The SEC is at it again.

Over the weekend we learned that the SEC has sent a Wells Notice to Robinhood regarding its crypto activities.

Goldman's push into consumer finance continues to be a disaster. While CEO David Solomon had grand plans, the entire move has proven to be an unmitigated disaster.

The US dollar stablecoin market has long been dominated by Tether (USDT) and Circle (USDC). Together these stablecoins have a market cap of around $140 billion or so.

While others have tried, notably PayPal last year, there is no other stablecoin with a market cap of more than $3 billion.

The Israel-Palestine conflict rages on, and for many fintech workers in Tel Aviv, life has had to continue through the chaos.

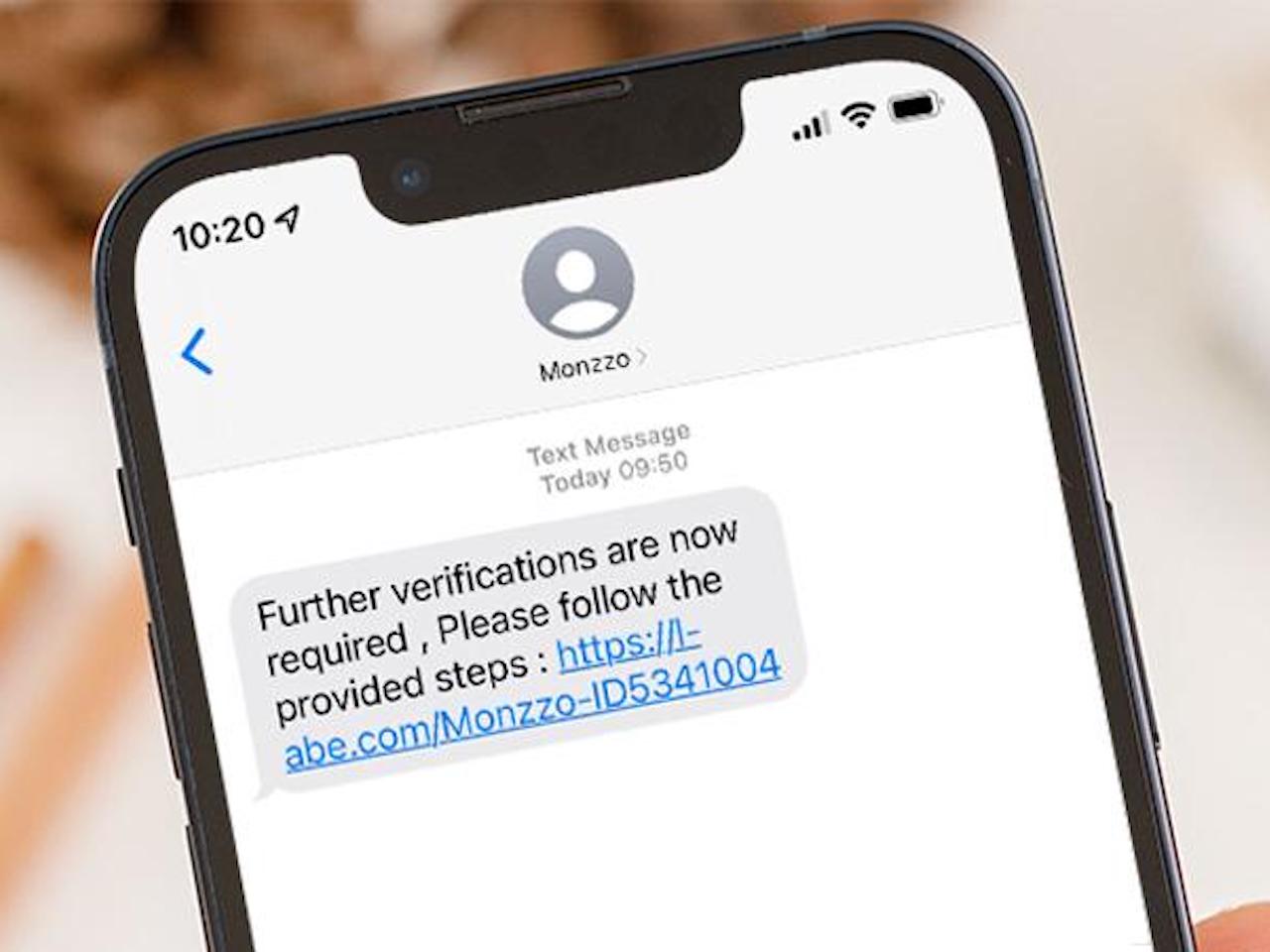

UK digital banking pioneer Monzo reported its financial results for the 2023-24 fiscal year today.

The numbers are impressive. Total revenue was £880 million for the year, more than 2x the £356 million from the previous year.

Upstart has been a trailblazer when it comes to using AI in lending. They were the first fintech lender to make it a core part of their offering.

The biggest name in Silicon Valley venture capital over the last half-century is Sequoia. And the biggest name in European fintech is Klarna.

In lieu of a solution that stops the crimes from happening in the first place, bank reimbursement is the only source of protection.

There is a new report out today that looks at the impact of generative AI on the workforce and what industries will be most impacted.

We have heard before that white-collar jobs, those people with college degrees will be most impacted. This report tries to quantify some of this impact.

Yesterday, the CFPB proposed supervision of “larger nonbank companies that offer services like digital wallets and payment apps.”