To best serve the payment needs of different emerging markets, a company must have a local presence so they can understand unique traits.

With a surge in subscription declines what is a consumer subscription business or a SaaS platform to do? There are steps you can take to decrease losses.

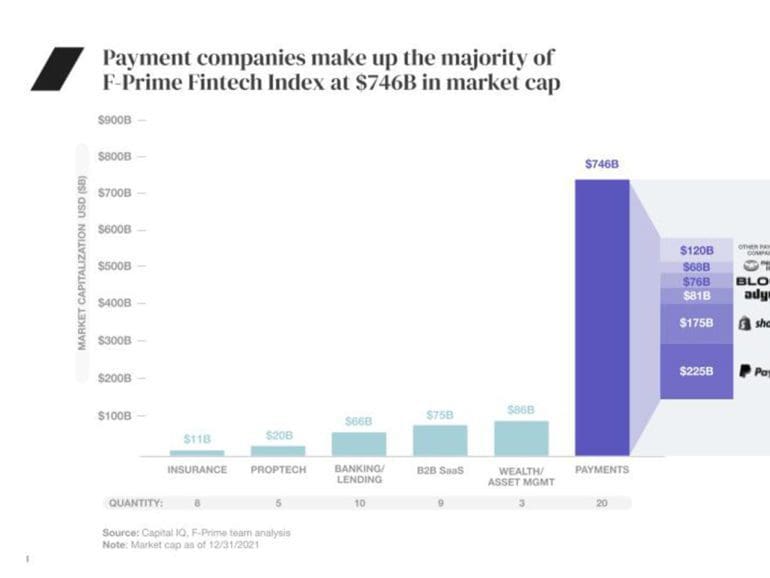

The F-Prime Fintech Index tracks the performance of emerging, publicly traded financial technology companies.

With Orum's new Deliver API small banks and fintechs will now have direct access to the Fed's payments rails.

The concept of embedded finance isn't new, but the modern form of the distribution model is emerging as a global payments force.

FedNow may have sparked some real time urgency but institutions may still be stuck in the "receive only" phase. Cloud could help.

While BNPL has been criticized as an easy way for shoppers to run up high debts, it's also being touted as an easy-to-understand payment method that's attractive to all.

Financial institutions struggle to meet consumer demand for more payment types, mainly because they lack the proper data science capabilities. This drives suboptimal strategies like layering multiple payment types.

In the west we take it for granted that the vast majority of people have internet access. But that is not true in the developing world. For digital payments to take off there we need to develop robust offline payments infrastructure.

For businesses to improve customer experience it is important that data is not lost between entities in the payments chain.