The open banking industry in the US had a slow start to life, but is shaping up for an exciting 2024. With the first glimpses of regulator support and increasing demand from merchants, Pay by Bank is set to become a serious alternative to mainstream payment methods in the minds of US consumers.

Open Finance turns three years in Brazil, and data shows it is growing at a steady pace, with over 40 million consents granted by users.

Plaid is becoming the glue that connects so much in financial services. Here is a rundown of just some of their recent developments.

When designing an intelligent budget-tracking app, Piere founder and CEO Yuval Shmul Shuminer prioritized functionality, integrations, and meeting the evolving needs of emerging generations. Billed as the“intelligent budget tracker app that’s ready in just two taps,” Piere offers quick functionality and automatic reconciliations and updating.

The results of a recent Axway survey on open banking in America bode well for its adoption stateside. More than half, 55%, have heard of open banking, with 32% believing they have a decent understanding of it.

The fintech industry urges the government to expedite the procedure, contending that the current legal framework is impeding growth.

Card payment fees have been a long-standing issue for businesses. Pay by bank could be a solution. Plaid joins Adyen to make it possible.

In a long awaited move, the CFPB proposed a rule to improve consumer access to their financial data and drive the shift to open banking.

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

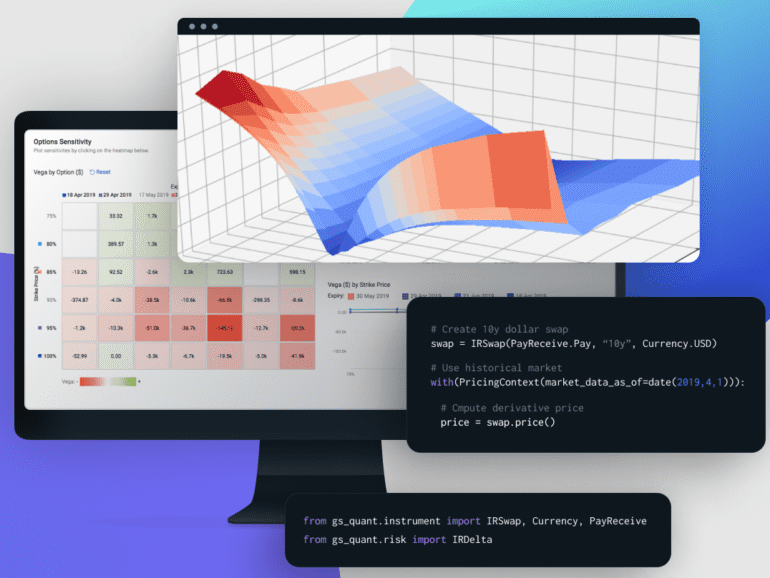

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta's $300MM of revenue & Ethereum's $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.