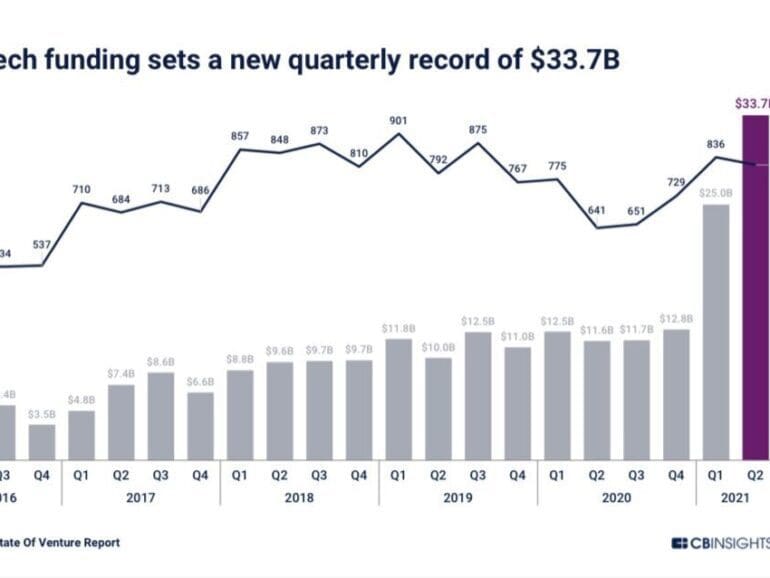

Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

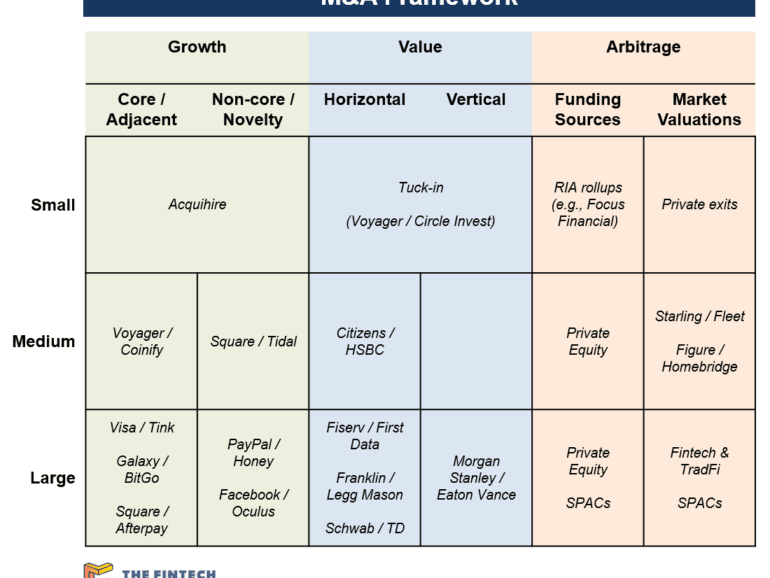

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

·

This week, we cover these ideas:

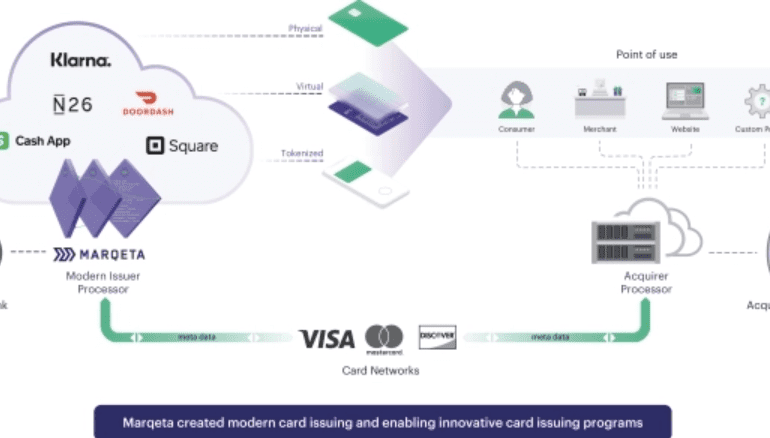

How market structure determines the types of companies and projects that succeed

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

This week, we look at:

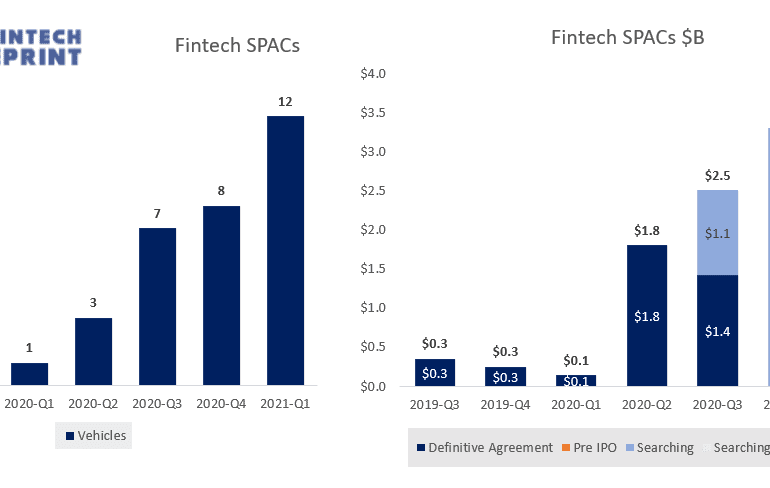

The $12 billion in cumulative SPAC capital focused on Fintech, of which $3.6 billion has been raised in 2021 Q1 alone

Analysis of the private and public financial services markets and their valuations of profitability and revenue

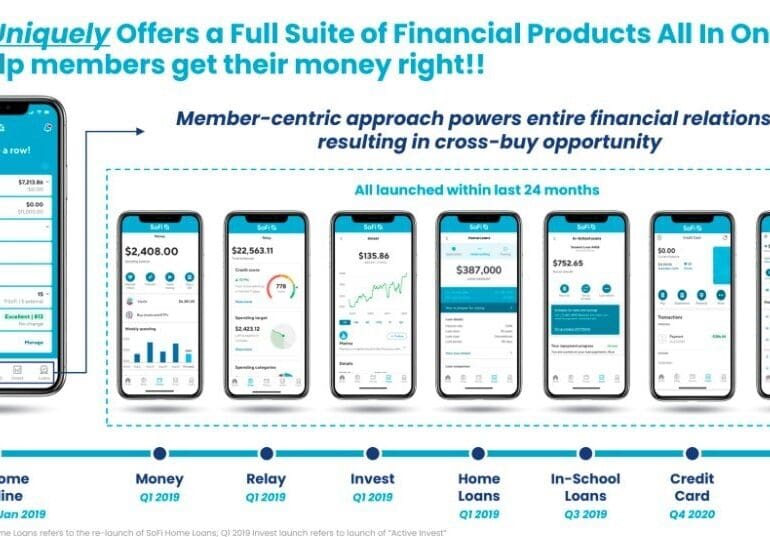

A deeper look at the fundamentals and business mix of SPAC targets MoneyLion, Payoneer, Apex Clearing, and SoFi

Not everything that glitters is gold

This week, we look at:

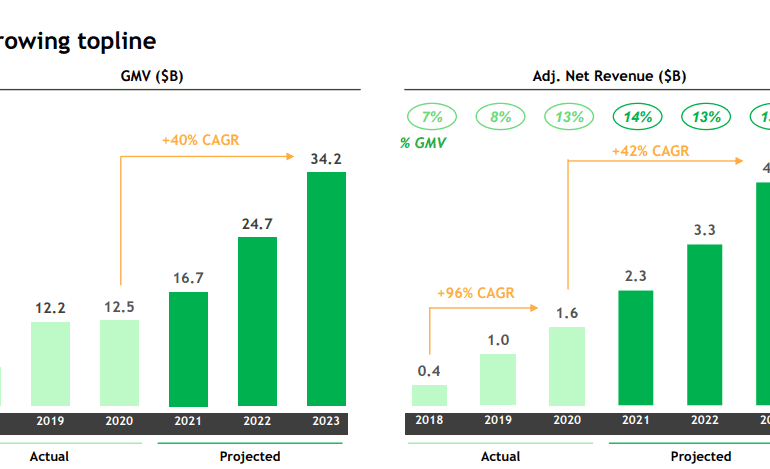

The economics of Southeast Asia’s largest super-app and its $40 billion SPAC valuation

The industrial logic of building out financial features adjacent to the core business of transportation and delivery

Why this model has not worked for Uber, but has worked for Apple, and the broader impact on financial services.

This week, we look at:

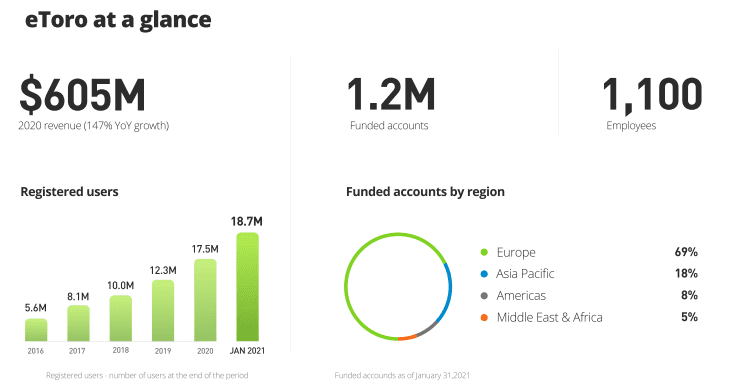

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

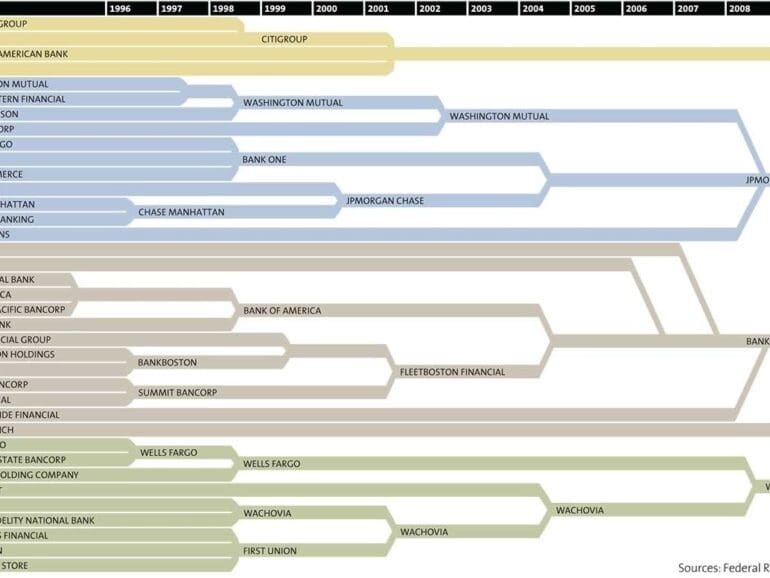

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

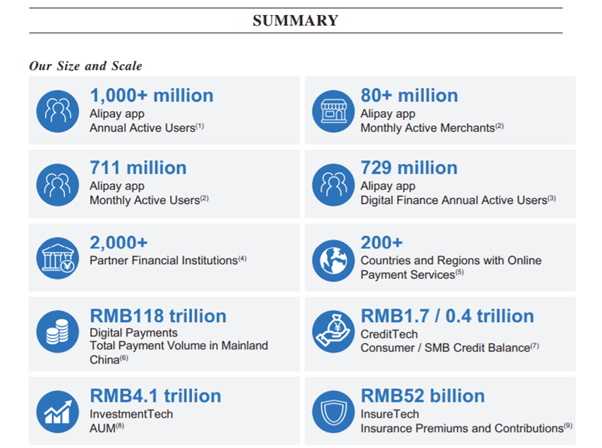

In this conversation, Max Friedrich of ARK Invest, Will and Lex break down Ant Group’s highly anticipated IPO.

Ant, a spinout from Alibaba and the parent of Alipay, one of China’s leading payments companies, filed papers to IPO in Shanghai and Hong Kong.

Max, Will and Lex dig into Ant’s business, from the origins to today, discuss growth opportunities and potential headwinds and explore the multi-faceted relationships between Ant and other big tech companies and national governments.

We cannot understate how impressive Ant Financial has become, connecting 700 million people and 80 million merchants in China, with payments, savings, wealth management and insurance products integrated in one package. The company also highlights the likely road for traditional banks — as underlying risk capital, without much technology or client management.

No More Content