Savvy operators have built contingent products and revenue streams to thrive despite the major economic and market turmoil

Even the most cursory survey of fintech-focused news headlines paints a concerning picture. Deals are down, public markets (plus global trade) possess the same teeter-tottering volatility as a ride at Six Flags, and major IPOs-to-be have been indefinitely rain-checked. Seasoned fintech investors like Logan Allin of Fin Capital have told Fintech Nexus that they predict a “clearer time to go out” into the public markets by September given greater visibility into rate cuts expected by that time, and have advised portcos to cut burn and lock in clients through favorable long-term contracts as a way to weather this wave of volatility.

But the most prominent fintech operators have survived more than one macroeconomic jolt (especially the Covid-19 pandemic and interest-rate hikes). They’ve built contingent products and revenue streams to weather the storm, and have sometimes developed their entire raison d’être around the inevitability of fickle economics and market failure.

A subset of fintechs may also stand to be bullish, not just disciplined, in the face of a bear market.

Sunset Service

Business is booming for going-out-of-business experts SimpleClosure. The self-described “TurboTax of shutting down” helps businesses legally wind down, including conduct asset sales.

Yesterday, SimpleClosure announced a $15 million Series A, which included backing from Infinity Ventures, Anthemis, and Vera Equity — as well as Carta, which previously aimed to compete with the company..

“We saw a 24.6% uptick in business between February and May in our business,” said Dori Yona, SimpleClosure’s Co-Founder & CEO. “Those are the numbers we’re seeing, and that’s the potential signal of what’s happening in the market.”

Yona mentioned that the firm’s latest fundraise “came together very quickly.” Simple Closure has grown from a 3-person to a 30-person company over the past year, and eyes a large market gap, with few technologized solutions serving the 700,000 to 1 million companies that shut down every year.

I asked Yona why such a large gap exists.

“It’s not sexy, it’s not interesting, and it’s not a fun topic. Naturally, no one gets excited from it. I think that’s number one,” he said. “And then number two, I think it’s just really hard. One of the things that we found is it’s actually a lot harder to close a company than to open one.”

Yona said his experience founding Earny, a platform acquired in 2021 that automated refund and cashback processes for consumers, helped him get used to technologizing bureaucratic processes and paperwork — core to the corporate shutdown process. He added that, although downturns may lead to an uptick in demand for SimpleClosure, his business depends on the continued establishment of new corporations to survive in the long run.

“There’s a lot of hypotheses in the market of what’s going on, and from our perspective, whether that happens or not… ‘death and taxes,’ companies will always need to dissolve,” Yona said.

Better Off at Betterment?

“Betterment really thrives in turbulent markets in large part because tax-loss harvesting is something we do best, and the value creation really jumps off of volatility,” said Sarah Kirshbaum Levy, CEO of wealth-management platform Betterment, onstage at Fintech Meetup in March.

I reached out to Betterment to determine whether Levy’s prediction has come to fruition — findings we can reasonably extrapolate to other robo-advisor platforms à la Wealthfront, M1, et al.

“Our customers have taken a little bit of a ‘risk-off’ posture this year in terms of committing new funds to investing markets, versus safer avenues like high-yield savings, but the changes from normal activity have been infinitesimal,” a Betterment spokesperson told Fintech Nexus, adding that the co’s roadmap for 2025 is unchanged.“The overall pattern changes haven’t been large enough to be meaningful. We recently fielded a retail survey which showed that younger investors are actually feeling bullish.”

So (reading between the lines) Betterment is experiencing “business as usual” more than it is a “glow-up,” though some investors, especially younger ones, are optimistic in the face of current Rumsfeld-esque unknowns.

Profitable Precarity

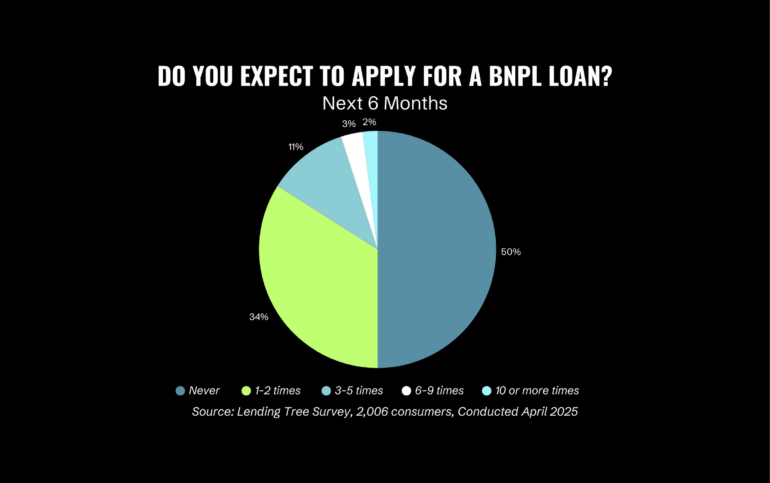

Amid economic uncertainty, there is a sense that BNPL providers are about to have another burst of momentum. A recent report by LendingTree suggests that a quarter of buy now, pay later (BNPL) users have allocated these funds to buy groceries, and a third (up from 30% a year ago) see BNPL as a “bridge” to their next paycheck.

The company’s April 2025 BNPL Tracker also suggests that 39% of Americans considered applying for a BNPL loan last month, an increase of eight points from the month before. Yet 63% of those surveyed who were considering getting a BNPL loan said they were very confident they could pay it off without missing a payment, which is an increase of 14 points from March.

This precarity seemingly bodes well for BNPL providers. Upticks in demand driven by the need to pay for everyday goods — coupled with a highly favorable shift from the Trump Administration’s Consumer Financial Protection Bureau (CFPB), which announced Tuesday it will not enforce a rule classifying BNPL as credit cards — may potentially counterbalance the broader demand-dampening effects of tariffs on consumer spending in other categories, where consumers may opt to forgo consumption tout court rather than split its cost into four. (It might also help offset the increased operating costs caused by interest rates that affect funding capabilities.)

Whether the current downturn bodes well for BNPL’s cousin, earned-wage access (EWA) is harder to gauge at this current juncture. In an interview with Fintech Nexus, Tate Hackert, Co-Founder and Chief Strategy Officer of EWA platform ZayZoon, said EWA volumes are typically seasonal, as households receive tax refunds and use that influx to address their cash-flow needs. Hackert said that a household needing $200 in additional funds per week and receiving a $600 tax return typically returns to EWA solutions after three weeks, “almost perfectly to the return that they get.”

“It speaks to just the pure need for a product like ours, and how close to the line of insolvency people are,” he said.

ZayZoon has seen its onboarding volumes of employers nearly double compared to last year, which Hackert attributes to greater employer and employee awareness of EWA products, macroeconomic conditions, and a drive on the employer “to offer a benefit that helps impact income without … that employer having to change income.” In the face of increased employee hardship, Hackert said the company is complementing its debt product with solutions like free tax filing as well as a perks marketplace.

Cash is King

Raymond Rouf of Pave, a cash-flow analytics solution for consumer and SMB credit risk — and which underwrites several EWA platforms, and which counts Hackert of ZayZoon as an investor — said he has been “shocked” by some of the companies interested in providing an EWA or cash-advance product. “We are seeing anybody and everybody launching more and more cash-advance/EWA products,” he said.

Rouf framed that as a positive, given that many Americans do not have access to credit, or otherwise have to resort to payday loans. It’s worth noting that state regulators have accused some EWA platforms of violating usury laws through tips and fees that exceed legal annual percentage rates.

I asked whether the systemic risks here echo those that brought about the 2008 financial crisis. Rouf highlighted that cash-flow underwritten lending products feature far shorter cycles, mitigating risk by enabling lenders to quickly cut off people failing to repay their loans.

“What we’re slowly starting to see in the data … is, Okay, groceries are going up, they’re going to go up some more, and other types of expenses are going to go up. People are going to be more crunched, and we’re going to see even more people applying for more cash advances,” Rouf said. “The ZayZoons of the world are going to do really well, because their products are needed. But, fortunately or unfortunately, they will need that and probably three other products, because they cannot underwrite more money [because of risk limits from their debt facility.]”

We are still in early innings for a selling cycle that truly began in late January, and with many predicting a full-blown recession to begin late summer, if tariff threats hold. But if product development pipelines are a reliable canary in the coalmine, seasoned investors backing startups offering ancillary debt products like EWA, cash advances, and rent installments suggests momentum in this arena is likely to continue despite a foreboding economic picture.