When we covered the BlackRock announcement last week of their new tokenized treasuries fund I thought it was a big deal. One week in, this new investment vehicle (ticker symbol BUIDL) is proving to be quite popular. On-chain data shows that $245 million worth of BUIDL shares are now held in seven different wallets. That is the beauty of blockchain data, everything is transparent.

There is never a dull moment in the Banking-as-a-Service space. Treasury Prime is the latest company to make news in the space.

With the trial of Sam Bankman-Fried in the spotlight last month it is easy to forget that there is still the massive FTX bankruptcy that has to be sorted out.

The next step in that process has now been revealed in the form of a proposal. At this stage, it is just a proposal that must be approved by creditors before it can go to the bankruptcy judge. But the major creditor and consumer groups have agreed to the plan outline.

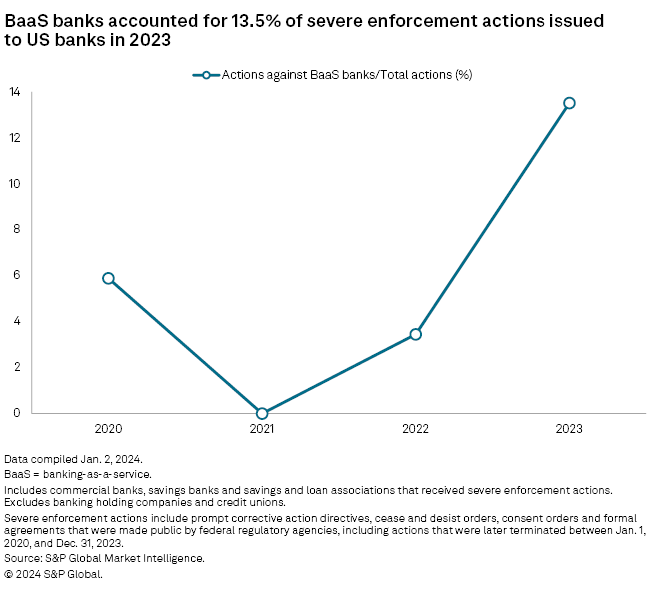

You could say Banking as a Service is under siege.

The number of severe enforcement actions BaaS banks received skyrocketed in 2023 to 13.5% of the total. When you consider there are probably only around 100 banks out of 4,800 that are involved in banking as a service, you can see why this number is disturbing.

Two years ago, before the crypto meltdown of 2022, stablecoin issuer Circle announced that it was going to go public via SPAC at a $9 billion valuation.

But then, you know, 2022 happened (Celsius, 3AC, Luna, BlockFi, FTX, etc). So plans were quietly shelved in December of that horrible year for crypto.

Payment by bank account is a functionality that has existed for more than a decade in many countries. But it is still a relatively new phenomenon in the U.S.

Robinhood is still bullish on crypto despite the SEC warning the company it plans to sue over this part of its business.

We learned yesterday that Robinhood will acquire crypto exchange Bitstamp for $200 million, making this its largest acquisition to date.

Fintech Nexus Newsletter (December 21, 2023): Small business lenders must get ready for Section 1071

In Congress, anything that helps small businesses typically comes with bipartisan support. But section 1071 of Dodd-Frank is a little complicated.

More positive signs for fintech as spend management unicorn Ramp closed another large funding round.

The $150 million was officially called a Series D extension, but it comes at a $7.65 billion valuation, a significant improvement over the $300 million raised for the initial Series D, which was at $5.8 billion.

In a blog post yesterday describing their 2024 plans, we learned that X will be launching peer-to-peer payments later this year.

We know that the company has been slowly obtaining money transmitter licenses as it builds out its payments capabilities. But this is the first time we have heard about concrete plans to launch a payments service.