Cion Digital's new Advisor Lending Platform connects wealth professionals and firms with lenders in a more efficient process than was previously available. They also now offer their product suite to a more significant portion of the financial services and retail sectors.

Sam Bankman-Fried claimed ignorance on many topics while answering questions via video call to the New York Times Dealbook Summit.

The Central Bank of Nigeria (CBN) plans to lower transaction fees for the eNaira platform by 50%, which they say will increase the volume of transactions on the central bank digital currency (CBDC).

Despite the continuing bear market, consumer interest in crypto remains high. Plaid found that increased trust could be the key to adoption.

·

Goldman Sachs has announced they are exploring NFT's- Why? Despite being a playground for collectibles, for some its the logical next step for incumbents.

Coinbase and Mastercard announced a partnership to offer users more "payment choices" on the upcoming Coinbase NFT platform.

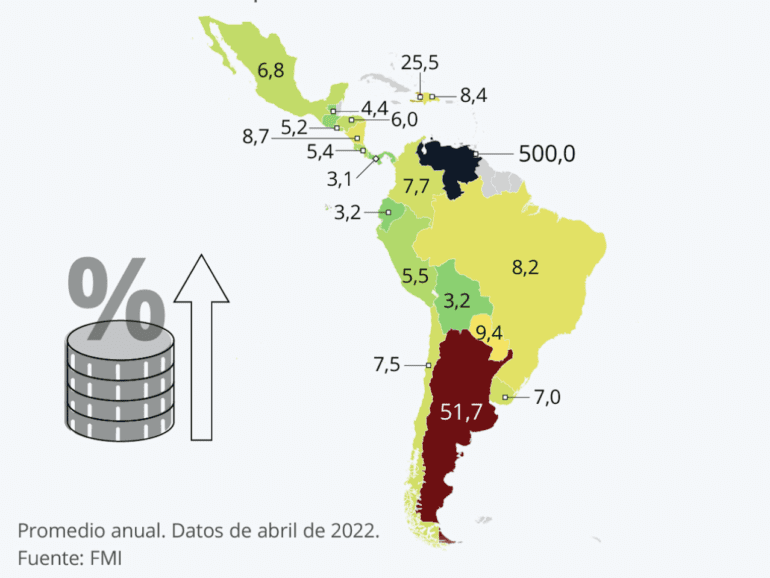

LatAm is seeing skyrocketing inflation and DeFi could mean survival for many citizens, but how can adoption be maximized?

Security throughout the DeFi lifecycle remains a real challenge to mainstream adoption, and it is key to the market reaching its full potential.

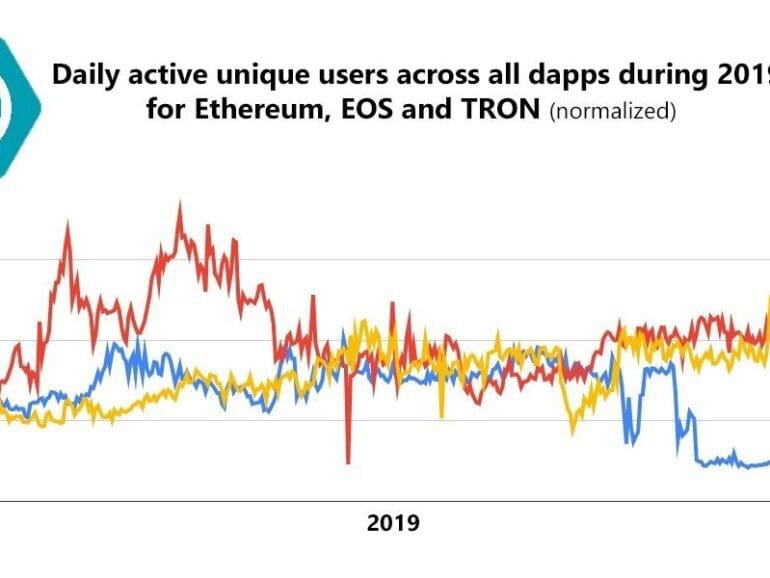

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

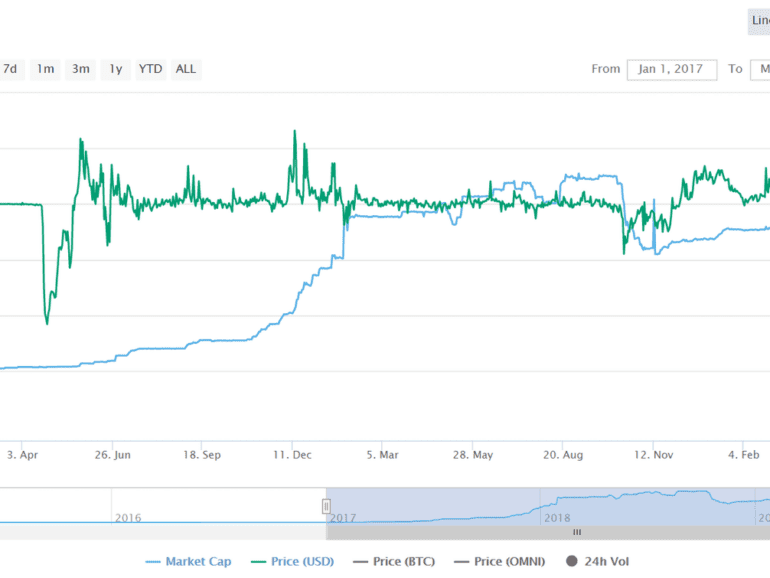

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.