It has been the talk of the crypto world all week. SEC watchers noticed early this week that the regulator appeared to be getting ready to approve an ETF for funds holding Ethereum.

It has been a lean legislative session in Congress for fintech. But this week some progress was made on earned wage access.

The Fed came back with a plan yesterday to debit card fees for merchants. Will it be too much for banks to handle?

The credit bureaus are becoming fintech companies. In an industry first, Experian is now offering a digital checking account and debit...

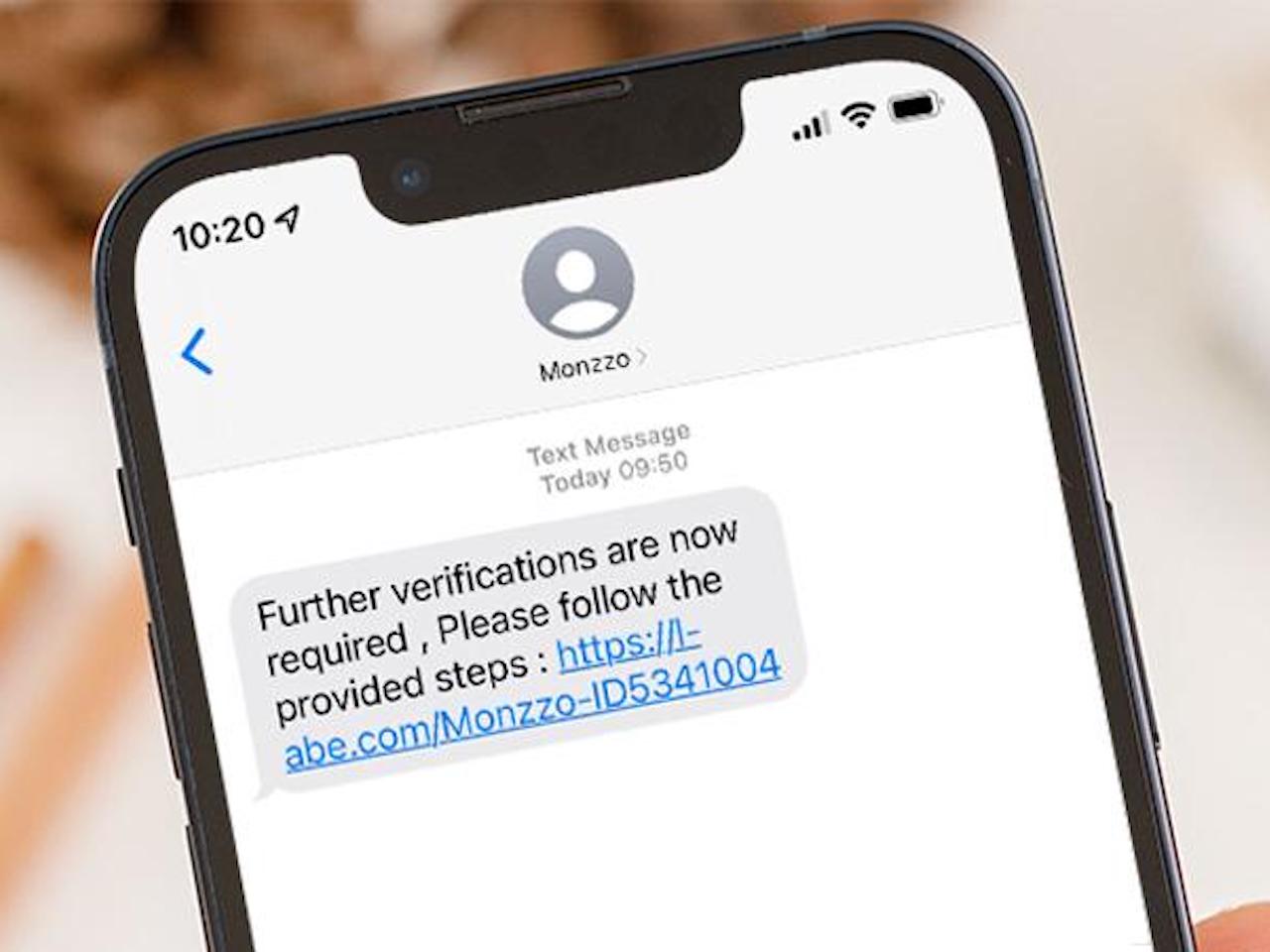

In lieu of a solution that stops the crimes from happening in the first place, bank reimbursement is the only source of protection.

When I first chatted with Mike Cagney back in 2011, when he was CEO of SoFi, it was clear he had big goals.

His second act in fintech, Figure, quickly became a leader in home equity lending with all loans originated and processed through blockchain technology.

The CFPB continues its attack on all kinds of junk fees charged by banks. This time they are targeting credit card late fees.

Being a direct-to-consumer fintech can be expensive and difficult.

The path to profitability is often a long and winding one, so we have seen several companies pivot to B2B in the last year or so.

Every quarter TransUnion releases its Credit Industry Insights Report. Their latest issue, released earlier this month, has some very interesting data.

We are moving to a world of instant payments but how we get there is still uncertain.

A blockchain-based payments system designed for central banks has just completed its first live transactions with the Bank of England. Created by Fnality, the system processed live payments from member banks, Lloyds, Santander and UBS.