At a major gathering of industry insiders, strategies for recalibration in the Trump era abounded

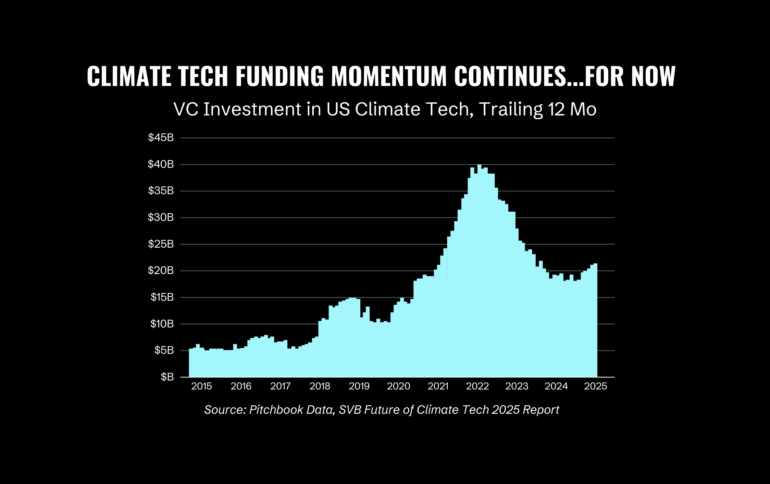

Despite massive cuts to critical weather and energy-related government agencies and expected pullbacks in funding for sustainability-focused projects, VC investors have continued to place bets on companies in what’s been known as the “climate tech” sector, with increased momentum in Q1, according to a recent report by SVB.

Fintech Nexus dug into the future of the space over a recent sunny week in San Francisco, as the city’s downtown swarmed with visitors whose numbers almost called to mind pre-pandemic crowds. No clouds of branded blimps hung overhead, nor did mascots run amok at Moscone. This wasn’t Dreamforce, after all; instead, some 20 thousand believers gathered for the third annual SF Climate Week, a grassroots-led series of events the SF Chronicle calls an “exchange of ideas on how to address climate change.”

Here’s what stood out:

Is grassroots programming indicative of broader, fractured dialogue and action, particularly around climate financing? Beyond Al Gore giving the keynote address on Monday, April 21st, with U.S. Rep. and House Speaker Emerita Nancy and Mayor Daniel Laurie joining him, SF Climate Week has few marquee events, instead offering a choose-your-own-adventure approach to programming.

The frisson of energy in many of the sessions was electric, but it was hard not to wonder: What’s missing by not driving a broader dialogue around tough, complex issues related to financing decarbonization and climate solutions? Is the somewhat fractured way we’re discussing these issues indicative of a lack of collective resolve and focused action to tackle these issues?

Or as Silicon Valley innovators have shown time and time again, will grassroots-led technology — and the founders, investors, and other key players a part of that ecosystem — surprise us, completely revolutionizing what we believe to be possible when it comes to climate solutions?

This feels particularly important to the broad topic of climate finance. During a session led by Impact Assets and Vibrant Data Labs, the Climate Finance tracker, a tool designed to identify who is funding what in the climate sector in the US to identify gaps and learnings across the ecosystem, stood out to me. With a dire need for funding across key areas related to energy abundance, industrial innovation, people-centered solutions, and nature-based solutions, it offers transparency into who is funding what.

The lead speaker ended on a stirring call to action: Funding climate solutions is not complicated. We know what needs to be done, we know the gaps, and we have the tools to monitor the holes in the dike. We simply need to fill the holes.

Investment in Climate Solutions is on the Rise (or is it?): A palpable tension existed in the antechambers related to the state of funding for climate tech innovators due to the current presidential administration’s renewed focus on increasing fossil fuel production. The California Infrastructure and Economic Development Bank (IBank) promoted a range of innovative funding mechanisms available through its programs.

During one panel with a handful of VCs, including Prelude Ventures, Lowercarbon Capital, and Khosla Ventures, focused on investing in climate tech led by Heatmap News, as one panelist cited the increase in funding during Q1, a fellow co-panelist insinuated it all depended on how you categorize and bucket the funding.

What’s clear: investment in climate is happening, and whether the increase will continue, it is impressive given this is amid a background of regulatory changes that are designed to dissuade decarbonization efforts.

Don’t say the C word: Does climate tech need a rebrand? Or will it be forced to go through one for its own survival? While the debate around the taxonomy of the ESG / climate space is not new, the conversation was top of mind. As panelists debated, one investor outright said “Do not say climate.” The opportunity to bring outright climate deniers or staunch business advocates along through a shift in messaging, focusing on “energy independence” and “job creation,” as examples, is there for the taking – and perhaps the one of the more effective tools available given a plethora of economic uncertainty and most critical for self-preservation of startups.

The elephant in the room: Are we energized or beaten down? In a fiery conversation moderated by Heatmap and Tom Steyer, Co-Executive Chair, Galvanize Climate Solutions, Mr. Steyer confidently asserted that the business of the energy transition cannot be stopped; that the economics are winning. Businesses and customers will adopt technology that is better for the environment, not because they’re altruistically motivated, but rather because the technology will be better, faster, and cheaper (the title of his new book), and will solve a pain point for the customer.

Steyer lauded the innovative spirit of northern California, the AI revolution we’re living through: “[We] will need to solve 21st-century problems, with 21st-century solutions.”

While not everyone I met or listened to during the week had this same energy, there was a palpable determination among attendees to keep innovating, keep building, and to keep going amid the Category 5 hurricane winds they’re facing at the federal level.

With a very different policy landscape from the previous administration’s, there remains much to be seen as to what we’ll be discussing during SF Climate Week 2026. Will the startups that were going to fail faster as a result of the external landscape? Or will the teams with experienced leadership, strong business model, and smart investment strategy live to see another day and propel the climate revolution?

As Scott Wu, CEO of IBank, offered in an open session, “If America will not lead, Americans will.”