Making fintech news this week was the former CEO of SVB, the CEO of OpenAI, The Canton Network, Nubank, Truist and more.

The SEC has staking services in its firing line. Crypto custodians are partnering to remain compliant despite uncertainty

Pinwheel’s new partnership with Jack Henry will help banks and credit unions win primacy with more clients.

How the Mexican SME lender went from startup to baking-licensed neo-bank looking at a NASDAQ-listed SPAC at a valuation of $547 million.

Lenders have long identified the need to develop better scoring models that include those with thin or no credit files, but the problem persists, Credolab’s CSO Michele Tucci said. Credolab tackles the problem using privacy-consented and permissioned data through smartphones and web pages.

Despite a stay, 1071 is expected to be implemented. Banks may need to rethink their approach to data processing.

BNPL business models gained momentum in Brazil earlier in the year among financial technology firms catering services to cardless customers.

·

Changpeng Zhao explained he has yet to ask Musk for a detailed plan but that charging for comments and blue ticks are both in the pipeline.

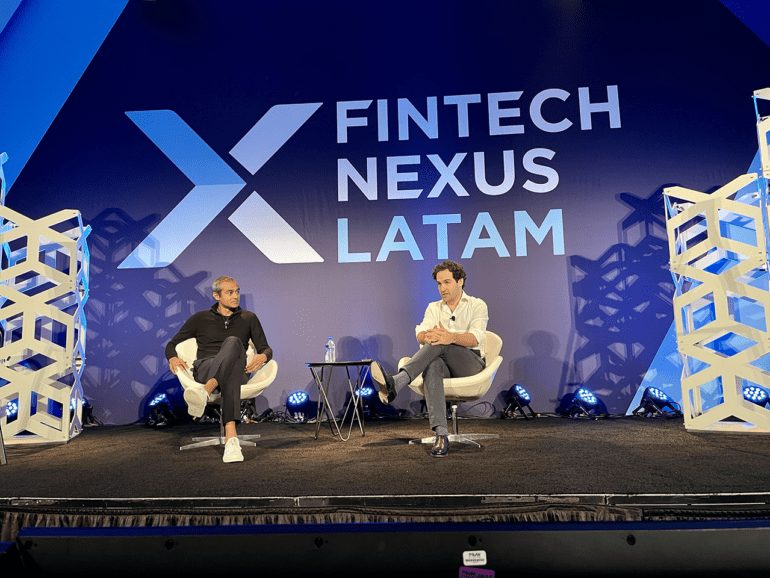

The illustrious awards ceremony, with a star-studded list of nominees, will be held in New York at the end of Fintech Nexus USA.

There are a number of fintech themes coming out of 2021 that will have a dramatic impact on the industry in 2022. Here are our top seven trends: Buy now pay later, fintechs going public, overdraft fees, embedded finance, cash flow underwriting, CBDCs and Web3.