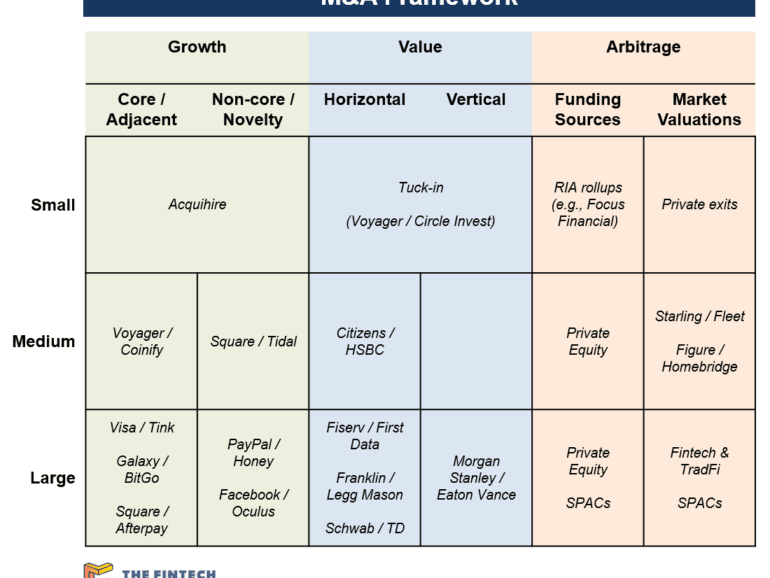

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

For incumbents, changing existing financial infrastructure systems is like taking the engine out of the plane in mid-air.

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

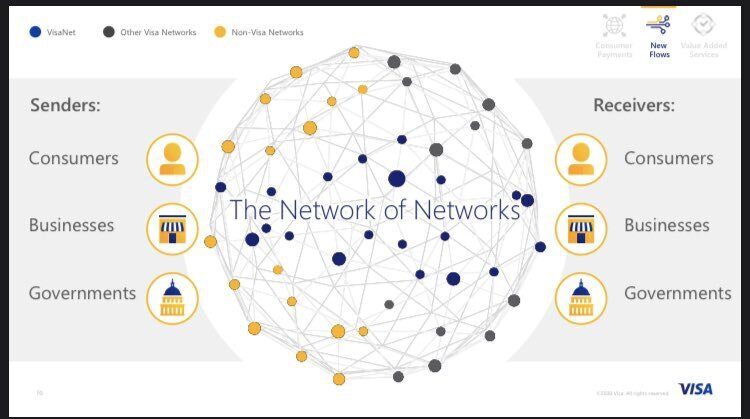

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

Co-Founders CJ MacDonald and Alexey Kalinichenko launched Step to offer teens financial tools. They plan to add stock and crypto investing.

As the growing value of cryptocurrencies generated increased media attention, the IRS began watching the space more closely.

On Tuesday, Paris-based Web3 payments startup Request Finance launched "Salaries" to help Web3 enterprises automate payroll in crypto.

There are multiple pathways for TradFi's venture into DeFi. We asked experts what they thought would be the best play.

·

The FTX debacle continues- when you thought it was all over, things just get weirder.

Minterest follows a disciplined approach in developing its decentralized finance lending protocol, one born from its founder's experience.

Celsius CEO Alex Mashinsky resigned on Tuesday, three months after the crypto lending scheme lost investors billions.