While AI seems to be everywhere these days, one place it is getting real traction is in the compliance space.

There is a lot of manual, repetitive work in the compliance teams at large banks and fintechs. Hummingbird is looking to ease that burden with the launch of a new AI-based compliance tool.

When I first chatted with Mike Cagney back in 2011, when he was CEO of SoFi, it was clear he had big goals.

His second act in fintech, Figure, quickly became a leader in home equity lending with all loans originated and processed through blockchain technology.

Fraud is going to be top of mind for all financial institutions in 2024. Banks and fintechs alike are constant targets of fraud attacks.

It was interesting to read this morning about the experience of Regions Bank when it comes to check fraud.

Yesterday, the OCC issued new guidance for banks, addressing the risks of buy now pay later lending. The guidance focused on the popular "pay in 4" segment of BNPL.

Not surprisingly, the national bank regulator recommended tight oversight of third-party servicers, the importance of transparent loan terms and fraud mitigation.

Many people have called Capital One the original fintech.

Founded in 1994 by Richard Fairbanks and Nigel Morris (of QED) Capital One broke new ground as a monoline credit card bank that married technology and data science before that was a thing in banking.

We are entering the thick of fintech earnings season and in the last 24 hours, we have seen earnings from two fintech pioneers: PayPal and Adyen.

They tell very different stories.

The US dollar stablecoin market has long been dominated by Tether (USDT) and Circle (USDC). Together these stablecoins have a market cap of around $140 billion or so.

While others have tried, notably PayPal last year, there is no other stablecoin with a market cap of more than $3 billion.

Yesterday, the official legislation was issued to make the long-awaited adjustment to the CRA, accounting for the digital landscape.

UK digital banking pioneer Monzo reported its financial results for the 2023-24 fiscal year today.

The numbers are impressive. Total revenue was £880 million for the year, more than 2x the £356 million from the previous year.

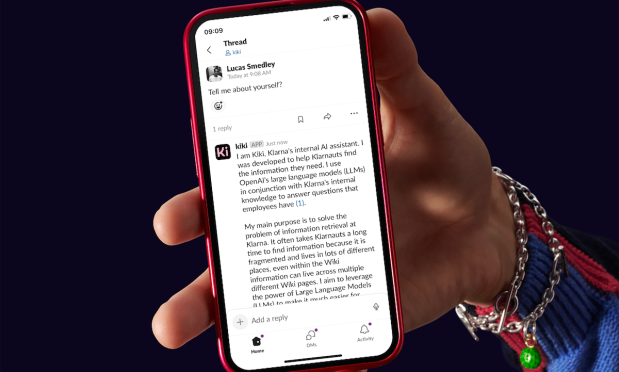

We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.