In this episode, we connect with serial founder Ohad Samet, CEO of TrueAccord. Ohad has been working in fintech machine learning for a decade and a half, applying multi-dimensional mathematics to consumer finance. The result? A more empathetic approach to the traditionally gnarly problem of debt collection.

Focusing increasingly on customer-facing AI tools, Brex has launched an employee expense assistant that integrates into employees' day-to-day.

You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

Upstart reported slipping revenues and forecasts that fell short of analysts' expectations. Girouard remains positive about their position.

A new report from Trustwave SpiderLabs provides a rich description of the myriad of threats facing financial services companies. 2023 Financial Services Sector Threat Landscape covers prominent threat actors and tactics, breaks down the financial services attack flow into steps, and covers several common hacker entry points.

In this conversation, we chat with Kevin Levitt who currently leads global business development for the financial services industry at NVIDIA. He focuses on global trends in accelerated compute and AI for consumer finance – including fintech, retail banking, credit card and insurance. Prior to joining NVIDIA, Kevin served as Vice President of Business Development at Credit Karma, and Vice President of Sales for Roostify.

More specifically, we touch on the role data plays in the financial industry, how the needs of financial institutions have changed, the age of big data, the definitions between artificial intelligence and machine learning, how to train an AI algorithm, the reasoning behind the incredible amount of parameters machine learning solutions consume, the fundamental purpose of AI/ML in financial services, what NVIDIA’s platforms comprise of, and lastly the future of AI/ML.

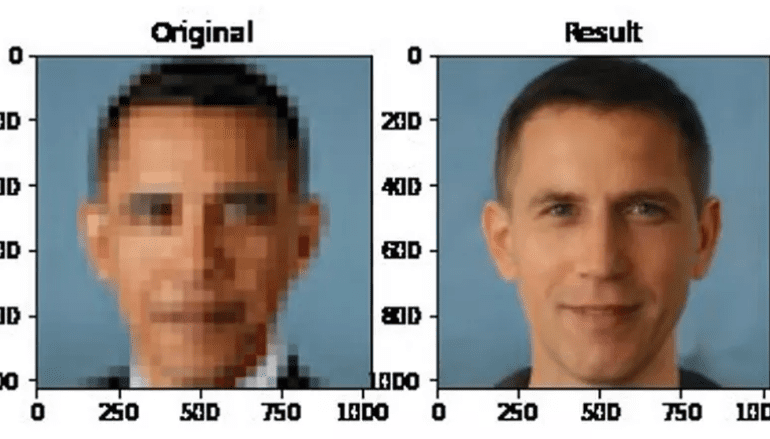

What we know intuitively, and what the software shows, is that the pixelated image can be expanded into a cone of multiple probable outcomes. The same pixelated face can yield millions of various, uncanny permutations. These mathematical permutations of our human flesh exit in an area which is called “latent space”. The way to pick one out of the many is called “gradient descent”.

Imagine you are standing in an open field, and see many beautiful hills nearby. Or alternately, imagine you are standing on a hill, looking across the rolling valleys. You decide to pick one of these valleys, based on how popular or how close it is. This is gradient descent, and the valley is the generated face. Which way would you go?

No More Content