The responsibility for managing compliance is increasingly falling on fintechs. Here are seven areas where fintechs need to focus.

Parliament and the Council agreed to track crypto transfers continuously and block suspicious transactions in a provisional agreement.

New regulations for peer-to-peer lending in Thailand are scheduled for approval by the end of the year; the new regulations will be formulated from an open comment, public hearing which ended on October 15; a licensing process is also expected to follow in 2017. Source

CFPB director Rohit Chopra lobbed a surprise grenade onto the expo floor Tuesday morning by announcing plans for an open banking rule.

Moody's has released a report commenting on the new FDIC guidelines for bank lending through third-party lenders; guidance from the FDIC is proposed and seeks to potentially improve controls on bank lending through marketplace loans; the new FDIC guidance will help to improve the overall quality of loans on marketplace lending platforms, according to Moody's; the new controls focus on greater analysis and oversight by banks of marketplace lenders' credit underwriting models to ensure that they align with the bank's lending terms. Source

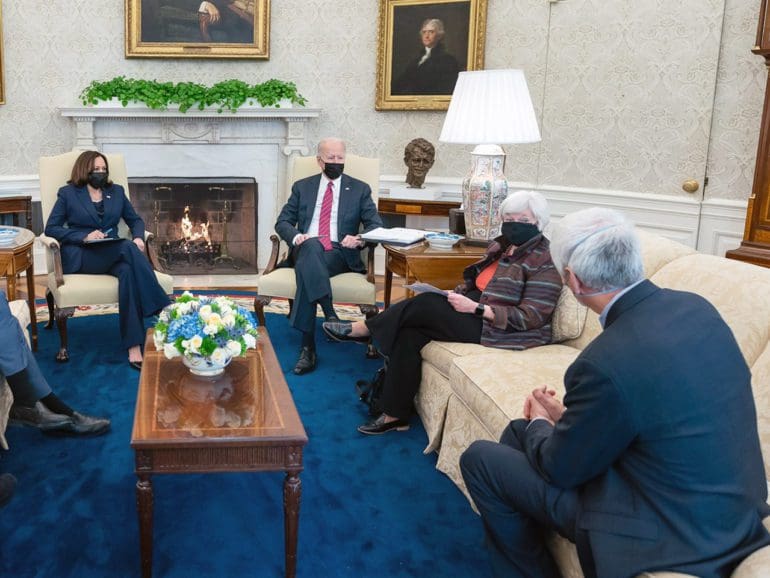

Secretary of Treasury Janet Yellen spoke at American University about the government's role in creating cryptocurrencies or CBDCs.

Gensler said his biggest worry about the equity market was competition and consolidation. While retail investing has taken off, the PFOF that enables it is ripe for conflict of interest.

This week, the Consultative Group to Assist the Poor (CGAP) proposes improvements to the loosely-regulated fintech sector in sub-Saharan Africa, particularly Kenya; CGAP is a global partnership of 34 leading organizations advancing financial inclusion; they note fintech companies may inappropriately publicize a borrower's personal information if they default on a loan, and others may sweep a user's social media data with minimal notice to the consumer; a key step, by law and proactive process, is to rigorously include all fintech platforms under existing laws for lenders in Kenya. Source

The Marketplace Lending Association was launched in April of 2016 and is one of the industry's leading advocacy groups; in September it hired Nat Hoopes to lead the Association and represent the industry in Washington, D.C.; Lend Academy interviews Nat Hoopes in their most recent podcast, providing details on his background in the industry, the evolvement of the MLA and his insight on the current regulatory developments affecting marketplace lending. Source

Earned Wage Access has specific legislation in Nevada, Missouri and now Wisconsin after the governor signed a new law this week.