Investors will be able to gain exposure to bitcoin through the fund, without direct exposure to the volatile currency that traded over $62,000 over the weekend alongside this and other pro-crypto news. On Tuesday morning, the ProShares ETF went live under the ticker BITO at around $40.

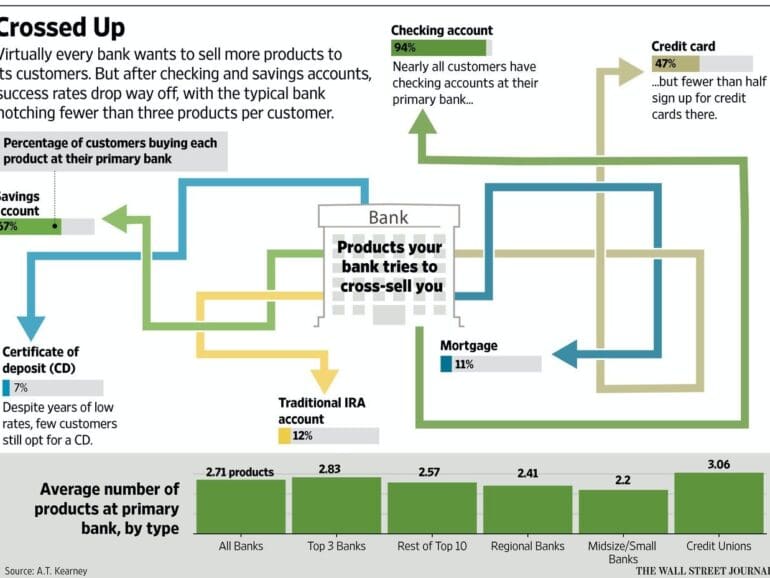

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

·

That kid who created his own $400,000 NFT project, Benyanub Ahmed, joined another successful NFT group. Together, their sales volume moved past the $5 million mark after just three weeks.

"We're aware that some people are having trouble accessing our apps and products," Facebook said in its first public comment on Twitter. "We're working to get things back to normal as quickly as possible, and we apologize for any inconvenience."

Jacobo Toll-Messia’s mission is to scale Layer 2 solutions to the point where they become viable commercial uses and he wants Nahmii to take it there.

In this conversation, we chat with Gabriel Anderson – Managing Director at Tachyon, Head of Market Strategy & Business Intelligence at ConsenSys Labs. Former Head of VaynerMedia. Alumnus of Merrill Lynch.

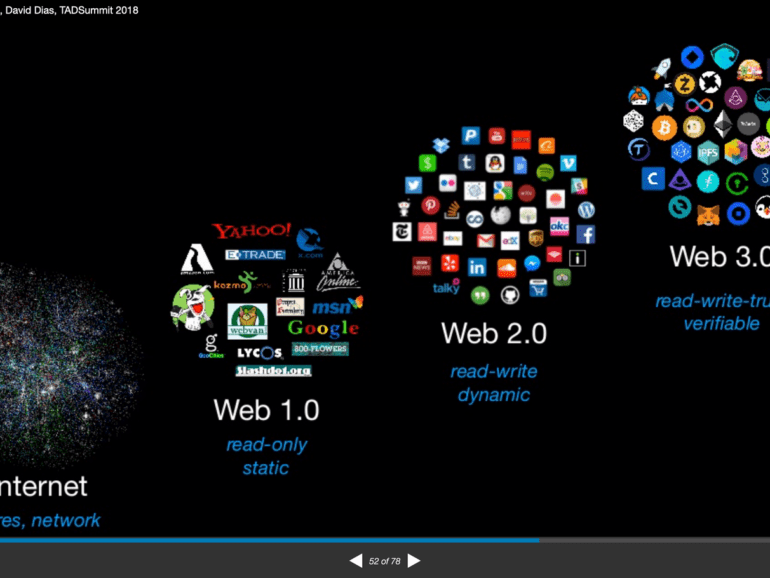

More specifically, we touch on what Tachyon is, how it works, and who it’s for, the growth of crypto, and what needs to come next to allow the widespread adoption of crypto by mainstream society. Gabriel talks about the best projects he has seen so far that combine NFTs with other elements of DeFi and crypto, and what he’d like to see more of in the future.

Gensler said his biggest worry about the equity market was competition and consolidation. While retail investing has taken off, the PFOF that enables it is ripe for conflict of interest.

The Walmart Litecoin fake post brought the coin price from $175 up to $231.

Someone, or a group of people, likely made a lot of money on a pump and dump. According to Coinmarketcap, the coin's trading volume tripled from $2.4 billion to $6.3 billion in the hour after the article went live.

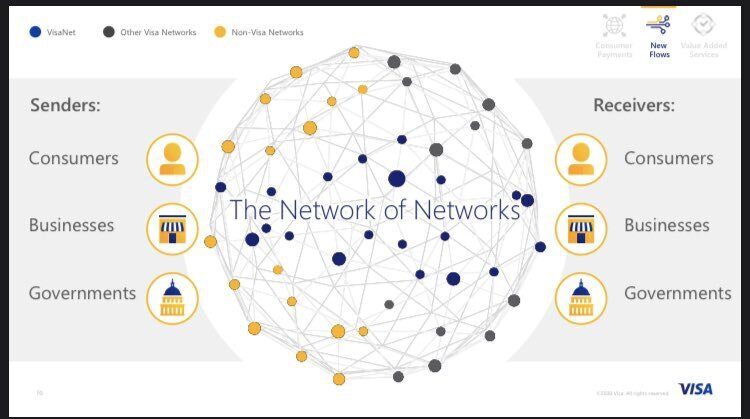

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.