Upgrade continues to break new ground in consumer fintech.

When the Upgrade Card launched in 2019, it was the first credit card ever to marry the benefits of a revolving line of credit with a fixed-rate installment loan.

Yesterday, Upgrade launched another innovative new card product. The Upgrade Secured Onecard is a secured card backed by a savings account that pays more than 5% interest. It is also a generous cash-back card, users earn 1.5% to 3% depending on the category.

Upgrade also offers the ability for users to graduate to an unsecured card if they hit certain milestones. And when they do graduate they can keep the same card, it just transforms into an unsecured card.

The new card is designed as a loss leader of sorts as CEO Renaud Laplanche stated, “It’s not a product that is designed to make money. It’s a way to help consumers build their credit.”

It is also a way to bring consumers into the Upgrade ecosystem who do not qualify for an Upgrade Card or a personal loan today.

Featured

Upgrade says its secured card has trifecta of differentiators

By Miriam Cross

The fintech is the second in two months to launch a secured credit card. Upgrade’s version will offer up to 3% cash back and elevate users to the unsecured version over time.

From Fintech Nexus

> E-commerce fintech SellersFi closes $300M credit facility from Citi

By David Feliba

E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.

> Long Take: Trusting Artificial Intelligence based on ZK Proofs, and the $10B fraud market

By Lex Sokolin

And a look at the recent controversy regarding Bridgewater Associates.

www.fintechnexus.com

We’re in a new age of fraud. What started as undetectable fraud through digitization now sees industrial-scale reproduction and distribution via automation in serial fraud. Learn how the digital shift of documentation brings opportunities for rapid customer onboarding but also unprecedented risks of onboarding fraud.

Podcast

Jason Bates, Co-Founder of 11:FS on a new framework for banking innovation

Jason Bates has co-founded two of the most successful digital banks in the UK. And his deep experience in financial innovation…

> Listen Now

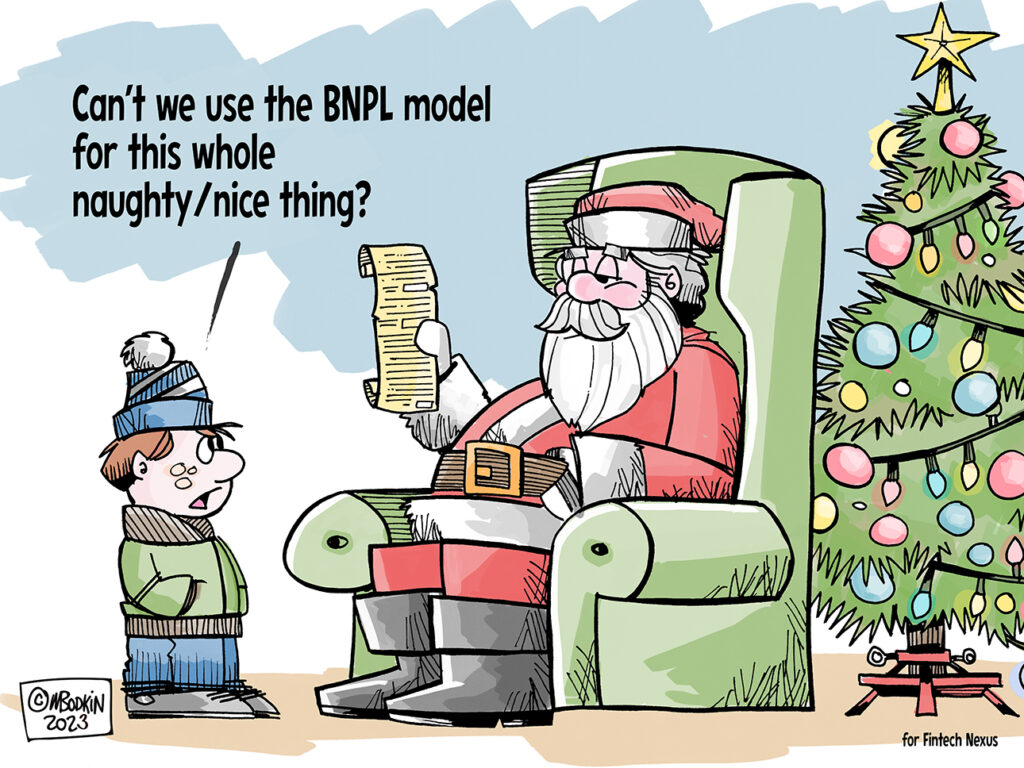

Editorial Cartoon

Webinar

Payments Innovation is Hot: What to Expect in 2024

Dec 14, 12pm EST

Global payments revenue grew double digits in 2023 – wondering what the near future of the burgeoning payments space might… Learn More

Also Making News

- USA: Neobank Dave’s new chatbot achieves 89% resolution rate, CEO says

The neobank and personal finance app this month launched DaveGPT, a gen AI-driven chatbot that can respond to customer inquiries in real-time. - Global: How generative AI is changing Klarna’s work culture

The Swedish payment company is using generative artificial intelligence to make its human workforce more efficient — but also expects the technology to fill in for roles it loses to attrition. - USA: Payitoff teams up with fintechs to lower student loan payments

The debt guidance platform provides borrowers access to federal repayment plans as student loan payments resume after over three years. - USA: New survey: Consumer distrust and ignorance surround Gen AI’s use in financial services

Consumers don’t care if their banks use Gen AI, at least that is what new data by FIS seems to suggest. 67% of consumers would make no changes if they found out their primary bank was using Gen AI, but at least 25% would consider discontinuing the relationship. - LatAm: Mexican Fintech Kapital Raises Financing Led by Tribe Capital

Financial technology firm Kapital raised funding in a round led by Tribe Capital to fuel expansion in Mexico and elsewhere in Latin America. - Global: Why Pave Bank Believes It Can Be The Future Of Digital Banking

Pave Bank has raised $5.2 million as it secures its first banking license for a venture planning to pioneer digital banking services - UK: Revolut’s Storonsky claims second place in UK ranking of top ten billionaires

Revolut’s Nik Storonsky has claimed second place in a new ranking of the UK’s youngest billionaires.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.