Stripe has, for some time, been one of the leading fintech companies globally when it comes to scale.

But the numbers it revealed today in its annual letter are truly staggering. It processed $1 trillion, around 1% of global GDP, through its platform in 2023. It crossed that milestone just 15 years after it was founded.

Speaking at an event yesterday, CPFB Director Rohit Chopra said his agency is looking at "price gouging" in credit reporting.

With credit reports required for selling mortgages to Fannie and Freddie, mortgage lenders have no choice but to pay for them. Some lenders have shared that the costs for credit reports have increased by up to 400% since 2022.

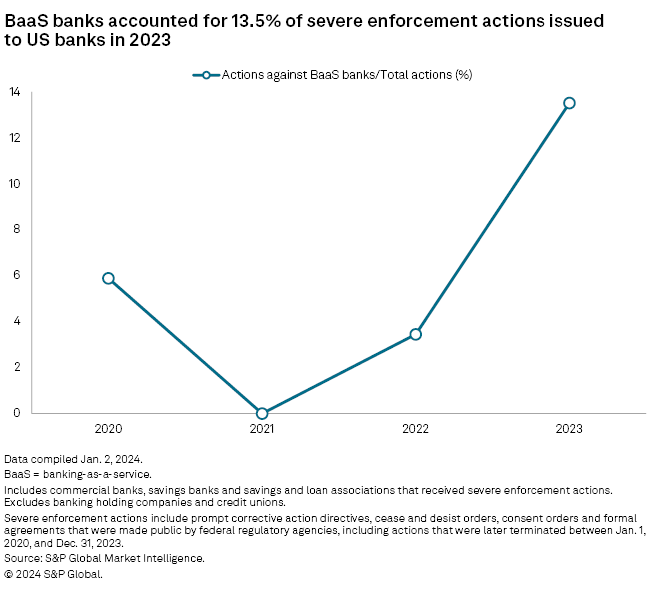

You could say Banking as a Service is under siege.

The number of severe enforcement actions BaaS banks received skyrocketed in 2023 to 13.5% of the total. When you consider there are probably only around 100 banks out of 4,800 that are involved in banking as a service, you can see why this number is disturbing.

We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.

Fintech Nexus Newsletter (January 2, 2024): HSBC’s Zing to take on Wise, Revolut in foreign exchange

HSBC has announced Zing, a new retail-focused service offering inexpensive foreign exchange.

The large banks. particularly in Europe, have mainly looked on with envy as startups like Wise and Revolut have built large businesses on the back of offering cheap foreign exchange to tens of millions of retail customers.

We have been following the recent developments in real-time payments with some interest. While adoption is increasing it is not going as fast as many industry observers had hoped.

No doubt, when Binance CEO CZ took to Twitter in the early moments of the FTX failure last year, he...

Fintech Nexus Newsletter (April 26, 2024): SVB Financial Group’s $2 billion lawsuit against the FDIC

We haven't written about Silicon Valley Bank in almost a year, but the saga of the third-largest bank collapse continues.

SVB's parent company, SVB Financial Group, had $2 billion on deposit at its bank subsidiary. When the FDIC made it clear that all depositors would be made whole, one would assume that included the $2 billion of the parent company's money.

Back in the go-go days of 2021 the two biggest names in crypto were known just by their initials: SBF (Sam Bankman-Fried) and CZ (Changpeng Zhao).

They often took to Twitter arguing with each other about where the market was going and whether certain tokens were overvalued. But there were no bigger names than SBF and CZ. They controlled the biggest crypto exchanges, outside of Coinbase: FTX and Binance.

The SEC has not had a great track record in court cases against crypto firms in the last few months. And another important case is playing out right now in a New York federal courtroom.

Back in June of last year the SEC sued Coinbase arguing that it was operating illegally and that it should register as an exchange and be overseen by the SEC.