The first ever J.D. Power survey on the personal loan market makes for some interesting reading; the survey was based...

Thales announces the signature of an agreement to acquire OneWelcome, a European leader in the fast growing market of Customer Identity and Access Management,...

Regulation in the US is far different than in China; CredEx is a Chinese company that shares the state of regulation there; Jo Ann Barefoot shares her perspective on regulation in the US, having spent most of her career working in consumer protection and financial inclusion; she believes that we have produced a regulatory system that has high cost and low value which has left consumers confused by products; while not discounting the importance of regulation, Barefoot shares that fintechs can do more to further goals around financial inclusion than regulation can; one area where the US is lagging behind much of the world, specifically China is in mobile adoption and regulators in the US are struggling to keep up as technology quickly changes. Source

The Fed took the unprecedented step of cutting rates to near zero to help ease the blow of Coronavirus and...

Software-as-a-service (SaaS) startup LoanPro announced Tuesday a partnership with Mastercard's open banking solution provider, Fincity.

As the CBOE bitcoin futures product goes live there are lingering questions with the exchange where they will base their pricing; Gemini is run by the Winklevoss twins but has had a number of issues including low volumes and system outages; Gemeni is currently ranked 14th according to CoinMarketCap; while well connected because of the Winklevoss twins critics worry they can be potential targets for price manipulation; as the futures market goes live there will be a lot of interest to see how this plays outs. Source.

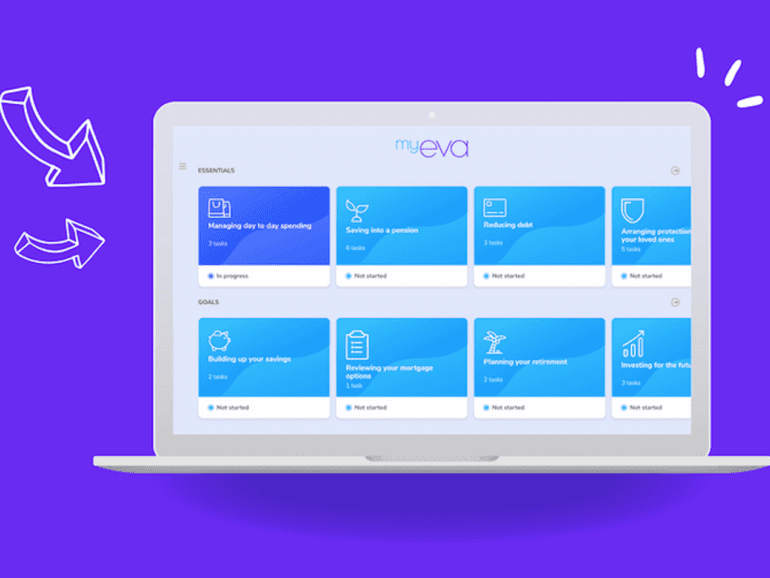

Long-term financial planning can be critical for mental health, especially in challenging times. MyEva could help employees manage finances.

An investigation by The NY Times found that the price of a taxi medallion jumped from $200,000 to more than...

Last week Prosper closed their Series G, raising $50 million from an investment fund co-managed by FinEx Asia and LPG Capital based in Hong Kong; sources say the post money valuation was $550 million, approximately a 70% drop from their high in 2015; Peter Renton reflects on the investment and the current state of the market. Source

According to The Times, sources say Funding Circle is in no hurry to do an IPO, but if the markets continue to be favorable they may go public in the second half of the year; article also shares the potential in their US business where they have much less brand awareness compared to the UK; there are some concerns from clients and investors that the company has not yet been through a recession as they look at an IPO; Funding Circle currently has 850 employees and last raised £82 million at a £990 million valuation. Source