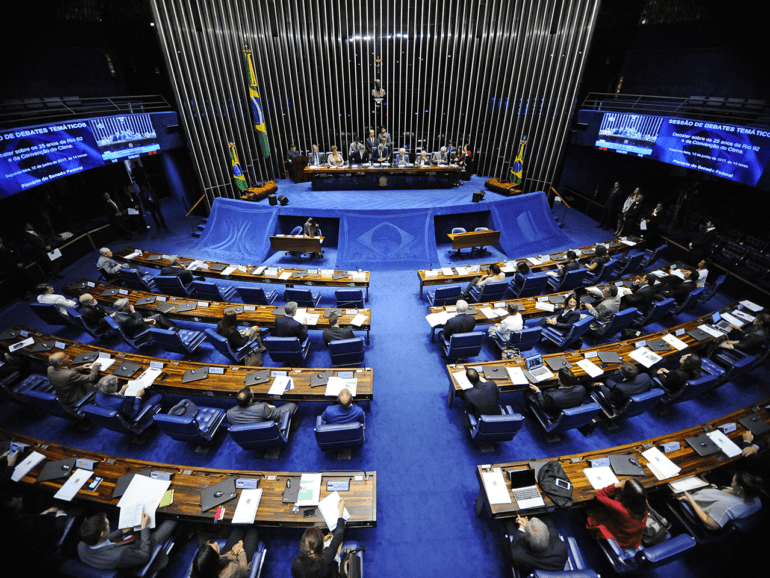

Brazil, the largest country in Latin America, is moving closer to regulating cryptocurrencies with its own version of a Bitcoin law.

Fintech leaders praised Milei's win in presidential elections, anticipating a more favorable scenario for the technology sector.

CFPB director Rohit Chopra lobbed a surprise grenade onto the expo floor Tuesday morning by announcing plans for an open banking rule.

Colorado passed a law this week that could have a dramatic effect on the ability of fintech lenders to do business in the state.

I am a big fan of earned wage access. When I last wrote about it in 2019, I made the...

[Editor’s note: This is a guest post from Ryan Metcalf, Head of Public Policy & Social Impact at Funding Circle.] Fintech...

President Donald Trump has issued an executive order requiring the Treasury secretary and regulators to come up with a plan to overhaul Dodd-Frank and its over 400 regulations; the banking industry's tighter regulations have been a factor helping the success of marketplace lenders since the financial crisis and deregulation in the sector could create new challenges and increased competition for marketplace lenders; as the government begins to take deregulatory actions for traditional banks it also seems that marketplace lending has reached a phase likely to see increased regulations and involvement from regulators; these two forces along with other market factors could change the competitive landscape for the marketplace lending industry. Source

A comprehensive 380-page document was released that explained the policy and future legislation.