While check usage has been in decline for years, for many businesses it is still a primary method of payment.

According to the Federal Reserve we processed over three billion commercial checks in 2023 valued at over $8 trillion.

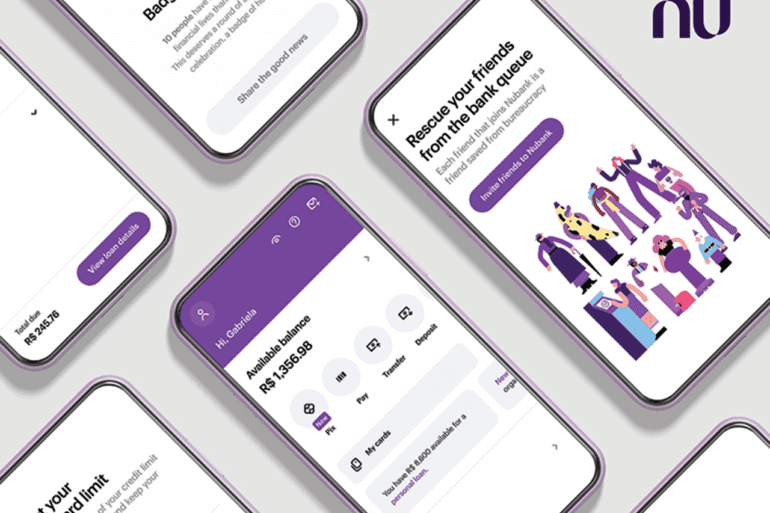

'Nu's valuation is not crazy. In fact, they are valuing each customer at about $1,000, whereas U.S. and European neobank valuations put their customers closer to $2,000.'

With a surge in subscription declines what is a consumer subscription business or a SaaS platform to do? There are steps you can take to decrease losses.

Globally, investigation into how CBDCs will be designed is being done. With Web3 development in the sidelines, banks could be affected.

Alternative data helps lenders score previously difficult-to-serve groups like thin- and no-file customers. Lenders seeking to serve those client groups need the right technology in place, Provenir’s executive vice president for North America Kathy Stares said.

Reports of the bank branch’s death are greatly exaggerated, though you soon might be unable to recognize the old boy. The bank branch indeed has a future, especially if one caters to specific groups or is based in certain parts of the world, SunTec Business Solutions President Amit Dua said.

Today, it is evident that a homogenized, static engagement and service strategy across all retail banking customers does not work.

With 40Seas, Eyal Moldovan believes he has solved a cross-border payments issue hindering importers and exporters who are already contending with a rapidly changing environment.

InformedIQ helps lenders find opportunities in today’s challenging environment while others pull back. The main difference is who embraces AI.

While Brazil's PIX has achieved great success, it is not alone. UPI has thrived in India, ushering millions into the digital economy.